Quantitative easing

Brazil steps up efforts to ease real gains

Central Bank of Brazil raises reserve requirements on domestic banks' foreign exchange position in bid to halt real appreciation

CentralBanking.com’s top ten stories of 2010

Regulatory change features heavily

Bank’s Bean mounts QE2 defence

Bank of England deputy governor Charles Bean says criticisms that QE2 is inflationary, will spark inflows in emerging markets, are incorrect

QE2 hopes reflected in dollar, risk reversal trends: BIS

Bank for International Settlements’ December Quarterly Review charts effects of QE2 anticipation, eurozone sovereign debt woes, in fourth quarter

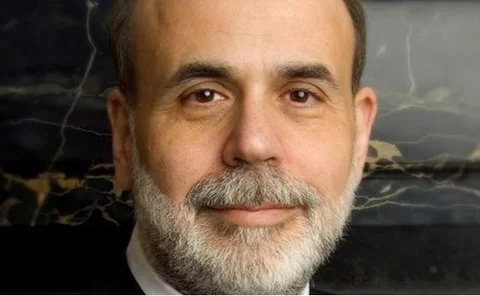

QE3 possible if conditions warrant it, says Bernanke

Federal Reserve chairman Ben Bernanke says a further expansion of Treasury bill purchase programme is possible; stresses worries on unemployment

Fed’s Yellen: QE2 could help emerging markets

Federal Reserve vice chair Janet Yellen makes case for currency appreciation in emerging markets; remarks come on the heels of emerging market criticism of QE2

St Louis Fed: central banks must plan credible QE exit

St Louis Federal Reserve study shows success of quantitative easing depends on central bank's ability to credibly plan for stimulus withdrawal

Shirakawa draws parallels with QE in Japan, US

Bank of Japan governor Masaaki Shirakawa says same aims underlie Japan's monetary easing scheme and Federal Reserve's asset purchase programme

Bernanke: QE2 a misleading moniker

Federal Reserve chairman Ben Bernanke says $600 billion Treasury purchase scheme not officially quantitative easing

HKMA, PBoC react to QE2

Hong Kong Monetary Authority and People’s Bank of China counter Fed’s quantitative easing programme with regulatory and monetary policy measures

What’s wrong with QE2?

Geoffrey Wood explains why he signed a letter arguing against the Federal Open Market Committee’s latest round of asset purchases

Academics attack QE2

Twenty-three academics call on Federal Open Market Committee to “reconsider and discontinue” QE2; signatory argues problems are as much on supply side as demand side

Too soon to judge QE2: Korea's Kim

Bank of Korea governor Kim Choong-soo says Federal Reserve's second round of monetary easing cannot be prejudged; outlines challenges for domestic economy

New York Fed announces QE2 purchase plan

New York Federal Reserve sets schedule for $105 billion-worth of purchases of Treasuries over the next month

QE2 criticisms “baffling”: King

Attacks on the Federal Open Market Committee’s latest round of asset purchases meet with scorn from Bank of England governor

Focus on trade rather than stimulus: business leaders to G20

International Chamber of Commerce honorary chair Victor Fung calls on G20 to focus on boosting international trade rather than monetary stimulus to raise growth; currency tensions expected to feature heavily at Seoul Summit

India’s PM backs QE2

Backing from Manmohan Singh follows attacks from other emerging markets

Zhou, Meirelles attack QE2

Central Bank of Brazil president Henrique Meirelles and People's Bank of China governor Zhou Xiaochuan bash Federal Reserve’s latest stimulus programme

Broaden renminbi use to curb dollar influence: ex-HKMA’s Yam

Former Hong Kong Monetary Authority chief executive Joseph Yam calls for more renminbi internationalisation; says Hong Kong a vital portal in the effort

Fed to buy $600 billion-worth of Treasuries

Size of QE2 exceeds expectations; pace of purchases slower than forecast

CIC’s Zhou calls on Congress, not Fed, to spend

China Investment Corporation’s Zhou Yuan says further quantitative easing will not cure United States’ unemployment problem; Fed expected to unveil more asset purchases, despite dissent

UK doesn’t need more QE: former MPC members

Sir John Gieve, DeAnne Julius and Rachel Lomax say Bank should hold on launch of QE2; Gieve flags asymmetric bias towards looser policy

BoJ’s Suda criticises decision to buy government bonds

Bank of Japan monetary policy minutes reveal dissent over central bank’s decision to include government bonds as part of stimulus programme