Monetary Policy

Norway's Olsen: price stability remains central bank's priority

Norges Bank governor Øystein Olsen says price stability will remain primary monetary policy objective despite low inflation experienced in Norway over recent years

Monetary policy effects on housing bubble: Bank paper

Bank of England study measures impact of monetary policy and capital inflows on housing activity

Central banks should consider price-level targeting: CentralBanking.com poll

Fifty-three percent of voters in CentralBanking.com poll think central banks should mull switch to price-level targeting framework

Mortgage discounting slows monetary policy pass through: Bank of Canada

Bank of Canada Winter Review 2010–2011 says mortgage-rate discounting slows monetary policy pass-through to lending rates

The inflation targeting debate: a case study in FOMC deliberation

Discussions among Federal Open Market Committee members in the mid1990s highlight two important lessons for central bankers, Marvin Goodfriend shows

Financial reform, Fed independence and the political economy of monetary policy

The 2010 Financial Reform Act will weaken the independence of the Federal Reserve. Looking at the central bank’s history and its political economy allows us to appreciate why, Thomas F. Cargill argues

FOMC minutes on why yield curve is steepening

Federal Open Market Committee meeting minutes explain steep rise in long-term Treasury yields

ECB overnight lending rockets to 19-month high

Banks’ borrowing from the European Central Bank’s marginal lending facility climbs to $21 billion on Wednesday; sudden move has sparked speculation on bank troubles, analysts say

RBA minutes: rates on hold as flood damage assessed

Minutes of Reserve Bank of Australia rate-setting meeting relay concerns over impact of floods on economic outlook; cautious over rising commodity prices

Buba study on robustness of monetary policy

Bundesbank research examines whether misspecification may have consequences on robustness of monetary policy decisions

Inflation may hit 5%, but we couldn’t have done it different: King

Bank of England’s Inflation Report says inflation will likely soar further; medium term outlook shifts slightly as spare capacity margin revised downwards

PBoC to lend to drought-wracked agricultural sector

People’s Bank of China says it will lend for agricultural purchases and drought relief to stymie effects of continuing drought

Inflation benefits poor, hurts rich: Central Bank of Chile paper

Central Bank of Chile study shows contrary to conventional wisdom inflation has negative affects on welfare of rich but benefits the poor

King acknowledges risk of wage-price spiral as inflation climbs to double Bank’s target

Inflation of 4% in January prompts Bank of England governor Mervyn King to pen another letter to the chancellor; letter acknowledges mounting inflationary pressures

Kansas City Fed paper on search frictions in monetary policy

Kansas City Federal Reserve paper finds evidence of indeterminacy in monetary policy in models with labour markets search frictions

Spanish banks’ ECB reliance drops

Spanish banks’ borrowing from European Central Bank declines just over 20% compared to December

Bank amends collateral rules for sovereign debt

Revisions adjust ‘narrow’ and ‘wide’ bands for eligible collateral; change is for liquidity reasons

NY Fed’s Sack: rise in long-term yields not down to inflation

New York Federal Reserve executive vice president Brian Sack says rise in longer-term interest rate reflects better growth outlook rather than rising inflationary pressures

Inflation often misunderstood: Atlanta Fed’s Lockhart

Atlanta Federal Reserve president Dennis Lockhart discusses common misuse of the term “inflation” in news reports

Bank’s inflation argument ‘fanciful’: ex-MPC’s Julius

Former Bank of England rate-setter DeAnne Julius says inflation expectations risk becoming unmoored; monetary policy acting for financial stability, ex rate-setter Tim Besley adds

Ex-Bank economists parry fears of wage-price spiral

Upsurge in inflation will not pass through into wages, economists at Fathom Consulting believe

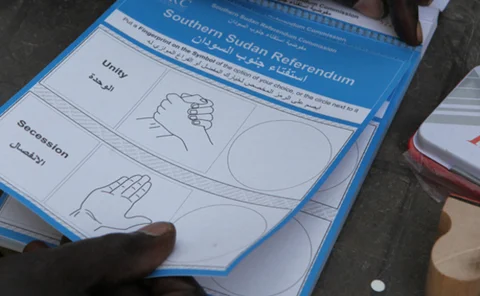

Southern Sudan should adopt currency board: IMF mission chief

Fund’s Sudan mission chief Edward Gemayel says simplicity of currency board system advantageous for soon-to-be country; South preparing to adopt new currency

Norges Bank’s Nicolaisen gives advice on rate-setting in turbulent times

Norges Bank director of monetary policy Jon Nicolaisen on setting monetary policy in volatile economic times

Monetary policy not responsible for land price bubbles: Minneapolis Fed’s Kocherlakota

Minneapolis Federal Reserve president Narayana Kocherlakota disputed claims that land price bubbles are a consequence of loose monetary policy