Monetary Policy

More sharia-compliant instruments would aid liquidity management, IMF paper argues

Working paper focused on Gulf states notes a lack of instruments has forced Islamic banks to hold a lot of cash, while making it harder for central banks to conduct monetary operations

Low rates from QE poses risks to some pension and insurance firms in eurozone, Visco warns

Pension funds and insurance companies in some eurozone countries may need to adjust their practices to limit the risks arising from asset purchases, Italian governor says

Rajan picked as BIS board vice-chair as he calls for global ‘rules of the game’

RBI governor chosen to take over position Masaaki Shirakawa vacated in 2013; delivers lecture in Frankfurt calling for global ‘rules of the game’

Sarb’s Mminele fears a ‘lengthening drought’ in emerging market capital flows

Sarb deputy warns emerging market nations must maintain “utmost vigilance” as they are buffeted by the effects of divergent monetary policies and fears about the state of the Chinese economy

Riksbank paper examines mixed forecast performance

Researchers find the central bank has tended to be overly optimistic on foreign economic performance, but makes similar errors to other institutions

No fireworks as Bank of England keeps rate options open

Rates remain on hold as BoE balances domestic strength with signs of weakness overseas; MPC hints a few forces could prompt an earlier hike than markets are predicting

BoE Court recommends forecasting rethink

Review of forecasting sheds light on strengths and weaknesses of central bank’s approach; recommends more systematic performance evaluation and new modelling techniques

Albania cuts rates as renovations to HQ completed

The Bank of Albania cut its policy rate to a record low of 1.75%; chair of Single Resolution Board visits as non-performing loans fall to approximately 20% of total in banking sector

Asset purchases having ‘sizeable’ impact on prices in eurozone, ECB paper finds

Working paper says ostensibly puzzling result can be explained by low levels of ‘market distress’ weakening some transmission channels but bolstering others

Fischer defends Fed independence

Attempts to make the FOMC adopt a policy rule and 'audit’ its decisions would restrict the Fed’s independence without generating much benefit, Stanley Fischer argues

Rising mortgage rates do not demand policy response, says RBA’s Stevens

Recent increases in mortgage rates have reversed some of the central bank’s easing, but there is no need to lean against the movement at present, governor says

Improved inflation outlook gives Icelandic central bank room for manoeuvre

Shallower path for near-term inflation allows central bank to make smaller rate hike than planned, but the longer-term picture still shows inflation overshooting the target

Hungarian central bank mulls lower capital requirements for SME-friendly banks

Central bank looks to incentivise lending to small businesses; risk-absorbing swaps and 'preferential' deposit facility could be supplemented by lower requirements

Inflation outcomes should not be sole criteria for judging performance, says RBNZ's McDermott

Assistant governor's comments come after policy reversal by RBNZ amid falling global commodity prices; staff article emphasises 'ex-ante' evaluation of monetary policy decisions

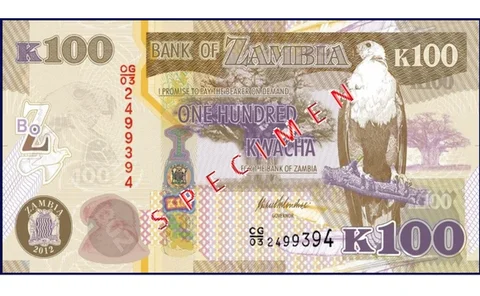

Zambia hikes by 300bp as inflation almost doubles

Bank of Zambia increases policy rate to 15.5% in an effort to keep inflation expectations anchored in single digits; annual inflation jumps to 14.3% in October as kwacha slides

PBoC monetary policy reform could be 'trial and error', economists warn

The Chinese central bank wrapped up a two-decade long interest rate liberalisation process last month – now the hard job begins

Europe should adopt expansionary fiscal policy, Fed's Stanley Fischer says

The ECB must continue with its ‘courageous’ supervisory and monetary policies, but they would be stronger if backed by an expansionary fiscal policy, says Stanley Fischer

Mandate change proposal would be unconstitutional, Polish governor says

Bank governor says giving the central bank a growth mandate would not be permissible under EU law; senior figures in governing party call for monetary easing programme

Economists challenge foundations of monetary economics

‘Neo-Fisherian’ approaches use standard New-Keynesian models to show that cutting interest rates will produce lower, not higher, inflation – and the result is surprisingly difficult to overturn

BoJ holds QQE fire but pushes back inflation forecast

Bank of Japan leaves asset purchase programme unchanged despite downward revision of outlook; central bank now predicts inflation target will be reached in second half of fiscal 2016

Fed rate rise given the ‘amber light’

Federal Reserve holds rates but hints there could be action at the December meeting; analysts still seeing mixed signals

Emerging markets risk ‘quantitative tightening’, Caruana says

Problems now affecting emerging markets are a continuation of global problems, head of BIS says; response by policy-makers is too reactive and based on domestic circumstances

Turkish central bank may act as inflation forecasts rise

Declining exchange rates and rising food prices have pushed inflation expectations upwards, monetary policy committee says; governor says he will raise interest rates if necessary

Tightening bank loans explains much of ‘Great Recession’ in eurozone

Tightening bank loans and increases in bond premia explain much of the recent contraction in the eurozone, paper argues