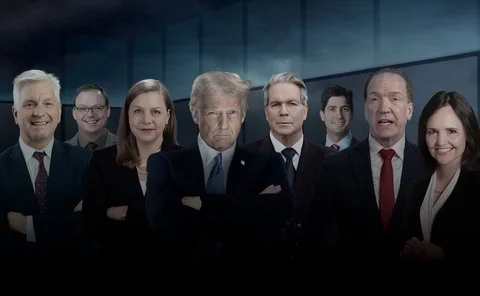

Jerome Powell

Options for realising gold revaluations

Is monetary gold a special case in central bank revaluations accounting?

How FX pricing is adapting to Trumpian markets

Dealers are tying pricing engines to new signals in effort to cope with out-of-the-blue moves

The investors who aren’t fretting over Trump’s stat sulk

Some see dismissal of statistics agency chief as an assault on US institutional integrity; for others it offers a chance to throw off outdated methods

How much do investors really care about Fed independence?

The answer for some is more nuanced than you might think

How to solve the Fed’s $300bn FRTB problem

A sacrifice will have to be made to ensure new market risk rules meet demands for capital neutrality

Economists lambast Cook’s ‘firing’ for lack of due process

Expert says if Trump succeeds it will be the end of Fed independence; governor sues to void presidential order

Bank notes: July to September 2025

A round-up of news and salient issues that have affected central bankers in the past three months

Powell indicates policy shift at Jackson Hole

The Fed chair says the balance of risks appears to be shifting; FOMC no longer plans to overshoot inflation target

Trump calls for Fed governor Cook to resign

Federal Housing Finance Agency director accuses the governor of mortgage fraud

On the eve of the Fed’s framework review

Experts speak about the Fed’s monetary strategy review, including the role of flexible average IT and the need to better communicate policy trade-offs

Kugler’s resignation from Fed opens door for Trump, say experts

Governor’s departure could enable president to appoint “shadow chair” to further undermine Powell

Trump should not have fired head of stats bureau, say experts

Economists say dismissal undermines trust in official data, along with president’s arguments and democracy itself

Fed holds rates, despite pressure from White House

Experts say stance is in response to Trump’s trade policies and lament his attacks on central bank

Markets bet on cuts when Trump threatens Powell – research

Economists link attacks on Fed independence with expectations of policy easing

RBA governor praises Fed’s independence following Trump’s attacks

Bullock says US central bank is “doing what it’s supposed to be doing”

Trump to inspect Fed buildings in Washington

Visit comes as central bank’s chair faces continued flak over renovations bill and refusal to cut rates

Bessent floats audit of Fed’s perceived failures

Treasury secretary is latest Trump official to attack central bank, but says chair need not step down

Judy Shelton on gold, tariffs and where the Fed went wrong

The potential successor to Jerome Powell discusses why she thinks the Fed is too powerful, why her stance on gold is not a ‘crank’ position, and why she feels events have vindicated her and president Trump on the need for rate cuts

Will Fed’s HQ cost overruns be enough for Trump to fire Powell?

Chair’s defenders say administration wants to use renovations bill as pretext for his removal

Fed succession planning: will Trump stick to the script?

The race to succeed Jerome Powell as head of the world’s most powerful central bank has already begun

No changes to Fed swap lines, Lagarde worried about ‘truth’ – panel

Fed, ECB, BoE, BoJ and BoK governors discuss tariffs, stablecoins, r*, scenario analyses and the future

Economists denounce Trump’s ‘bullying’ of Fed chair

Experts also back Powell’s assessment rates would probably be lower were it not for tariffs

Ex-OCC chief Michael Hsu on the impact of an America-first agenda

The former acting comptroller of the currency speaks with Christopher Jeffery about the future of the US Treasury market, Fed independence, financial de-regulation, the Genius Act and international co-operation

Fed unveils plan to cut leverage ratio requirements

Bowman says proposed eSLR reform will free up banks’ capacity to deal in Treasury market