Fintech

Video Q&A: Maciej Piechocki, BearingPoint

Central Banking met with BearingPoint’s Maciej Piechocki at the Central Banking FinTech RegTech Global Summit in Singapore to discuss financial and regulatory technology – known as fintech and regtech respectively – solutions, how technology can help in…

Research project weighs bold plans for cross-border payments

One possibility is to create a single global central bank digital currency

‘Big tech’ finance raises fundamental questions – BdF deputy governor

Risks from cloud computing not being addressed by supervisors, Denis Beau warns

Central banks should challenge risky fintech projects – Carstens

Crypto assets do not measure up against the “laws of economics”, BIS chief warns

MAS chief laments ‘data localisation’

Misguided notions of data security threaten digital growth, says Menon; central bank further strengthens fintech support

HKMA’s ‘e-wallet’ feature suspended weeks after launch - local media

“Autopay” feature of new payments system hit by fraud allegations; HKMA says security is robust

Carstens: regulators must promote ‘orderly assimilation’ of tech

Technology should bring benefits, but may threaten “integrity” of financial markets, BIS chief says

New York Fed files to dismiss narrow bank lawsuit

“The costs are real and continuing”, TNB says, as the New York Fed continues to delay

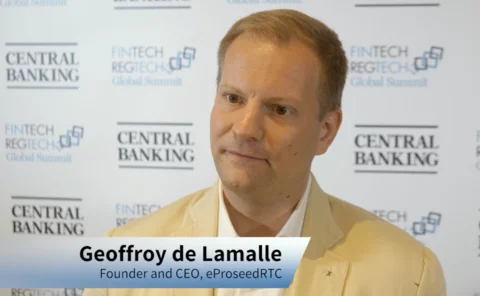

Video Q&A: Geoffroy de Lamalle, eProseedRTC

Central Banking spoke to Geoffroy de Lamalle, founder and chief executive at eProseedRTC, at the FinTech and RegTech Global Summit in Singapore

Bank of Canada launches tech collaboration initiative

“We want to partner with anyone who has something to contribute,” COO says

Poloz: ‘digital disruption’ makes it harder to track supply and demand

Technology brings net benefits but also makes the central bank’s work harder, governor says

Bank of Brazil and HKMA sign fintech agreement

Central banks to promote innovative financial services companies

Automation of financial services poses problem for labour market

Central bankers fear the labour market may not recover as quickly as during previous technological revolutions

Central bankers admit they are not yet prepared for crypto assets

Uncertainty around the assets’ use and regulation calls for further research, debate finds

Central Banking FinTech RegTech Global Awards 2018

Winners In Focus

Insights from network analytics in suptech

With regulators leveraging technological innovations to move towards informed, data‑driven decision‑making and automation, supervisory technology is attracting enhanced interest. Kimmo Soramäki and Phillip Straley examine how regulators are gaining…

Distributed ledger technology in regulatory reporting

Satisfying regulatory demands can be made cheaper and more straightforward via distributed ledger technology as regulatory reporting has a transformational effect on the regulatory value chain. Maciej Piechocki, Moritz Plenk and Noah Bellon of…

An informed approach to banknote security and durability

De La Rue explains how its data consultancy service, DLR Analytics, allows central banks to ensure notes in circulation are secure and durable, and offers value for money in spite of increasingly prominent alternative payment solutions. By facilitating…

MAS fintech officer tells regulators to upgrade to cloud

Data centres are no longer equipped to handle the “uncontrollable” growth of data, Mohanty says

Jackson Hole: policy-makers come to defence of disruption

Poloz and Carstens highlight benefits of technological and trade disruption; monetary policy can cope with the uncertainty, Bank of Canada governor says

Sarb’s Mminele says IT investment could help African cities grow

South African deputy governor encourages investment in both human and physical capital

Book notes: Digital human, by Chris Skinner

Skinner provides a valuable insight into the challenges banks face as technology continues to permeate further into the financial industry

Next financial crisis “will be brewing” in shadow banking – Bullard

Silicon Valley disruption represents threat to financial stability; Fed has limited powers to counter it despite FSOC and tough new bank rules, says Eighth District president