Banks

Cyber security should become part of a firm’s culture – Irish deputy governor

Warnings must not get diluted as they pass up the chain, Sibley says

Draghi’s ‘whatever it takes’ cut bank risk-taking – BIS paper

Study examines Mexican markets to pick out effects of the ECB president’s intervention

Fed could change capital rules for bigger banks – vice-chair Quarles

Deregulatory act had already softened regulations for banks with below $100 billion, up from $50 billion

Zimbabwe banks ordered to ring-fence foreign currency accounts

Move appears to be a step towards de-dollarisation

Euroclear to offer US dollar settlement in central bank money

New settlement should reduce credit and operational risk on settlement banks

Crypto bank targets 2019 launch

Switzerland’s Seba Crypto sets its sights on banking licence with “technology-neutral” regulator

New crypto asset database needed to better understand risks - Canada’s Lane

Crypto assets should be classified by attributes and functions, Canadian deputy says

IMF paper explores interaction of capital controls and macro-pru

Capital controls do not “consistently” mitigate potential increases in cross-border flows

RBI steps in to tackle liquidity crunch

Central bank steps up market operations as financial markets wobble

Supervisory lessons: fault lines in prudential regulation

Former Bank of Spain head of supervision Aristóbulo de Juan highlights the lessons he has learnt about weaknesses in prudential regulation, in the second of a four-part series on supervision

Italy’s expansionary budget increases pressure on debt

Draghi warns government plans have tightened financial conditions for households and businesses

Future balance sheet size hard to judge – BoE’s Ramsden

Reserves demand likely to become more important as QE winds down, but how large the balance sheet will be is an “open and difficult question”, deputy says

HKMA launches new faster payments system

New system will reduce transaction time and scrap interbank fees

Bundesbank paper looks at secondary markets’ role in bank runs

Adding secondary markets to model significantly alters possible equilibria, authors say

Female regulators increase stability of the financial system, IMF paper finds

IMF research: including women in the regulatory process has benefits “beyond” equality

EC’s Cyprus ‘failure’ undermined Eurozone central bank independence – Demetriades

Barroso’s decision not to take legal action against Cyprus for undermining the independence of the central bank damaged the ECB’s authority and emboldened others, claims former CBC governor

New York Fed wraps up final sales of crisis portfolio

Maiden Lane vehicle created in wake of Bear Stearns bailout ultimately turns a profit

Report says financial firms may be ‘overconfident’ about cyber

Accenture’s research shows only around 20% of firms are making improvements to IT security

Bank of Brazil and HKMA sign fintech agreement

Central banks to promote innovative financial services companies

Demetriades on political pressures on central banks and their governors

Former governor of the Central Bank of Cyprus speaks about the Cypriot banking crisis, the need for EU-wide AML oversight, independence and his fears for stability of the monetary union

Banks will ‘inevitably’ fail, says Ireland’s Donnery

Deputy governor takes stock of the policies implemented since the financial crisis to protect consumers against bank collapse

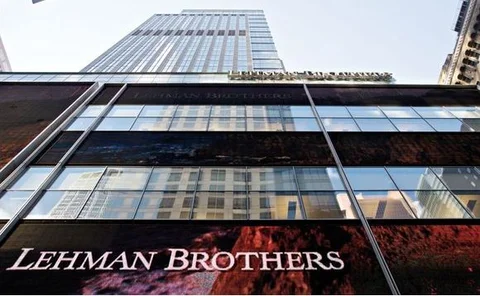

A decade on: Lehman Brothers at the brink

On September 14, 2008, there remained hope that Lehman could be saved and a crisis averted. Events moved rapidly thereafter

Atlanta Fed tackling commercial banking compliance

Article sheds light on Fed’s approach to supervising smaller institutions

RBA’s Bullock: Australia faces large housing risks

Debt-to-income ratio has risen and banks are highly exposed to the housing sector