Payments

RBNZ to chair Pacific infrastructure working group

New Zealand central bank given role after drafting law on FMI regulation

Central Bank of Brazil forms CBDC working group

Report by commercial bank warns that Brazil faces strong structural obstacles to CBDC

Fed paper looks at different CBDC types

“Account-based”, “cash equivalent” and “hybrid” CBDCs all have varying advantages – researchers

RBI lines up ‘pan-India umbrella entity’ to shake up retail payments

Firm “may be permitted” to hold an account at the central bank

Facebook’s libra could disrupt collateral markets – IMF paper

Collateral used to back ‘stablecoins’ such as libra will be unavailable for reuse

Chinese state-run banks start testing PBoC’s ‘e-wallet’

Four biggest state banks trialling payments system for PBoC’s “digital yuan”

More changes at top of NBU as donors watch closely

Council approves new deputy governor as NBU confirms strategy director has left

Bank of Japan intensifies CBDC research

Central bank appoints new CBDC head as ruling party warns Chinese effort poses security threat

Fed reveals instant payment plans

FedNow will feature interoperability on ISO 20022 message standard and new liquidity tool

Brazil plans new note as cash demand hits record high

Central bank will introduce 200 real banknote as Brazilians start to hoard cash

CLS proposes second-tier FX settlement system

Stripped-back system for EM currencies mooted to tackle rising settlement risk

‘E-money’ is boosting financial inclusion in Philippines – deputy governor

“E-money” system has driven rise in citizens with bank accounts, BSP says

Dutch cash payments fall sharply, DNB says

Cash payments were 30% of transactions in early 2020 but fell to 13% in April, study finds

BoE awards Accenture RTGS overhaul contract

Consultancy firm wins contract worth up to £150 million for payments system upgrade

Timothy Lane on CBDCs and why the private sector is no competition for central banks

The Bank of Canada deputy governor discusses the difference between a private-sector-motivated digital currency and a CBDC, and why finding a balance between privacy and regulation is such a challenge

CBDCs cannot have unlimited privacy – Canadian deputy governor

Timothy Lane says central banks should consider “hybrid privacy levels”

Banque de France names CBDC partners

HSBC and Euroclear among firms chosen to take part in CBDC experiments that include improving cross-border payment infrastructure

FATF will set up global network of virtual asset supervisors

Current standards are sufficient to govern stablecoin activity, report says, but risks may grow

MAS finishes work on prototype blockchain payments system

Singaporean central bank and investment fund will share details of blockchain-based payments system

The evolving role of central bank money in payments

The line between commercial and central bank money continues to blur, but the multiple-issuer/one-currency paradigm underpinning the current monetary system is set to remain in a CBDC world, write Ulrich Bindseil and Ignacio Terol

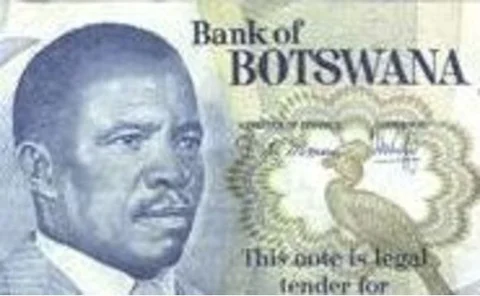

Cash issuance in Botswana balloons 18% in 2019

Annual report shows banknote issuance growth for all denominations, despite rise in electronic payments

Libra reinvents itself in bid to overcome ‘fatal’ flaw

Pivot to present more of a payment-network image could save libra from regulatory haranguing. But at what cost for innovation?

PBoC partners with tech giant to test digital yuan

Chinese ride-hailing firm partners with PBoC digital currency research arm to test digital yuan

People: CBSL gains board members; RBNZ forms new department

RBNZ fills two new payments roles; long-time Danish official retires from the central bank; ECB comms chief moves to private sector