News

IMF strikes €1 billion funding deal with Cyprus

Staff team agrees Fund’s contribution to overall bail-out package; Christine Lagarde praises Cyprus’s ‘ambitious’ programme of reforms

Haldane defends BoE's macro-prudential policy

Andrew Haldane says recent instruction to banks to increase levels of capital will stimulate lending to real economy; academics debate viability of macro-prudential policy

Australia shuffles top managers but governor Stevens stays on

RBA governor Stevens reappointed for three more years, while Wayne Byres moves from Basel Committee to head up prudential regulator Apra

Asean report maps road to financial integration

Key to achieving an Asean Economic Community will be capital account and financial services liberalisation; member states should integrate at their own pace, to avoid EMU-style crises

ECB’s Cœuré damns ‘Panglossian’ view of currency war danger

ECB board member’s comments on ‘dangerously alluring’ monetary easing come a week after Bernanke claimed widespread QE is an ‘enrich thy neighbour’ policy

UK enters new regulatory landscape

UK’s new conduct and prudential regulators take over from the FSA and aim to avoid the failings of their predecessor

Barbadian governor proposes adopting new policy rate

DeLisle Worrell and other senior central bank staff suggest adopting three-month Treasury bill rate as key policy rate, saying it is more practical for small, open economies

IMF calls on Hungary to safeguard central bank independence

The Fund's executive board urges National Bank of Hungary to preserve legal and operational independence; encourages a 'pause' in monetary easing

Bank of Lithuania chief urges banks to consider fee cuts as non-cash payments rise

Report shows sharp increase in volume of non-cash payments in Lithuania; governor Vitas Vasiliauskas says this gives banks room to consider cutting fees

Turkish banks face larger bill for holding forex and gold

Central bank increases price of holding gold and foreign exchange for Turkish banks who want to diversify reserve holdings away from Turkish lira

Fed doves disagree over FOMC's next move

Boston Fed’s Rosengren sees scope to continue asset purchases at current rate throughout 2013; Cleveland Fed’s Pianalto wants to slow programme down if labour market improvements hold

McKinnon says Fed must raise rates to stimulate growth and employment

Leading academic says positive real interest rates are the only way out of a credit crunch that's holding back lending to the productive economy

Michael Woodford backs combining nominal GDP and inflation target

Leading monetary policy theorist advocates immediate fiscal transfer to the public, funded by central bank purchase of government debt, coupled with adoption of nominal GDP target

Asia corporates unfairly ‘penalised’ by CVA capital charge

The move by European authorities to exempt European banks from holding CVA capital should be matched by regulators in Asia, according to senior bankers in the region

Fiji's new $5 note is island nation's polymer pioneer

New FJ$5 note will be Fiji's first polymer banknote, and will supplant the defunct FJ$2 note as the country's smallest

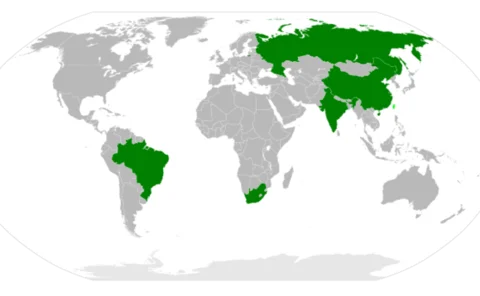

Brics leaders agree to set up $100 billion ‘financial safety net'

Contingent reserve agreement will allow Brics countries to provide each other financial support and will 'contribute to strengthening the global financial safety net'

Parliament gives Agus green light to become Bank Indonesia chief

Agus Martowardojo gets parliamentary approval to replace Darmin Nasution as governor of Bank Indonesia, after nine hours of questioning by commission

Slovenia picks new central bank governor to guide economy to safety

Boštjan Jazbec will take over from Marko Kranjec at the helm of the eurozone nation's central bank - tasked with 'repairing the financial sector'

BoE’s FPC calls on banks to raise more capital despite drop in lending

Financial Policy Committee says banks must correct a £25 billion shortfall by the end of the year, but should not cut lending; loans to private sector continue downward slide

Sanusi impersonators shut down in fight against Nigerian scams

Central Bank of Nigeria ensures over 100 social networking accounts impersonating governor Sanusi Lamido Sanusi are closed down in battle against fraud

China uses Brics summit to further RMB internationalisation

South Africa and Brazil sign deals with PBoC to 'strengthen economic relations' between Brics nations

Osborne defends new Bank of England remit

George Osborne defends changes to Bank of England’s remit; UK economists say the finance minister has shifted the burden for stimulating growth on to the central bank

UK FSA finalises Libor regulations

Financial Services Authority produces final rules for regulating benchmarks, days before it will cease to exist; regulated firms will undergo compliance review by new watchdog in coming year

Blanchard and Summers warn on central banks' democratic deficit

Axel Weber opposes supervisory role for central banks, as Olivier Blanchard and Larry Summers warn expanded mandates cause questions over democratic accountability