Resolution

RBI intervenes as another bank comes close to collapse

Failure of Lakshmi Vilas Bank highlights strain on Indian banking sector

Pandemic has impacted post-crisis reform work – FSB

“Substantial work” still outstanding in important areas, Financial Stability Board says

EBA wants Basel to revisit prudential rules on software

Banking regulator set to soften capital impact of IT assets, but proposals are still out of line with US

BoE may update resilience guidance, post-Covid

Granular targets on minimum service provision after outages could be revisited, adviser suggests

Action needed to avert Latin American banking crisis – report

Emergency measures may mask growing solvency problems, institutions warn

Bank investors still don’t think bail-in will happen, FSB told

Questions over bailing in bank bondholders mean problem of too big to fail persists, experts warn

Resolution colleges must update resilience plans – EBA

EU’s resolution colleges should review whether their plans are “credible and feasible”, report says

Former RBI deputy attacks government over fiscal dominance

Recent actions by Indian government are “tantamount to coercive monetisation”, says Viral Acharya

PBoC official joins policy lender after clearing up Baoshang Bank

Zhou Xuedong joins China’s biggest policy lender, as PBoC declares Baoshang Bank bankrupt

Claudia Buch: ‘We need higher transparency’ on resolution

Bundesbank vice-president discusses progress towards ending ‘too big to fail’, evidence of fragmentation and how to fill information gaps

Banks will be tested in next phase of pandemic – FSB chair

Reforms are needed to improve resolution planning and non-bank resilience, Randal Quarles says

US living wills must include ‘lessons learned’ from Covid-19

Large banks must outline how crisis is impacting resolution planning capabilities, Fed and FDIC say

Central banking enters a new era

Central banks face a delicate balancing act to preserve their reputations as they evolve into ‘buyers of last resort’ and some of their actions appear functionally equivalent to ‘monetary financing’

Libra’s Disparte on big tech’s move into digital currency

Libra Association vice-chair Dante Disparte speaks about the decision to abandon a multi-currency reserve, stress-testing a global payment network and how the Facebook-backed body still has 3 billion customers in its sights

Beware of capital: much ado about nothing?

Capital increases can be offset by asset valuation, provision and income recognition forbearance

The dawn of a safer and sounder European banking sector

Implementation of two pillars of banking union has led to significant improvements in the safety and soundness of the European banking system

RBI prepares rescue plan for failed bank

State Bank of India agrees to help rescue Yes Bank, which remains under “moratorium”

People: UK’s FCA makes three new appointments

FCA reshuffles board; senior Bank of Spain official joins Single Resolution Board

Stability versus solvency

There is still far too much regulatory forbearance on troubled bank debt. More on-site inspections and genuine writedowns are needed to fix the banking system

Some countries lack systemic banking crisis resilience – IMF report

IMF staff sketch out priorities for countries’ resolution-planning frameworks

People: Fed governor gets new term; IMF’s Poul Thomsen to retire

New appointments made and portfolios reshuffled in the US, UK and more

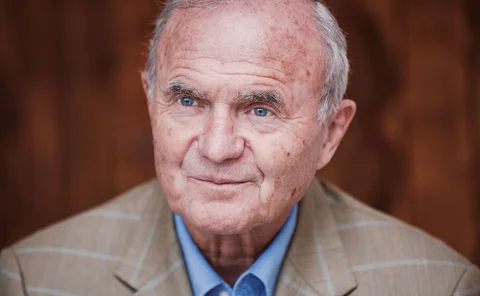

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Governor of the year: Mark Carney

Carney has played a vital role in managing Brexit risks while driving efforts towards climate, payments and dollar funding reform

Central bank of the year: Bank of Ghana

The African central bank has carried out extensive reform of Ghana’s banking sector