Monetary policy

Dominican Republic keeps rate on hold

Inflation decreased to target in August

Global output gap matters for inflation – BIS paper

Authors find domestic and global output gaps both important, but effects differ across economies

Italy’s expansionary budget increases pressure on debt

Draghi warns government plans have tightened financial conditions for households and businesses

Poloz: ‘digital disruption’ makes it harder to track supply and demand

Technology brings net benefits but also makes the central bank’s work harder, governor says

Argentina adopts floating exchange rate regime to tackle peso crisis

IMF extends running standby arrangement to $57.1 billion

Sub-Saharan Africa increasingly exposed to debt risks

Public sector borrowing and tighter financial conditions a challenge for regional reserve managers

Price pressures subside as Morocco holds interest rates

Headline inflation expected to average 2.1% by year end, central banks says

BoE reveals details of nowcasting approach

Central bank explains approach to generating timely estimates of global GDP

Turkey reinforces monetary tightening with fiscal caution

New economic plan considered appropriate by analysts, but currency instability remains

SNB maintains ultra-loose policy despite stronger growth

Central bank is once again grappling with the effects of safe-haven flows into the franc

Inflation proves worrisome for Sarb MPC

Governor stresses central bank has inflation target range and not a specific point; MPC leaves interest rates on hold

Brazil holds interest rate at record low

Recent indicators of economic recovery point to more gradual pace than envisaged early this year, committee says

Norges Bank hikes for first time since 2011

Rate path slightly lower than before due to weak wage growth and high private debt

Weak policy co-ordination associated with excess liquidity, paper finds

Trinidad and Tobago authorities can improve policy co-ordination, researchers say

Boston Fed economists call for monetary policy evaluations

Effective lower bound and reduced ability to stabilise the economy warrant a rethink of the monetary policy framework, economists say

Hungary prepares to normalise its array of policy instruments

Central bank reshuffles its wide range of unconventional instruments and launches lending facility

What next for the BoJ’s unprecedented ETF experiment?

No other central bank has attempted such purchases, and exiting the policy may prove extremely challenging, says Sayuri Shirai

ECB should enhance forward guidance during normalisation – Cœuré

Executive board member thinks changing economic phase and QE unwinding require more communication

Market power can explain financial market anomalies – BIS paper

Market power of intermediaries can explain behaviour of risk premiums, authors find

Argentina to continue reducing stock of short-term debt

Lebac’s expansion thought to contribute to inflation

Riksbank focused on falling krona, weak inflation and instability – minutes

Executive board said it intends to increase rates by 25 basis points in December or February

Carney says UK prepared for multiple Brexit outcomes

The BoE’s stress tests have become more rigorous amid rising concerns of possible Brexit scenarios

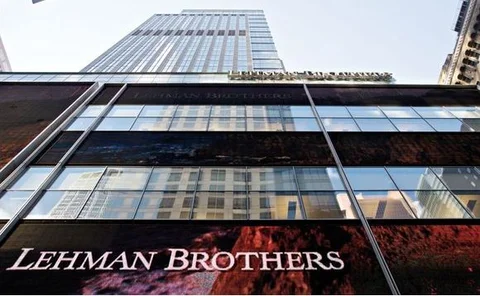

A decade on: Lehman Brothers at the brink

On September 14, 2008, there remained hope that Lehman could be saved and a crisis averted. Events moved rapidly thereafter

Fed adviser sets out new equilibrium rate model

Long-term interest rates are more important for spending decisions, author claims