Central Banking

BoE and FDIC campaign for end to ‘early termination’ of derivatives contracts

International authorities want a ‘short-term suspension’ of the rights that allow derivatives contracts to be terminated ahead of schedule when a major financial institution is being resolved

Dollarisation and institutional weakness hamper Congolese monetary policy

IMF paper highlights 'fiscal dominance' and 'lack of authority' as among reasons for central bank's ineffectiveness; strengthening current policy framework remains 'first-best option'

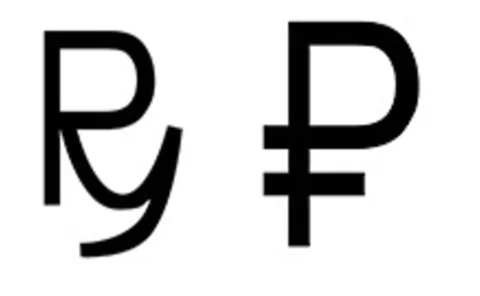

Russians vote to choose new rouble symbol

Central Bank of Russia says more than 102,000 people voted in the first day of its online poll to choose a symbol to represent the nation's currency; voting is open until December 5

Constâncio insists private sector will play ‘major’ role in filling capital shortfalls

The ECB’s vice-president says banks will be able to fill any capital holes turned up in the central bank’s comprehensive assessment at least partly through private funds

ECB paper finds value in high-frequency trading

Working paper suggests high-frequency trading aids price discovery, such that regulatory restrictions could damage market efficiency

ECB faces parliamentary grilling on Troika track record

Senior managers from European Central Bank and European Commission defend the accountability and forecasting track record of the Troika in European Parliament hearing

Fed reaction function shift helped support recovery, research finds

NY Fed research finds markets viewed ‘calendar’ forward guidance as a more dovish approach to policy, supported by comments from FOMC members; ECB and BoE both denied such a move in own guidance

Bank of England waging payment system war on three fronts

Chief cashier Chris Salmon says the central bank must contend with issues relating to cyber security, user access and new regulation within the UK payments infrastructure

Kuroda sets out evidence that Japan’s recovery will persist

Bank of Japan governor highlights a range of factors that suggest Japan may be bringing 15 years of stagnation to a close – supported by the central bank’s aggressive monetary policy

ECB’s Asmussen urges Denmark and Sweden to sit at banking union table

Jörg Asmussen says the single supervisory mechanism will be the envy of those outside the eurozone; tells Denmark and Sweden they will get more of a say if they have ‘a chair at the table’ now

Fed’s Powell downplays QE impact on emerging markets

Governor admits Fed policy has played a part in capital flows to and from emerging markets, but argues other factors are more important; follows fresh complaints from Asian economies

Boston Fed president wants low rates well into future

Boston Fed president Eric Rosengren says Federal Reserve should not raise its short-term interest rates until there is ‘much more progress’ towards full employment and its inflation target

Chilean policy-makers grow concerned over inflation

Central Bank of Chile board members voice concerns over persistently low inflation in their October monetary policy meeting; vote to cut key policy rate for first time in 18 months

BoE creates new role in response to cyber crime threats

Chief information security officer will oversee the Bank of England’s IT security defences; UK banks to be tested on their ability to withstand online attacks

Federal Reserve reveals new, tougher stress tests

Details of stress tests for 2014 include scenario based on severe global recession, with some banks facing additional criteria; tests will be applied to 12 more banks than before

BoE official calls for greater transparency on CCP margin modelling

Central counterparties should compete on quality of risk management, rather than a race to the bottom on margins, says Bank of England's head of payments and infrastructure

Cypriot commission criticises ‘cumbersome’ managerial structure at central bank

Independent commission wants to see more power handed to the executive and non-executive directors at the Central Bank of Cyprus; says senior management dropped the ball on financial stability

Thailand’s Prasarn highlights ‘dramatic’ turnaround caused by Fed taper-talk

Embattled emerging market central banks trying to resist capital inflows suddenly had the opposite problem as Fed hinted at QE taper, but some may have tightened too fast, says Thai governor

Overburdened central banks may become ‘repoliticised’, says Orphanides

Former Central Bank of Cyprus governor warns overreliance on central banks may eventually ‘diminish and compromise’ their independence, in a paper published by the Boston Fed

Fed paper trials new model for estimating trend inflation

Researchers at the Federal Reserve generate lower estimates of trend inflation in advanced economies by using a multivariate model; still struggle to outperform random walk forecasts

Fed’s Fisher attacks ‘ineffective’ US government

Dallas Fed president Richard Fisher holds the United States government accountable for the slow pace of economic recovery; says the Fed has acted swiftly and decisively in comparison

US Senator vows to block Yellen nomination

Republican Rand Paul - son of long-time Fed critic Ron Paul - says he intends to fight confirmation of Janet Yellen as the next Fed chair unless monetary policy is subjected to Congressional scrutiny

Asia Risk Congress: BIS points to Asian example as evidence new LCR not 'relaxed'

Asian regulators' partial recognition of Level 2B assets justifies revised Basel liquidity approach

Central bankers cannot fix Asia's economic woes, warn bank economists

Government-driven reform is urgently required to ensure continued development in Asia; India comes in for most criticism as market watchers turn attention to forthcoming plenary in Beijing