Kevin Warsh

Lagarde downplays odds of early exit

ECB president uses interviews to say she is on a ‘mission’ with a ‘baseline’ of serving out her term

Fed risks president’s ire by holding rates

Experts say decision was obvious way to go, given US labour market and inflation figures

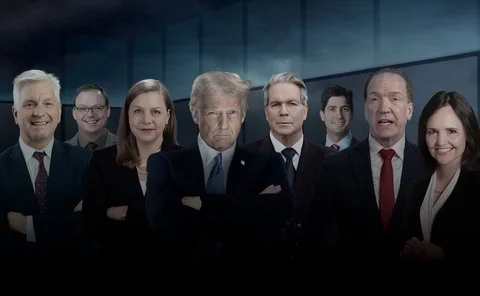

Fed succession planning: will Trump stick to the script?

The race to succeed Jerome Powell as head of the world’s most powerful central bank has already begun

30 years of forecasting: have central banks learned anything?

Forecasting models are constantly being upgraded, but forecast errors are still persistent. What more can central banks do?

The candidates knocking at Yellen’s door

Leading academics and economists weigh the competency of the top candidates for the Fed job – and how likely they are to win Trump’s favour

The MPC process in light of the Warsh Review

The Bank of England’s revised MPC meeting schedule has some merits but will not add to transparency and raises the risk of news shocks, writes former member Charles Goodhart

Bank of England launches review of MPC transcripts policy

Bank of England commissions former Fed governor Kevin Warsh to review practice of destroying records and assess the costs and benefits of publishing meeting transcripts

Obama nominates two new members to Fed board

Former undersecretary of the Treasury Jerome Powell and Harvard economist Jeremy Stein put forward to fill vacant seats on Federal Reserve Board of Governors; need Senate backing

Role of Fannie, Freddie failure in crisis has been underplayed: ex-Fed’s Warsh

Recently departed governor Kevin Warsh tells Central Banking that decision to take government-sponsored enterprises into state ownership had significant ramifications

Nobel Prizewinner not right for Fed: key Republican senator

Senate Banking Committee ranking member Richard Shelby sets out reasons underpinning party’s repeated rejection of Nobel Prizewinner Peter Diamond for Fed board seat

Warsh quits Fed

Federal Reserve board member Kevin Warsh plans to step down from Fed seven years before term ends

Fed’s Warsh advocates pro-growth fiscal policy in US

Federal Reserve governor Kevin Warsh says pro-growth fiscal policy will spur long-term investment

CIC’s Zhou calls on Congress, not Fed, to spend

China Investment Corporation’s Zhou Yuan says further quantitative easing will not cure United States’ unemployment problem; Fed expected to unveil more asset purchases, despite dissent

King takes firm line on QE, direct lending

Bank of England governor Mervyn King says small businesses’ problems won’t be solved by direct help from the central bank; stresses that banks will be weaned off liquidity support

Fed’s Warsh: market panic a signpost, not source of global economic woes

Market volatility merely a signal of how far we are away from the new normal; warns against expecting monetary and fiscal policy to do too much

Republicans propose end to Fed's quasi-fiscal activity

Senate Republicans leak alternative regulatory proposals calling for an end to Fed’s involvement in shoring up broad sectors, central bank cannot lend to firms with solvency problems under plans

Warsh acknowledges Fed’s quasi-fiscal action

Governor suggests Fed’s crisis-fighting measures may have tested the boundaries of central bank’s ambit

New York Fed starts search for Geithner successor

The New York Federal Reserve has set up a panel to search for a successor to Tim Geithner, the current president of the central bank who was last week announced as the new treasury secretary.

Fed's Warsh: we would take covered bonds

Highly rated, high-quality covered bonds would generally fall within the range of collateral acceptable at the Federal Reserve's discount window, said Kevin Warsh, a governor at the Federal Reserve Board.

Recovery requires more than Fed cuts: Warsh

Returning the economy to equilibrium requires actions more befitting than changes in the federal funds rate alone, noted Kevin Warsh, a governor at the Federal Reserve.

Regulation should aim to burst bubbles

Frederic Mishkin, a governor at the Federal Reserve, has acknowledged that the Fed should consider responding to asset price bubbles - a move that would contravene a tenet of the Greenspan-era institution.