Payments

Richard Doornbosch on central banking in a tempestuous climate

The president of the Central Bank of Curaçao and Sint Maarten speaks to Christopher Jeffery about addressing legacy financial scandals, transition to a Caribbean guilder, tapping gold holdings and managing a currency peg at a time of US policy uncertainty

China to continue ‘moderately loose’ monetary policy in 2026

PBoC plans to work with other agencies in effort to boost consumption

BIS tests tokenised FX settlement in instant cross-border payments

Minimal tech upgrades proposed to link central bank money on DLT across Europe and Asia

Norway’s central bank latest to disavow CBDC

Currency would not be ‘appropriate’ to maintain krone’s monetary sovereignty, Norges Bank says

IMF has no mandate for SDR stablecoin, says Tobias Adrian

Fund’s capital markets head says backstops are also crucial if instruments are to live up to their name

Eurozone bank uncompetitiveness a ‘myth’ – Schnabel

Regulations have made lenders better, says ECB board member

IIF says China’s CBDC irrelevant to renminbi internationalisation

Economists say yuan’s use for payments growing, though it remains “stagnant” as reserve currency

Bank of Russia to scrap some FX transfer limits

Institution to lift restrictions four months early for citizens and foreigners from “friendly countries”

NBFIs could dent transmission – Bundesbank board member

Growing non-bank activity could diminish banking channel’s importance, says Köhler-Geib

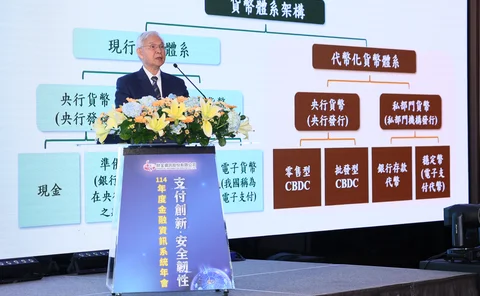

Taiwan’s Yang says central bank money remains global ‘anchor’

Governor says it is still ‘ultimate settlement asset’, notwithstanding development of tokenisation

Permissionless payments may be the future – NY Fed study

Stablecoins’ accessibility makes them different from other fast payment options, say authors

Synchronisation can support tokenised securities settlement – BoE

But central bank says it is unclear whether it outperforms unified ledger

Serbia says sanctions on Russia pose financial stability risks

Central bank sounds warning as government threatens to divest Russian stakes in domestic oil refiner

Sarb finds ‘no compelling need’ for a retail CBDC

Central bank pivots towards wholesale version while modernising national payments system

HKMA asks Hong Kong’s banks to assist victims of apartment fire

Lenders requested to offer liquidity, repayment flexibility and replace documents for those affected

ECB in no hurry with new structural operations – Välimäki

Portfolio will first need to be reduced ‘considerably’, says bank's alternate board member

BSP remains cautious about stablecoins as proposals roll in

Deputy governor says most submissions are for dollar-backed assets focused on retail use

Central banks must respond to challenges of digital innovation – panel

Central Banking Autumn Meetings panel looks at how stablecoins, CBDCs and AI are shaping decision-making

ECB moves to link Tips with India’s UPI and Nexus

Connection with Nexus still hinges on ECB exploring potential ‘feasibility’

BoE, MAS and BoT to test synchronised FX settlement

Project will use ‘synchronisation operator’ to achieve atomic settlement

CBDC or fast payments can break up ‘walled gardens’ – BIS paper

Study of ‘competing digital monies’ finds public system could prevent fragmentation and rent-seeking

India to set up remittance link with Bahrain

Bilateral corridor will facilitate instant payments by Gulf kingdom’s large Indian community

Stablecoins should be tightly regulated – HSBC exec

John O’Neill says lender’s views on the assets are aligned with those of central banks

ECB holds rates for third consecutive time

Lagarde celebrates ‘fading risks’ to eurozone growth thanks to trade deals and Gaza ceasefire