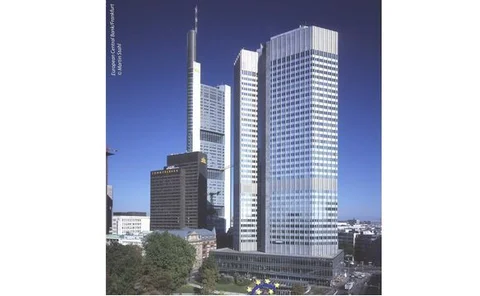

European Central Bank (ECB)

ECB insists stress tests are credible

ECB denies claims stress test scenarios were not severe enough

ECB: Crisis amplified monetary policy channels

European Central Bank study on credit channels finds the financial crisis amplified the impact of monetary policy on the economy

ECB will always end up bailing out sovereigns: Buiter

Former Bank of England rate-setter Willem Buiter says ECB will lose in “game of chicken” with finance ministries over who rescues sovereigns

Hungary prepares bracing bank tax, wage caps

Hungarian parliament set to approve hefty bank levy to shear budget deficit; public sector wage freeze will affect central bank employees, despite ECB protests

Estonia upgraded on euro accession; Ireland knocked down on banks’ weakness

Fitch lifts Estonian credit rating two notches, citing benefits of eurozone membership and strong fiscal performance; Moody’s downgrades Ireland on poor growth projections, worries over bad bank

ECB identifies dark side of wholesale funding

European Central Bank study finds that despite benefits of wholesale funding, liquidity scares can cause instability to banks that are uninformed of potential risks

Fed better prepared than us for financial crisis: ECB paper

European Central Bank study shows stronger emphasis towards output allowed the Fed to react faster than Frankfurt to financial crisis

Euro counterfeits fall by 13%

ECB statistics show 387,000 forged euro banknotes recovered in first half of 2010; €50 note overtakes €20 as most popular bill to fake

Central bank auctions reveal banks' liquidity risks

BIS study says aggressive bidding in central bank auctions good indication of liquidity risks at banks

Spanish banks’ reliance on ECB rockets again

Bank of Spain data shows the country’s lenders borrowed 48% more from the European Central Bank in June than in May; figures renew worry on sector’s health, but government remains adamant

ECB's Bini Smaghi: Europe must regain competitive edge

ECB executive board member Lorenzo Bini Smaghi says even surplus countries in eurozone must improve competitiveness

ECB draws Hungarian government’s fire over pay dispute

European Central Bank opinion on proposed wage cap at National Bank of Hungary angers government; prime minister plans objection

Monetary aggregates remain about price, not financial, stability: ECB’s Stark

ECB Executive Board member Jürgen Stark says critics-cum-champions of monetary analysis are wrong once more about the true purpose

Trichet: Reforms must keep an eye on financial markets

ECB president Jean-Claude Trichet outlines four main areas of reform in the financial sector where there is further room for improvements

Trichet on World Cup: I don't mind who wins

Jean-Claude Trichet refuses to declare favourite as two eurozone members vie to scoop soccer's top prize

Cebs unveils details of EU stress tests

Committee of European Banking Supervisors names 91 banks that will be subject to stress tests; vague on methodology

ECB bond purchase effect wearing off, warns IMF

Fund cautions that stability risks are on the rise again as effect of European Central Bank’s foray into bond markets loses bite; southern eurozone to face refinancing contest with US, UK and Japan

Azerbaijan to move to DSGE model

National Bank of Azerbaijan will switch to consolidated DSGE framework by year-end; deputy research director says model valued for overall coherence and ability to factor in irrational behaviour

ECB attacks Bucharest over central bank pay cuts

European Central Bank criticises Romania’s decision to impose wage cuts on central bankers after its government failed to consult Frankfurt

ECB handled Greek crisis well: CentralBanking.com readers

CentralBanking.com poll shows more than 40% approval rating for European Central Bank’s handling of the Greek debt crisis

ECB’s Tumpel-Gugerell: towards a safer financial system

European Central Bank executive board member discusses key elements of new approach to safeguarding stability

Klaus Regling to head euro bailout vehicle

German economist and former director general Klaus Regling to head European Financial Stability Facility set up to bail out troubled eurozone states

EXCLUSIVE: Pick and choose from social media tools: BIS’s Laurmaa

Bank for International Settlements’ head of web publishing Timo Laurmaa says Twitter more beneficial to profit-making companies; short releases help when reaching out to wider-than-usual audience

Relationship between government and markets must change: Padoa-Schioppa

Former executive board member at the European Central Bank Tommaso Padoa-Schioppa says successful exit from the crisis will require a shift in the market-government nexus