The Americas

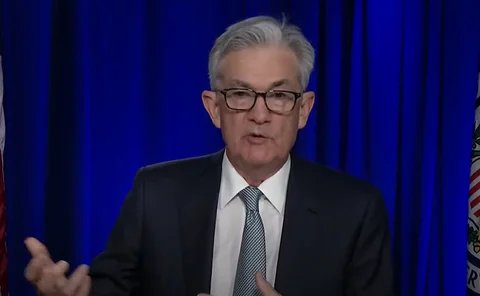

Fed risks president’s ire by holding rates

Experts say decision was obvious way to go, given US labour market and inflation figures

Risk management reviews are most common assessment method

Centralised teams are less likely to conduct external or management evaluations

UK’s Orange Book risk approach rarely used by central banks

Only three centralised risk management departments utilise principle

Sticky fears about sticky inflation

Survey finds investors are not yet ready to declare victory on inflation – with good reason

Staff error is largest cause of op risk at central banks

Legacy systems tend to trigger most threats in jurisdictions with greater than average number of incidents

Experts decry ‘show trial’ of Fed chair

Probe slammed as politically motivated attack on Powell for doing his job

Central bank governors express ‘full solidarity’ with Powell

Lagarde and Bailey among signatories of statement in wake of Department of Justice investigation

Op risk incidents average over 100 a year among central banks

Financial impact is risk managers’ strongest metric for gauging incidents’ severity

Collateral velocity is disappearing behind a digital curtain

Dealers may welcome digital-era rewiring to free up collateral movement, but tokenisation will obscure metrics

Phishing and ransomware are central banks’ main cyber threats

Teams widely use training, monitoring and privilege management to mitigate cyber threats

Just under half of risk departments are sufficiently staffed

Units with satisfied staffing levels earn below global average annual salary

Mitigation and reporting are leading components of risk strategy

Decentralised teams more likely to embed philosophy in divisional decision-making

People: New governor in Malta

Plus: Bahamian governor reappointed and new vice-governor in Bosnia

Most centralised risk teams prioritise cyber security

Decentralised teams primarily cover credit and counterparty, op and market risks

Risk policies widely reviewed by committee in larger teams

Central banks with larger teams favour risk committees over CROs

Bowman’s Fed may limp on by after cuts

New vice-chair seeks efficiency, but staff clear-out could hamper functions, say former regulators

How Bessent learned to stop worrying and love the T-bill

Short-dated issuance shows no signs of slowing. Some fear it could end badly.

Fed cuts by 25bp amid another three-way split on FOMC

Miran votes for deeper cut, and Goolsbee and Schmid opt to hold, as experts point to stagflation risks

US banks hoping for end of DFAST global market shock

As Fed consults on stress-test reform, lobby group argues regulator is double-counting market risk

People: Former DNB chief Knot joins Systemic Risk Council

Plus appointments at BIS Innovation Hub and Turkish central bank