Central Banks

Norwegian paper finds implicit intra-day interest rate in UK money market

Research says that – in the absence of contractually binding repayment time – there is an implicit cost of delaying payments in the UK’s overnight money market

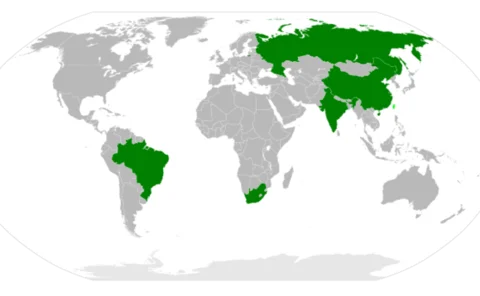

Brics leaders agree to set up $100 billion ‘financial safety net'

Contingent reserve agreement will allow Brics countries to provide each other financial support and will 'contribute to strengthening the global financial safety net'

Parliament gives Agus green light to become Bank Indonesia chief

Agus Martowardojo gets parliamentary approval to replace Darmin Nasution as governor of Bank Indonesia, after nine hours of questioning by commission

Australian banks ‘relatively strong’, says RBA

Reserve Bank of Australia’s latest financial stability review finds banks’ profits and capital levels are increasing; real economy suffering from high exchange rate

RBNZ article says ‘open bank resolution’ helps keep banks in line

Quarterly bulletin describes resolution mechanism aimed at minimising disruption to bank customers; suggests use as an alternative to bail-out strengthens incentive for banks to operate prudently

Slovenia picks new central bank governor to guide economy to safety

Boštjan Jazbec will take over from Marko Kranjec at the helm of the eurozone nation's central bank - tasked with 'repairing the financial sector'

BoE’s FPC calls on banks to raise more capital despite drop in lending

Financial Policy Committee says banks must correct a £25 billion shortfall by the end of the year, but should not cut lending; loans to private sector continue downward slide

Sanusi impersonators shut down in fight against Nigerian scams

Central Bank of Nigeria ensures over 100 social networking accounts impersonating governor Sanusi Lamido Sanusi are closed down in battle against fraud

Bundesbank researchers test if higher inflation could ease public debt burden

Paper finds 'minor effect' on public debt from a raised inflation target, and would only be felt over a long time-frame

Canadian deputy encourages use of derivatives central counterparty

Bank of Canada deputy calls for ‘material increase’ in central counterparty membership; supports smaller institutions accessing service through existing participants

China uses Brics summit to further RMB internationalisation

South Africa and Brazil sign deals with PBoC to 'strengthen economic relations' between Brics nations

Osborne defends new Bank of England remit

George Osborne defends changes to Bank of England’s remit; UK economists say the finance minister has shifted the burden for stimulating growth on to the central bank

UK FSA finalises Libor regulations

Financial Services Authority produces final rules for regulating benchmarks, days before it will cease to exist; regulated firms will undergo compliance review by new watchdog in coming year

Blanchard and Summers warn on central banks' democratic deficit

Axel Weber opposes supervisory role for central banks, as Olivier Blanchard and Larry Summers warn expanded mandates cause questions over democratic accountability

BoE Financial Policy Committee gets three new members

Former LSE head Clara Furse among the new external members named to Bank of England’s FPC; Donald Kohn re-appointed to his post

Bernanke denies QE represents competitive devaluation

Fed chairman plays down effect of asset purchases on exchange rates and emerging markets; Axel Weber says countries can lean against QE if necessary, but highlights more serious flaws

BoE survey sees signs of easing in UK financial markets

Funding costs fall and investor demand rises ‘significantly’, although total volumes remain roughly flat, Bank of England liabilities survey finds

Fed working paper measures FOMC comms effect against theory of UIP

Paper finds 'little evidence' for a changed relationship between FOMC announcements and US interest rates since the 'onset of the zero lower bound'

Kuroda uncompromising on deflation

New Bank of Japan governor says the central bank will need to expand its asset purchase programme and firmly communicate its commitment to raising inflation

ECB paper finds initial response to financial crisis was not good enough

Working paper suggests policy up to end of 2011 was insufficient to reduce credit availability problems for small businesses, underlining the importance of more recent innovations