Financial crisis

Capturing moral hazard: the Scarlet Pimpernel of finance

Moral hazard exists in many contexts, but can be ‘damned elusive’ to capture, writes Jesper Berg

Proportionality in bank regulation: striking the right balance

The ‘final’ Basel III framework contains elements designed to make the rules fairer while reducing regulatory arbitrage. This means careful analysis is required when making any proportionality adjustments in the EU single rule book, writes Maurizio…

Bank of England pushes ahead with ‘Basel 3.1’

Central bank says amendments to Basel III could halt downward drift in risk-weighted capital ratios

Chile’s Costa on tackling inflation, forex interventions and nowcasting

The Central Bank of Chile governor speaks about stubbornly high prices, Fed policy spillovers, reserve buffers, retail CBDC and the need to address unconscious bias

Book notes: Zero interest rate policy and the new abnormal, by Michael Beenstock

Author's contention that asset purchases caused the low neutral rate of interest is entertaining and infuriating in equal measure

Book notes: Yellen, by Jon Hilsenrath

This book offers new insights into the tough decisions and tremendous efforts Yellen has made as a pre-eminent economic policy-maker

Christopher Sims on modelling the inflation surge

Unprecedented series of shocks creates major challenges for central bank forecasters, the Nobel Prize-winning economist tells Daniel Hinge

Eurozone sovereign downgrades increased corporate risk – ECB paper

Ratings changes for “core” eurozone countries had largest effects on corporate bonds

Bernanke, Diamond and Dybvig win Nobel Prize

Economics prize goes to authors of widely cited work on financial crises

Ukraine: the challenges for central banks

Rules on the weaponisation of money would help to protect a ‘public good’ amid geopolitical splits in a testing environment for central banks, write Gavin Bingham, Paul Fisher and Andrew Large

Quantitative tightening: missed opportunities

Treasuries and central banks must think harder about balance sheet policies, says Philip Turner

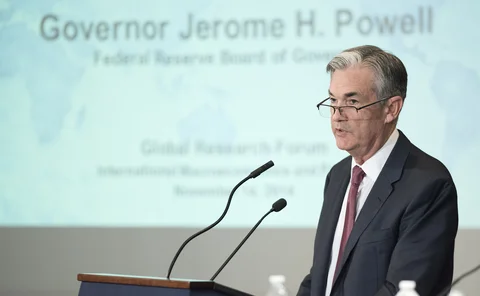

Rate rises reveal defi weaknesses – Powell

Regulating algorithms highlighted as key crypto challenge at Banque de France conference

Inflation: what went wrong, and why?

Charles Goodhart and Manoj Pradhan detail three theories on the causes of high inflation, as well as their implications for policy responses

Book notes: 21st century monetary policy, by Ben S Bernanke

Bernanke’s great book offers important insights for today’s policy-makers, writes Stephen Poloz

Economy’s ‘first responders’ now in the line of fire

Forceful but late interventions to combat inflation raise the risk of central bank overreactions

IMF paper offers ‘fear-based theory’ of economy

Central banks risk distorting the economy if they don’t move interest rates to offset “fear cycle”

Financial Stability Benchmarks 2022 report – executive summary

Data sheds light on how central banks are dealing with risks to stability

Joseph Stiglitz on the challenge of fixing macroeconomics

The Nobel Prize-winning economist discusses the flaws in mainstream models and how to repair them, whether central banks went wrong in 2021, and what to do – or not to do – about inflation

Will the dollar remain the world’s reserve currency?

Bank of Russia sanctions are unlikely to undermine the US dollar’s central role in reserve portfolios. But a relative decline in US economic weight and technological innovation are benefiting other currencies

Book notes: The money minders, by Jagjit S Chadha

This book acts as an invaluable primer on money-credit-fiscal theory and practice

Gontareva on Ukraine’s funding, NBU policy and reconstruction

Former NBU governor Valeria Gontareva speaks about donor funding shortfalls, NBU policy and financial stability challenges, Nabuillina and the seizing of Russian assets, and post-conflict rebuilding and modernisation

Book notes: The Fed unbound, by Lev Menand

Instead of the Fed expanding its tasks to meet shadow banking needs, this book calls for charter-like oversight of NBFIs

Fed paper explores information problems in financial panics

Tight liquidity can cause investors’ beliefs to become “systematically divorced from fundamentals”

The PBoC, real estate debt and financial stability in China

Central bank policy-makers are restricted in terms of capacity and space by their efforts to manage the nation’s property bubble amid declining growth