Central Banks

RBNZ could ‘scale up’ forex intervention

Reserve Bank of New Zealand governor Graeme Wheeler signals willingness to sell more NZ dollars to combat currency appreciation; house price increases put central bank in policy ‘bind’

HKMA's Chan identifies inherent flaws in risk models

HKMA chief questions the use of financial models in risk management; argues the inability of models to account for irrationality is a major defect

Pressure builds on ECB as figures show no lending growth

OECD and the European Commission call on the European Central Bank to do more, as ECB figures show lending to the eurozone's productive economy continues to shrink

BoJ’s Kuroda highlights 'increasing attention' on capital controls

Bank of Japan governor notes greater understanding of volatile capital flows as a channel for financial shock transmission; says banking union may be plagued by 'financial trilemma'

Bank of Mexico paper backs credit multiplier as amplification mechanism in DSGE

Working paper finds that credit multipliers do produce the amplification effects expected of them in a DSGE model and are not failing as some suggest

BoE deputies warn of slow policy coordination

Charlie Bean says eurozone periphery will weigh on demand for ‘some time’ as wage and price adjustments are needed; Tucker highlights trade-off between speed and balance in global regulation

Bank of Thailand rate cut aims to boost demand, not weaken baht

BoT makes clear its move was driven by disappointing economic growth, and not aimed at weakening the currency as the government would like

Latvian annual report reveals reserves diversification

Bank of Latvia publishes annual report for 2012; reveals 15% increase in foreign reserves and diversification into Canadian and Singapore dollar-denominated assets

Belize annual report details financial stability measures

Central Bank of Belize publishes annual report for 2012; establishes financial stability unit to explore macro-prudential surveillance and introduces measures to reduce share of NPLs

BIS finds ‘no evidence' of persistent collateral scarcity

Report says increased reliance on collateralised funding and demands of regulatory reforms have not led to any 'lasting or widespread scarcity' of high quality assets

Colombian paper trumpets transparent forex intervention

Research says ‘pre-announced and transparent’ interventions had a greater impact on the Colombian exchange rate than more discretionary or ‘dirty’ purchases

RBA considers overhaul to card access regimes

Reserve Bank of Australia launches consultation on whether to change or revoke rules governing access to credit and debit card systems – which might allow the RBA itself to acquire cards

Israel cuts rate for second time in two weeks

Bank of Israel cuts benchmark interest rate by 25 basis points for second time this month as global monetary easing ‘accelerates’

Danish governor rejects financial transaction tax

Per Callesen says tax will restrict market liquidity and banks are ‘right to complain’ about it; says the central bank’s experience with negative interest rates has been a success

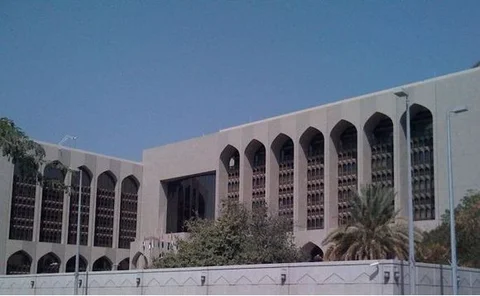

UAE central bank annual report shows sharp balance sheet expansion

Annual report for 2012 sees balance sheet growth driven largely by higher foreign exchange purchases; prudential measures implemented to shore up banking system

Discontent on BoJ board over monetary policy outlook

Three board members suggest changes to the wording of the outlook for economic activity and prices as fears emerge over effects of continued QE; Kuroda and Miyao upbeat in separate speeches

Fed paper analyses impact of public views on FOMC forecasts

Working paper says FOMC forecasts are influenced by both internal and external views; analyses the weighting given by committee members to each

RBI targeting 'greater internationalisation' of rupee

Reserve Bank of India executive director Padmanabhan says currency is a ‘natural candidate’ for internationalisation; aims for ‘careful and gradual’ progress

Martowardojo sworn in as governor of Bank Indonesia

Former finance minister promises to combat inflation and increase the stability of the banking sector

Central bank operations push up Target2 turnover

ECB annual report says central banks helped push the value of payments in Target2 system to €634 trillion in 2012; balances diverged as German claims and Spanish liabilities increased

Gideon Gono fears ‘financial isolation’ for Zimbabwe

Central bank governor believes country could lose access to global payments platforms and external lines of credit if the indigenisation of foreign-owned banks is forced through

Danish paper uses three centuries of data to show tail risks underestimated

Research says severe stress cannot be properly understood with short time horizons; suggests results could be used to design tougher stress tests

Cyprus challenges accusations of weak anti-money laundering controls

Central bank and finance ministry say summary of two reports into anti-money laundering controls in Cyprus gives a biased view of the results