Transparency

Carney says over $130 trillion of capital now pledged to net zero

But rich countries admit they have fallen short of net zero financing goals

‘Say what?’ Trust in central bank communications

Central banks are changing how they communicate with different audiences, but judging the success of these communication efforts is difficult

Approaching green central bank balance sheets

Climate-friendly balance sheets come at a ‘greenium’, panellists argue at a roundtable at Central Banking’s Summer Meetings, in collaboration with Invesco.

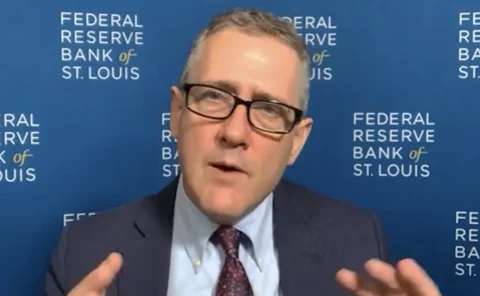

Fed’s Bullard believes a ‘five-year window’ for AIT is ‘realistic’

St Louis Fed president says “big tent language” was a reason overshoot details were not specified; “precise numerical implementations” can “get you into trouble”

Most central banks invest in derivatives

External managers facilitate wider use of these instruments

James Bullard on Fed policy, action and governance

St Louis president calls for tapering amid “exceptional” job market and risk of “more persistent” inflation, quantifies ‘big tent language’ for pioneering AIT move, and details Congress’s role in Fed ethics oversight

BoE ends off-the-record meetings with banks

Change follows concerns about similar practices at other central banks

Georgieva promises to learn lessons from ‘Doing Business’ controversy

IMF chief says she will have “candid discussion” with staff after accusations of improper conduct

Slovak governor charged with bribery

Peter Kazimir denies wrongdoing, as president says he should consider resigning

Georgieva keeps job as Yellen promises further scrutiny

Evidence did not “conclusively demonstrate” the IMF chief played an “improper role”

BoE report sheds light on Covid market operations

Surge in scale and frequency of operations amid switch to work from home created “issues”

Larry Summers on stagflation risks, lessons from Delphi and never-ending ‘punch’

The former US Treasury secretary speaks about fiscal ‘overexpansion’, Fed/Treasury debt discord, the pitfalls of ‘unknown unknowns’ and central bankers ‘unable’ to remove the ‘punchbowl’

Campos Neto named in Pandora Papers

Investigation identifies Brazil governor as stakeholder in four offshore companies

Why fintech governance matters for central banks

Fintech throws up an array of challenges that may require central banks to adapt their frameworks

IMF ethics committee investigating Georgieva allegations

Executive board promises “thorough, objective and timely review” of alleged “improprieties”

Monetary Policy Benchmarks 2021 report – executive summary

Insights into the staff that work on monetary policy, decision-making, tools, transparency and market operations

ECB’s stress capital buffer still a ‘black box’ – banks

National regulators retain wide latitude to set Pillar 2 Guidance under new rules

Central banks split on blackout periods

Reasons for operating blackout periods include facilitating effective policy transmission and avoiding speculation

In-depth reports less frequent than monetary policy meetings

Over 80% of central banks set monetary policy without always publishing in-depth reports

Central banks divided on publishing policy meeting minutes

Central banks in advanced economies more likely to publish minutes

Policy-maker votes largely kept secret

Most central banks do not reveal how individual monetary policy-makers vote

BIS to throw open doors for 90th anniversary

Delayed celebration will invite public to multimedia exhibition in main tower

Too great expectations from the ECB’s strategy review

The review process represents operational best practice, but will fail to unify the Governing Council

Swiss government sets parameters for climate reporting

Guidelines intended to bind large Swiss companies from the 2023 financial year