Central bank digital currency

IIF says China’s CBDC irrelevant to renminbi internationalisation

Economists say yuan’s use for payments growing, though it remains “stagnant” as reserve currency

Digital euro could reopen e-krona debate for Riksbank – Bunge

Swedish central bank to fully move to eurozone settlement system by 2030

NBFIs could dent transmission – Bundesbank board member

Growing non-bank activity could diminish banking channel’s importance, says Köhler-Geib

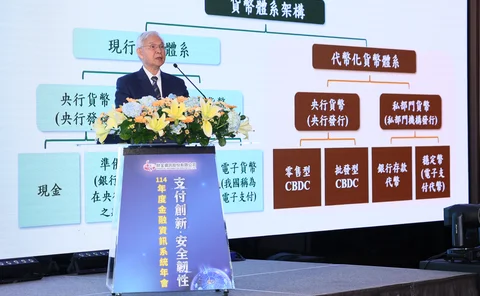

Taiwan’s Yang says central bank money remains global ‘anchor’

Governor says it is still ‘ultimate settlement asset’, notwithstanding development of tokenisation

PBoC emphasises stablecoins are illegal in China

Bank reiterates virtual currency ban and says pegged assets fail to meet identity and AML requirements

Sarb finds ‘no compelling need’ for a retail CBDC

Central bank pivots towards wholesale version while modernising national payments system

ECB in no hurry with new structural operations – Välimäki

Portfolio will first need to be reduced ‘considerably’, says bank's alternate board member

Cash is the tender of last resort – panel

Officials at Central Banking Autumn Meetings discuss risks of long-term outages in era of digital payments

Japan will not implement Basel crypto regs by 2026, says FSA

Regulator cites country’s limited exposure to digital assets as reason for not meeting deadline

More independent central banks hold fewer dollars – research

De-dollarisation benefits Singaporean and Korean currencies, while Australia’s and China’s lose out

‘Imaginations are running wild’ – Nagel on AI

Europe is prepared for a financial downturn, Bundesbank president says

CBDC technical design has little impact on demand – BoK study

Working paper also finds that interest-bearing retail instruments attract more interest

CBDC or fast payments can break up ‘walled gardens’ – BIS paper

Study of ‘competing digital monies’ finds public system could prevent fragmentation and rent-seeking

ECB planning to use law to make Apple give way on digital euro

Bank looking to use Digital Markets Act to enable people to hold CBDC on iPhones’ ‘secure element’

Stablecoins should be tightly regulated – HSBC exec

John O’Neill says lender’s views on the assets are aligned with those of central banks

ECB holds rates for third consecutive time

Lagarde celebrates ‘fading risks’ to eurozone growth thanks to trade deals and Gaza ceasefire

ECB enters new phase for digital euro, with issuance set for 2029

CBDC’s next phase to focus on technical readiness, market engagement and legislative support

Why Europe cannot afford to delay the digital euro

CBDC would counter the erosion of sovereignty as cash recedes, substitution by foreign digital monies and weaponisation of access, argue Biagio Bossone and Céu Pereira

BoK denies dollar stablecoins threaten monetary sovereignty

South Korean central bank remains cautious about won-backed instruments as legislation moves forward

Kyrgyzstan to pursue digital strategy with Zhao

Country’s president calls Binance founder “trusted adviser” following controversial pardon by Trump

PBoC’s language suggests policy shift on yuan – China economist

Central bank drops ‘cautious’ from pronouncements on currency’s internationalisation

BoE considering new form of offline payments for UK

Phase two of digital pound work to start next month, as Bailey softens stance on stablecoins

Prioritise CBDCs over stablecoins, RBI’s Malhotra tells central banks

Indian central bank governor says CBDC collaboration needed to boost cross-border payments

Tariffs will not solve US ‘twin deficits’, BdF governor says

Villeroy de Galhau wants to maintain spirit of transatlantic co-operation despite disagreements