Interest rates

ECB to reduce monthly asset purchases to €30 billion

Central bank extends QE by nine months until September 2018, and keeps rates unchanged

Brazil’s central bank slows pace of monetary easing

Central bank scales back cuts to 75bp with suggestion it will slow pace further moving forward; inflation continues to fall as forecast

BoE paper studies interest rates across eight centuries

In July 2016, the global risk-free rate hit its lowest level since at least 1273, according to a new extra-long-term dataset

Argentina raises interest rates in pursuit of lower inflation

Despite declining core inflation, higher fuel prices could pose a threat to the central bank’s 2018 target; central bank raises rates to 23.75%

The optimal size for central bank balance sheets

As the Fed seeks to reduce the assets on its balance sheets, Charles Goodhart examines the role between monetary and fiscal policy, central bank and debt office, and the optimal size of a central bank’s balance sheet

Sri Lanka working to introduce ‘proactive’ policy – governor

Central bank in the past tended to do “too little, too late”, leading to big swings in interest rates, says Coomaraswamy

BoJ says Japan is overbanked

The central bank says Japanese banks may have too many employees and branches

Florens Luoga named new Bank of Tanzania governor

Tax lawyer and academic picked to head the central bank as Benno Ndulu completes second term

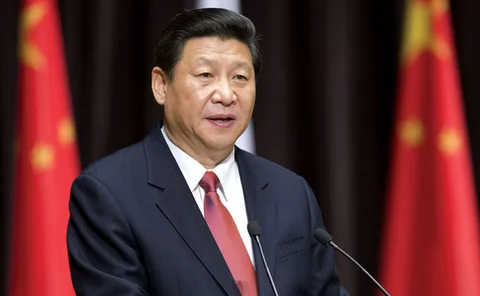

Xi sees renminbi taking greater role in global monetary system

President Xi Jinping calls for quality and equality of growth rather than speed; flags plans to promote renminbi as global reserve currency

Inflation target supports price setting and wage formation – Ohlsson

Target contributed to economic recovery in Sweden, Riksbank deputy governor says

Williams: weak productivity, population growth keep rates low

The “new normal” implies a federal funds rate at 2.5%, says San Francisco’s John Williams

BoE paper sheds light on global policy transmission

Comparison of UK and Hong Kong based on bank-level data finds evidence of both portfolio and funding effects

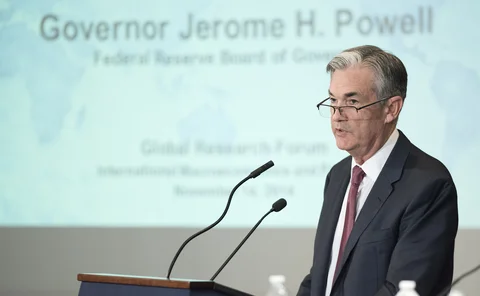

Fed’s Powell: normalisation will be ‘manageable’ for emerging markets

Fed governor says current capital flows appear to be in line with fundamentals; corporate debts a vulnerability but “situation is not alarming”

FOMC split over inflation forecasts, minutes show

Participants expressed concern that low inflation this year might reflect not only transitory factors

ECB taper unlikely to upset major European equity investors

Norway’s sovereign wealth fund is boosted by its €200 billion investment in European stocks

Theory of inflation dynamics is not good enough, warns Tarullo

Former Fed governor says economists have “almost paradoxical” mix of scepticism towards and reliance on shaky concepts

US economy would have performed better without rate hikes – Kashkari

Minneapolis Fed president says Fed should not raise rates until 2% inflation target has been reached; removal of accommodation has negatively affected inflation expectations

Bank Indonesia under pressure from falling inflation

Bank Indonesia cuts rate for the second consecutive month; policymakers in Indonesia have been struggling to hit ambitious growth targets

Yellen stresses commitment to ‘gradual’ rate hikes

Fed chair examines possible factors behind disappointing inflation results, but concludes gradual rate hikes are still warranted

John Williams on the neutral rate of interest and mandate change

The president of the Federal Reserve Bank of San Francisco speaks about the plunge in the natural rate of interest, and why it means central banks should work together to review their price stability targets

Bank of Ghana pauses policy easing on inflation worries

Central bank holds interest rates at 21% to see if external pressures will prove persistent; improvement in export prices will provide country with buffer against shocks

FOMC triggers balance sheet wind-down

Fed will begin allowing securities to roll off its balance sheet from October; Janet Yellen stresses changes will proceed gradually

Renminbi ‘crucial’ for reserve managers – Isabelle Strauss-Kahn

Central banks must consider how Chinese currency fits into reserves - World Bank expert

Stronger Canadian dollar weighing on policymakers' minds – Lane

Bank of Canada deputy says bank is paying ‘close attention’ to how markets respond to higher interest rates and stronger currency, which could threaten supply chains