News

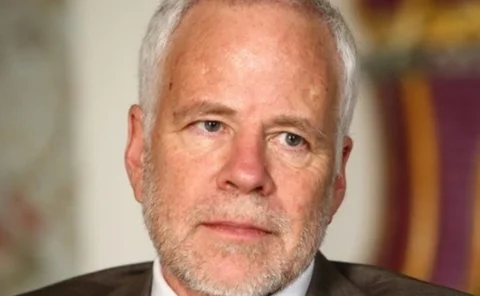

Mersch backs close relationship between monetary and macro-prudential policies

ECB executive board member says policies should take one another into consideration and exploit informational synergies; LSE academics concerned by politicisation of macro-prudential frameworks

G-20 leaders vow co-operation to avoid monetary policy spillover

St Petersburg summit sees IMF concede advanced economies are now the major engines of global growth; European banking union is a top priority in the G-20's joint ‘action plan'

FSB flags up financial reform concerns

Financial Stability Board reports on progress of financial reforms to G-20 leaders; details the ‘serious problems’ emerging in some areas of national policy implementation

FX now a $5.3 trillion per day market, says BIS

The latest BIS triennial survey shows the UK has strengthened its grip on the FX market, while USD/JPY has seen a strong increase in trading activity

ECB holds rates as Draghi is ‘caught between doves and hawks'

ECB sticks to forward guidance as eurozone recovery deemed too 'green' to warrant a tightening of policy; announcement is imminent on the single supervisory mechanism

Fed presidents opposed as September meeting nears

John Williams backs reducing asset purchases ‘later this year’ while Narayana Kocherlakota says the Fed should be providing ‘more stimulus… not less’

Riksbank holds rates as IMF sees ‘sizeable' risks at Swedish banks

Interest rates held at 1% as Swedish central bank attempts to support growth without adding to household debt stock; IMF Article IV report frets over large and vulnerable financial system

BoE and BoJ shun further easing as economic activity picks up

Both the Bank of England and Bank of Japan keep their interest rates and asset purchases unchanged as their respective recoveries work up a head of steam

Haldane says central banks have ‘further to go’ to improve communication

Bank of England executive director Andrew Haldane says policy-makers are still searching for a language that resonates with the general public

Central banks are getting more transparent, study finds

Study conducted by Barry Eichengreen and Nergiz Dincer finds trend towards greater transparency was not knocked off course by the financial crisis; independence, however, is more patchy

RBI's Rajan sets out vision for ‘inclusive development'

India's new central bank governor hits the ground running, outlining several concrete policy measures ranging from a short-term forex swap window to national savings instruments

European Commission launches shadow banking onslaught

Commission looks to impose more stringent liquidity and capital requirements on money market funds; industry body hits out at 'ill-considered' proposals

Bank of Finland deputy calls on Denmark and Sweden to join the SSM

Pentti Hakkarainen says a strong Nordic dimension in the European banking union would benefit all countries involved; Sweden focused on domestic supervision for time being

BIS papers study effects of monetary and fiscal policy shocks

Researchers find fiscal shocks within the eurozone lead to a real exchange rate appreciation through inflation differential; monetary policy shocks have minor impact on commodity prices

East African central banks take different approaches to rising inflation

Bank of Uganda hikes key rate by 100bp to 12% as food shortages push crop prices up by 16% in August; Central Bank of Kenya dismisses own inflationary pressures and holds rates

German voters want to keep the euro - but not to save it, poll finds

Two-thirds do not believe the next chancellor has mandate to support eurozone countries financially after the September 22 elections; a third supports break up of eurozone and return to deutschmark

RBA quiet on further easing as it holds rates

Reserve Bank of Australia holds its key policy rate at 2.5% and omits earlier guidance on the prospect of an additional rate cut from accompanying statement

Net lending to UK businesses still negative, BoE data shows

Second quarter figures for the UK's Funding for Lending scheme shows credit creation remains subdued; Bank of England attributes weak performance to alternative funding sources

Danish central bank calls for better liquidity management in payments markets

National Bank of Denmark urges market participants to reserve ‘adequate liquidity’ for payments settlement; breaks down ongoing modernisation of financial market infrastructure

Carney urges G-20 leaders to cooperate

FSB releases report on global progress toward ending too-big-to-fail as its chairman, Mark Carney, stresses importance of cross-border cooperation over global financial reforms for global trade

Regulators exempt forex swaps and forwards from initial margin rules

Working Group on Margining Requirements exempt forex swaps and forwards from initial margin rule for non-centrally cleared derivatives; offer a more restricted exemption for cross-currency swaps

US takes lead in ending credit rating agency ‘hard-wiring’, says FSB

China, Indonesia and South Korea have made little progress in dealing with concerns about over-reliance on credit rating agencies; US takes the lead, followed by Europe, in reducing hardwiring of ratings in the financial system, FSB report finds

Bank Negara Malaysia strikes deals with AFI and HKMA

Malaysian central bank joins forces with the Alliance for Financial Inclusion to develop global capacity-building programmes; will work with HKMA on offshore renminbi business development

Summers trails Yellen and Fischer in Central Banking Fed poll

Readers of CentralBanking.com make Janet Yellen first choice to succeed Ben Bernanke as Fed chair - with Stanley Fischer a strong second; Larry Summers joint third with Christina Romer