Collateral

Central banks grapple with dollar funding crunch

Indicators of stress hit highest levels since global crisis; dollar backstops may soon be tested

The Tokyo Olympics: downside risks prevail

The Bank of Japan’s latest stimulus effort seems to be weak, and comes at a time when the benefits of hosting the Tokyo Olympics may be overstated – even if the games still take place

Ghana’s Addison on banking reform, innovation and the future of the eco

The Bank of Ghana governor speaks about the next steps in banking reform and why West Africa may need more time to start using a common currency

Do low rates spur investment?

Many believe low interest rates spur investment, but there appears to be little hard evidence to support such claims, writes former IMF head Jacques de Larosière

BoE to impose Libor-linked collateral penalties

Andrew Hauser says regulators will employ carrots and sticks as deadline for transition looms

NY Fed speeds up repo withdrawal

US banks’ demand for cash remains high as NY Fed’s first term repo is oversubscribed

‘Intangibles’ may be adding to long-run rate decline – BoE’s Haskel

Economist says “tyranny of collateral” could be a problem for modern economies

Central Banking Awards 2020: the winners

All the winners in the 2020 Central Banking Awards

Central Banking Awards 2020: final winners announced

Awards include lifetime achievement, transparency, communications and website

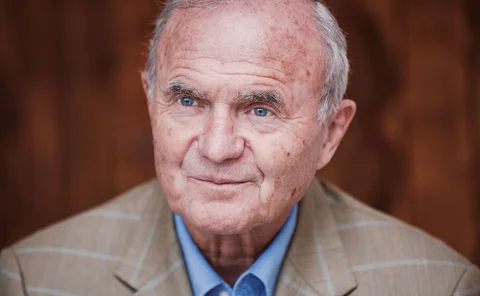

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Collateral management services: National Bank of Georgia/Montran

The duo developed Georgia’s fully automated new collateral framework

Treasury systems initiative: Calypso Technology

The tech company secured important breakthroughs including with its Maps treasury operations system

Paper takes ‘Hank’ approach to eurozone policy transmission

Authors identify three key dimensions of household heterogeneity

Will the Fed pass its year-end funding test?

An unprecedented rate spike in September prompted the Fed to inject billions into funding markets. But will its efforts be enough to foil year-end pressures? Could opening the standing repo facility to foreign central banks help?

Bank of Canada plans new emergency liquidity facility

Facility designed in response to new threats, such as cyber and extreme weather events

King calls for radical shake-up to escape ‘low-growth trap’

Central bank models fail to appreciate demand-side secular stagnation; IMF could help to drive country-specific policies to reallocate resources

Big tech: a threat to banks?

The explosive growth of financial services offered by big tech companies in China offers important lessons

Seven threats from big tech’s libra

Can central banks avoid a ‘big tech’ monetary meltdown?

Banque de France research takes fresh look at eurozone interbank markets

Secured interbank markets not bounded by ECB’s deposit facility rate, results show

BoE paper explores collateral’s impact on labour market

Collateral value affects hiring decisions by small businesses, authors find

BIS’s Borio warns of ‘troubling’ negative yields

BIS quarterly review highlights new peaks in negative-yielding debt and examines CLO risks

30 years of central banking

Central banks face credibility tests on a number of fronts

Norges Bank lays out plans for collateral management during resolution

Liquidity assistance in a resolution will “never” be a long-term solution, Torbjørn Hægeland says

Asset bubbles play role in macro-prudential policy – IMF research

Their size may determine optimal tax levels to address credit imbalances