Central Banks

Zambian governor targets Muslim banking expansion

Michael Gondwe says the economically valuable Muslim community is shunning the use of commercial banks due to lack of appropriate products; proposes banking expansion

Palestine Monetary Authority finds greater parity between West Bank and Gaza territories

Palestinian central bank develops business-cycle indicator to assess economic performance in real time; finds gap in performance between two territories is shrinking

Norges Bank governor outlines Norwegian model for stability

Øystein Olsen tells Harvard audience of Norway's fiscal rule and inflation-targeting - but warns the system has yet to be seriously tested

Sri Lankan central bank reveals inflation spike in 2012

Sri Lankan annual report says economic growth, while still strong, fell in 2012 while inflation rose sharply; central bank increased reserves by 15%

FDIC vice-chair says Basel III capital requirements provide illusion of safety

Thomas Hoenig says capital ratios allow banks to leverage up while outwardly appearing safe; warns systemically important banks have much worse leverage ratios than smaller institutions

IMF says independent central banks have ‘muzzled’ the inflation threat

World Economic Outlook says central banks have little reason to fear inflation resulting from loose policy – so long as their independence is upheld

FOMC members saw QE continuing ‘through midyear’ at March meeting

Participants at the FOMC’s last meeting broadly agreed to continue QE at existing pace ‘through midyear’ but failed to reach a consensus on when to slow asset purchases

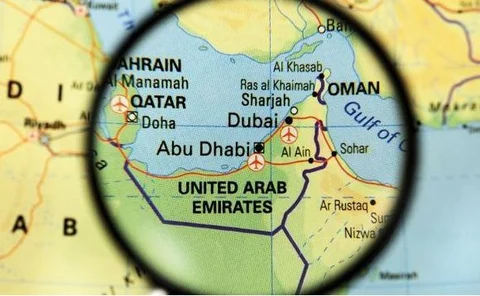

Emirates central bank to introduce direct debit system

Central Bank of UAE to bring in direct debit system to allow payment in instalments without the need for post-dated cheques

Norwegian authorities chase benchmark rate reform

Financial Supervisory Authority of Norway proposes new framework for Norwegian Interbank Offered Rate-setting process; central bank looks to push envelope further

Bernanke says Fed stress tests were a ‘critical turning point’ in crisis

Fed chair says stress tests offer macro-prudential dimension to supervision; US banks have more tier 1 common equity under a severe stress scenario than they did in reality in 2008

Polish paper scrutinises interest rate holds

Research finds that central banks keep interest rates unchanged on majority of occasions; proposes model that distinguishes between rate-holds in period of tightening, easing and neutrality

Thatcher's stance on the ECB deserves re-appraisal

Former UK prime minister Margaret Thatcher feared an independent ECB ‘accountable to no one, least of all national parliaments'. Her concerns seem even more relevant today

Sarb’s head of financial stability fears new powers may cause conflict

Hendrik Nel says the Reserve Bank was not given much choice but to accept new supervisory powers; warns of conflict with monetary policy and possible threat to independence

Ireland’s financial regulator quits central bank

Deputy governor for financial regulation announces departure to ‘pursue other interests’; term spanned turbulent period for Ireland’s economy

New model prescribes strongly counter-cyclical medicine for financial shocks

Working paper from the Bank of Canada suggests counter-cyclical bank capital rules can help steady the ship in the wake of financial shocks, in tandem with monetary policy measures

BoJ minutes reveal tensions over asset purchase programme

Minutes of final meeting under governor Masaaki Shirakawa show disagreement over whether to loosen policy further, including changes to quantitative easing

Cyprus deputy sacked after two months

President revokes contract of central bank’s first ever deputy governor, whose ethnic Greek heritage made his appointment unconstitutional

ECB paper examines shifts in fiscal regimes

Study finds responsibility for stabilising debt levels has swung between monetary and fiscal authorities in UK, Germany and Italy; most clearly defined in UK

FSB to assess efforts to end ‘mechanistic reliance’ on credit ratings

Peer reviews aim to hasten a move away from rating agencies, with countries expected to eliminate references to credit ratings from laws and encourage better internal credit risk assessments

Hungarian deputy governor resigns over new central bank regime

Last remaining deputy from the previous regime cites lack of professional debate and 'Potemkin' approach to stimulating growth

Accumulating reserves to guard against inflation is 'misplaced'

Researchers at Bofit institute find that using reserves as a ‘bulwark against goods price inflation' is a mistake; say best protection against costly reserves accumulation is flexible exchange rate