The Americas

Central banks with resource deficiency tend to pay higher salaries

Average financial stability budget also higher in units with that report non-staff resource shortage

Financial stability staff sufficiency improves year on year

Most central banks report contentment with non-staff resources

Most central banks co-ordinate monetary and financial stability tools

Cross-scenario evaluation and committee overlap cited as areas of interaction

Fed holds rates, despite pressure from White House

Experts say stance is in response to Trump’s trade policies and lament his attacks on central bank

Bank of Canada holds rates as core inflation heats up

Governor points to tariffs, but economist highlights “mystery” of core metric’s divergence from headline measure

Chile cuts rates for first time this year

Central bank says more easing to come as US tariff threats on copper complicate outlook

Fed hears renewed calls for tuneup of G-Sib surcharge

Failure to revisit 2015 methodology has led to inflated systemic risk scores, experts say

Barr slams weakening of bank supervisory tests

Fed governor warns deregulation during boom times ushers in crises

Judy Shelton on gold, tariffs and where the Fed went wrong

The potential successor to Jerome Powell discusses why she thinks the Fed is too powerful, why her stance on gold is not a ‘crank’ position, and why she feels events have vindicated her and president Trump on the need for rate cuts

Supervisors widely use suptech tools for data collection and validation

AI use is growing but remains much less widespread than suptech

Resolution framework update planned by 56% of supervisors

Non-central bank supervisory authorities less likely to have bail-in powers

Collateral pre-positioning reported in half of jurisdictions

Most supervisors believe banks are ready to access emergency central bank liquidity

Supervisors report low adoption of newer global standards

High income supervisors more likely to have regulations in place

Former OCC chief on the sting of peeling the Basel III ‘onion’

Michael Hsu warns successors not to cut bank capital or neglect rate risks that destroyed SVB

Three in five supervisory authorities publish oversight outcomes

Majority of respondents release supervision details in annual report

Digitalisation is top strategic priority for supervisors

Majority of supervisors have a strategy document but only half make them public

Ex-OCC chief urges new approach to AI explainability

Michael Hsu suggests shift from academic analysis to decision-based techniques

Tariffs worsen monetary policy trade-offs and inflation – study

Fed researchers find evidence of persistence in cost pressures stemming from levies

High-emission jobs in US more exposed to shocks – research

Kansas City Fed study says wages in ‘dirty’ industries are rising, but employment growth is not

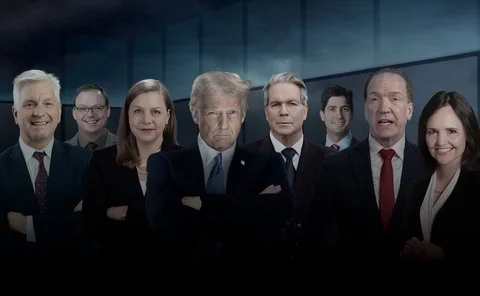

Fed succession planning: will Trump stick to the script?

The race to succeed Jerome Powell as head of the world’s most powerful central bank has already begun

Supervisors review banks’ asset quality at varied frequencies

Middle income supervisors tend to review assets more often than high income counterparts

Eastern Caribbean Central Bank posts record profit for 2024–25

Monetary authority says tally exceeds previous record by 57%

Replacing migrant labour will prove costly for US agri – research

Study by Kansas City Fed says farm operators may respond by shifting to foreign production

Systemic banks prioritised in onsite inspections

Supervisors’ activities commonly include interviews, reviews and verifications