Capital

FSB calculates G-Sib list with revised methodology

Some global banks change “bucket” under first use of Basel Committee’s revised method

Book notes: Yellen, by Jon Hilsenrath

This book offers new insights into the tough decisions and tremendous efforts Yellen has made as a pre-eminent economic policy-maker

Liquidity dependence may hamper QE exit

Expanding reserves may prove perilous for financial stability, with maximum danger during QT, writes Viral Acharya

BdF to achieve 1.5°C climate goals by 2026, governor says

De Galhau calls for mandatory climate disclosure, green capital requirements and collective ecological governance

Christopher Sims on modelling the inflation surge

Unprecedented series of shocks creates major challenges for central bank forecasters, the Nobel Prize-winning economist tells Daniel Hinge

African governors face multiple financial ‘floods’

Kenyan governor says a “doubling, tripling” of access to IMF resources is needed

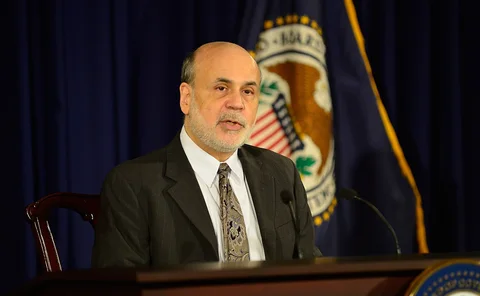

Bernanke, Diamond and Dybvig win Nobel Prize

Economics prize goes to authors of widely cited work on financial crises

ECB paper looks at Covid-19 emergency supervisory measures

Relaxation of CET1 requirements positively affected lending, but change to Pillar 2 guidance did not

Quantitative tightening: missed opportunities

Treasuries and central banks must think harder about balance sheet policies, says Philip Turner

Morocco’s Jouahri on inflation, forex reform, digitalisation and sustainability

The Central Bank of Morocco governor speaks with Christopher Jeffery about Covid-19 policies, Fed tightening, BIS membership, regional co-operation and financial inclusion

Joseph Stiglitz on the challenge of fixing macroeconomics

The Nobel Prize-winning economist discusses the flaws in mainstream models and how to repair them, whether central banks went wrong in 2021, and what to do – or not to do – about inflation

Banknotes: July to September 2022

A round-up of news and salient issues that have affected central bankers in the past three months

BoE’s planned procyclical capital hike bewilders banks

Some doubt regulator will go through with counter-cyclical buffer hike while forecasting recession

Will the dollar remain the world’s reserve currency?

Bank of Russia sanctions are unlikely to undermine the US dollar’s central role in reserve portfolios. But a relative decline in US economic weight and technological innovation are benefiting other currencies

Tensions flare between policy-makers over US Treasury reform

SEC’s proposed rule-changes have “ruffled feathers” at Treasury department

US judge rules against seizure of Afghan central bank assets

Assets cannot be seized while US government does not recognise Taliban regime, judge says

Gontareva on Ukraine’s funding, NBU policy and reconstruction

Former NBU governor Valeria Gontareva speaks about donor funding shortfalls, NBU policy and financial stability challenges, Nabuillina and the seizing of Russian assets, and post-conflict rebuilding and modernisation

Quiet man: is Michael Barr the Clark Kent of regulation?

A decade after crafting Dodd-Frank, Fed’s new vice-chair must tame DC's warring regulatory factions

Book notes: The Fed unbound, by Lev Menand

Instead of the Fed expanding its tasks to meet shadow banking needs, this book calls for charter-like oversight of NBFIs

The PBoC, real estate debt and financial stability in China

Central bank policy-makers are restricted in terms of capacity and space by their efforts to manage the nation’s property bubble amid declining growth

How central bank mistakes after 2019 led to inflation

Central banks must acknowledge their own mistakes and outline concrete steps to restore the public’s confidence in their ability to ensure price stability, write Graeme Wheeler and Bryce Wilkinson*

The case for restoring the role of monetary aggregates

Tim Congdon argues that a surge in money supply in response to Covid-19 sparked heightened inflation and central banks need to refocus their attention on monetary aggregates

Chinese authorities repay more depositors amid banking scandal

Analysts say the banking crisis in Henan and Anhui could precipitate more rural bank runs