Interest rates

Sarb raises rate 25bp now to avoid bigger move later

Increasing risk of inflation spurs the South African Reserve Bank to raise its key rate by 25 basis points to 6.25%; two out of six MPC members preferred not to move

RBA’s Debelle outlines potential benchmark rate reform

Australian consultation paper suggests modifications to the calculation of the bank bill swap rate, with one option expanding the set of transactions covered

Canadian paper sees costs to leaning against the wind

Research estimates difference in policy rates between ‘lean’ and ‘clean’ central banks, while identifying costs in terms of inflation and output deviations

Haldane charts impact of automation on UK economy

Up to 15 million jobs could be at risk from automation in the UK alone, the BoE’s chief economist says, adding a rate rise is unnecessary at this juncture

No fireworks as Bank of England keeps rate options open

Rates remain on hold as BoE balances domestic strength with signs of weakness overseas; MPC hints a few forces could prompt an earlier hike than markets are predicting

Improved inflation outlook gives Icelandic central bank room for manoeuvre

Shallower path for near-term inflation allows central bank to make smaller rate hike than planned, but the longer-term picture still shows inflation overshooting the target

Research assesses South Africa’s vulnerability to Fed hike

Countries with large ratios of external financing needs to foreign exchange could be more vulnerable to Fed rate hikes, working paper finds

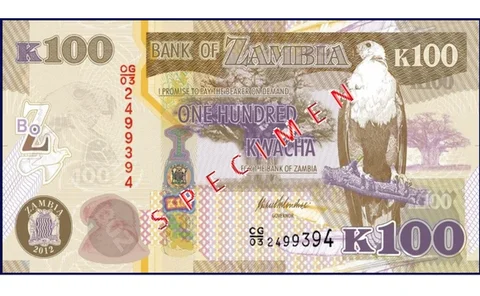

Zambia hikes by 300bp as inflation almost doubles

Bank of Zambia increases policy rate to 15.5% in an effort to keep inflation expectations anchored in single digits; annual inflation jumps to 14.3% in October as kwacha slides

PBoC monetary policy reform could be 'trial and error', economists warn

The Chinese central bank wrapped up a two-decade long interest rate liberalisation process last month – now the hard job begins

Economists challenge foundations of monetary economics

‘Neo-Fisherian’ approaches use standard New-Keynesian models to show that cutting interest rates will produce lower, not higher, inflation – and the result is surprisingly difficult to overturn

Swaziland currency drops under Fed decision pressures

Delayed Fed rate rise put pressure on Swaziland lilangeni, central bank says, and more moves are likely

Fed rate rise given the ‘amber light’

Federal Reserve holds rates but hints there could be action at the December meeting; analysts still seeing mixed signals

Riksbank unleashes further easing

Central bank hopes extended asset purchase programme and commitment to keep rates lower for even longer will help reinforce a gradual upward trend in growth and inflation

RBI advisers supported rate cut, minutes show

Minutes of technical advisory committee meeting show six of seven members recommended a cut as inflation in India had fallen ‘dramatically’ and growth proved elusive

Draghi sets stage for December easing

Governing council could adjust asset purchases or cut rates further at next meeting, ECB president says; staff tasked with examining different options as they were before QE launch

Poloz sees risks to inflation outlook as ‘roughly balanced’ as Canada holds rates

Canadian governor highlights ‘building’ economic momentum after central bank holds its target for the overnight rate at 0.5%

Bank of Uganda takes rate hikes to 600bp in five meetings

Bank of Uganda raises rates for fifth consecutive time by 100bp to 17% in a move to curb inflation; sees earlier moves taking effect

BoE needs to avoid getting ‘behind the curve’, says McCafferty

The monetary policy committee member warns against leaving the rate hike "too late", making it harder to raise it gradually to minimise disruption to households and businesses

Further rate hikes likely as Chile raises 25bp

Central bank lifts rate to 3.25% in first move in four years; analysts suggest the move is an effort to rein in expectations

RBI economists attempt to pin down India’s natural rate

Researchers lend support to monetary policy by estimating natural interest rate; results imply the policy rate is now set more appropriately for tackling inflation

RBNZ governor reiterates further easing ‘seems likely’

Graeme Wheeler says the central bank is ‘conscious’ of the impact low rates can have on housing demand; RBNZ has cut OCR by 75bp since June

Fed’s Brainard counsels patience on interest rates

Governor Lael Brainard warns there could be ‘some distance to go’ before reaching full employment in the US, and questions the impact of further labour market improvements on inflation

Swedish economists add voices to criticism of leaning against the wind

Current and former Riksbank deputy governors Martin Flodén and Lars Svensson warn against the large rate hikes necessary to address financial stability concerns

Poloz explores ‘risk management’ in policy framework

Bank of Canada governor says monetary policy cannot always be used to lean against the wind, but financial stability impact can be taken into account on occasion