Eurozone

Eurozone could improve fiscal pact – ECB paper

Reformed framework should combine expenditure growth rule with “debt anchor”, researchers say

Many central banks ‘layer’ news for different audiences

Techniques include use of differing language, visual and video presentation, and data release

ECB sticks to plan of gradual policy normalisation

Lagarde says net asset purchases should finish in the third quarter of the year

ECB announces phased end to Covid-19 collateral loosening

Conditions for access to liquidity schemes will tighten but Greek sovereign debt waiver will remain

Book notes: Shutdown, by Adam Tooze

A useful, wide-ranging overview, showing how health and economic policies are intimately intertwined with geopolitics

Markus Brunnermeier on the need for CBDCs

The Princeton academic co-authored a paper for the European Parliament exploring the potential pitfalls of CBDCs. But they are still needed, he says

Commodity prices rise sharply after Russia’s invasion of Ukraine

Energy prices already account for around 50% of headline inflation in the eurozone

Change at the Bundesbank: from Weidmann to Nagel?

Joachim Nagel’s appointment highlights the importance of politics at the apex of German central banking. Veteran central bank watcher Klaus C Engelen looks at the media reaction and asks if Buba/ECB discord is set to continue

Croatian central bank denies allegations against governor

Financial supervisor is investigating media claims of insider dealing by central bank staff

2021: The year in review

The year has seen central banks switch from recovery mode to battling inflation. Central Banking looks back at the stories that made the biggest impact in 2021

German government names Nagel as new Bundesbank governor

Social Democratic party member is longstanding central banker and voiced scepticism over QE

Podcast: Oliver Wünsch on a solution to eurozone fragmentation risks

A common fiscal authority could offer stability, but would require sharing more sovereignty

Labour market changes key to inflation – BIS’s Shin

Central banks may face “race against time” to prevent wage-price spiral, says Hyun Song Shin

Tackling surging inflation

Central banks around the world are grappling with rapid price rises, with some taking very different routes to one another

Eurozone inflation hits record high of 4.9%

ECB expected to clarify the future of its stimulus programme on December 16

Book notes: Monetary policy in times of crisis, by Massimo Rostagno et al

A mass of intellectual effort gives rare insights into the ECB’s inner working, but fails to fully address questions about who really controls inflation

Reforming FX reserve and macroeconomic management for ESG

Arnab Das, global market strategist, Europe, the Middle East and Africa, at Invesco explores why central banks must play a role in ESG risk mitigation, management and prevention, as they are expected to during wars, pandemics and other major shocks.

‘Say what?’ Trust in central bank communications

Central banks are changing how they communicate with different audiences, but judging the success of these communication efforts is difficult

Forecaster surveys improve eurozone inflation modelling – ECB paper

Households’ and firms’ expectations do not provide useful data on inflation

Securities lending prevalent in European central banks

Monetary policy, market maturity and currency variation may limit adoption in other regions

SSM reduced large eurozone banks’ risk-taking – ECB paper

Reduced credit risk was driven by supranational authority’s greater efficiency, authors argue

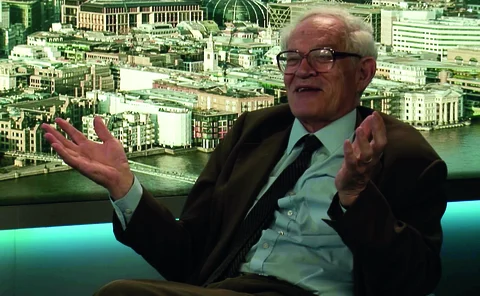

Goodhart, Gopinath and Lippi disagree on inflation

Central banks lack tools to deal with inflation, Goodhart warns, but IMF chief economist disagrees

ECB climate stress test reveals uneven risks across eurozone

First step in ‘climate roadmap’ assesses 1,600 banks and over four million firms

ECB’s stress capital buffer still a ‘black box’ – banks

National regulators retain wide latitude to set Pillar 2 Guidance under new rules