Interest rates

Denomination matters for banknote demand – paper

Bank of Canada paper finds people make different choices when holding high-value banknotes

Dollar may soon give breathing space to emerging economies

Global growth, higher US debts and a tighter ECB policy could weigh on the currency

HKMA rolls out new initiatives to lure bond issuance

The three-year pilot promises to fund half of eligible bond issuance expense, up to a maximum of HK$2.5 million

Carney defends communications approach as BoE holds

Central bank criticised for apparent U-turn on rate hike; governor says majority of people in the economy are “not fixated” on the timing of a hike

RBA paper finds elusive interest rate-investment link

Authors present empirical evidence for inverse relationship between rates and investment

Voluntary reserve targets can aid transmission – Fed paper

Voluntary targets could help central banks set policy more effectively

Argentina calls on IMF for help

President Macri calls upon the IMF for financial aid as peso depreciation continues; policymakers hold rates at latest meeting

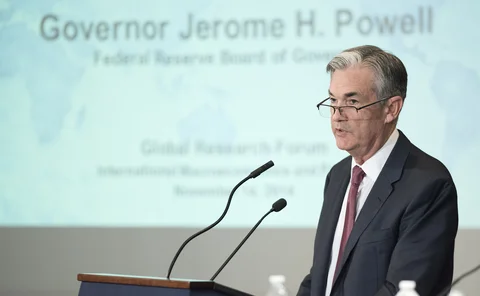

US ‘normalisation’ should be manageable for emerging economies – Powell

Turkey and Argentina grapple with weaker currencies as US Treasury yields rise

FOMC signals patience as rates stay on hold

Minutes emphasise “symmetric” target, noting inflation expectations are still “low”

IMF tells Vanuatu central bank to tighten monetary policy

Excess liquidity starting to put pressure on prices, as inflation is expected to reach 4.8% in 2018

RBA governor dispels view board ‘does nothing’

Central bank board votes to leave rates on hold, extending period to 21 months with no change; Lowe says next move is likely to be up

BoJ drops timeframe for achieving inflation target

Bank has postponed target for achieving 2% inflation six times since 2013

Riksbank delays first hike on weak inflation

Repo rate expected to remain negative until late 2019

SNB loses $6.9 billion in Q1

Higher interest rates reduced the value of sovereign bonds

Turkish central bank makes long-awaited hike

Inflation has been in double digits for several months, but the CBRT has struggled to hike

The IFF China Report 2018: Chinese financial system reform

China is focusing greater effort in tackling the build-up of risks in its banking and financial system, while also seeking to ensure credit is more effectively distributed in the real economy. At the same time it is has embraced fintech but policymakers…

China’s macroeconomy in the ‘new era’ of politics and power

Lou Jiwei, president of the National Council for Social Security Fund and former minister of finance of China, explores the three key aspects of China’s macroeconomic situation in the ‘new era’ of Chinese politics and power

BoE faces ‘uncomfortable’ approach to May meeting – Forbes

Former MPC member says pre-announcing a rate rise “could be quite dangerous”, as Mark Carney appears to row back from signalling a hike

Few US low-wage workers progress in labour market – Fed research

Only 5% had a better job within one year, and the group is more likely to become unemployed

PBoC cuts reserve requirement in bid to support lending to smaller firms

Move may be "precautionary" response to slowing growth – analyst

Fed’s Brainard warns of ‘financial imbalances’

Fed board member points to risks in high asset prices and business debt

Canadian households may be responding to higher interest rates - Poloz

Canadian governor says higher interest rates will be warranted “over time”

Central banks: the economy’s emergency responders

When economic infrastructure is destroyed during natural disasters, central banks spring into action, engaging contingency plans to ensure the economy continues to run

Real rates likely to move back up – BIS paper

Use of “shadow rate” allows authors to account for the effective lower bound