Central Banking

US growth remains solid in Q3 – Atlanta Fed

Real-time GDP estimation signals 4.4% growth in current quarter

Former Liberian governor to assist in corruption probe

Government launches investigation into missing banknotes

Danske Bank acknowledges ‘major deficiencies’ in money laundering case

CEO quits as bank publishes internal investigation into irregular operations at Estonian branch

Weak policy co-ordination associated with excess liquidity, paper finds

Trinidad and Tobago authorities can improve policy co-ordination, researchers say

BoJ sticks to upbeat message despite dissent

Policy remains on hold as inflation continues to disappoint; Kataoka questions positive message

Boston Fed economists call for monetary policy evaluations

Effective lower bound and reduced ability to stabilise the economy warrant a rethink of the monetary policy framework, economists say

Papua New Guinea transitions to IFRS 9

Central bank will look to disclose more information around risk exposures

Hungary prepares to normalise its array of policy instruments

Central bank reshuffles its wide range of unconventional instruments and launches lending facility

Report says financial firms may be ‘overconfident’ about cyber

Accenture’s research shows only around 20% of firms are making improvements to IT security

IMF pessimistic over UK’s post-Brexit future

The larger the impediments to trade in the new relationship, the costlier it will be, IMF head says

Bank of Brazil and HKMA sign fintech agreement

Central banks to promote innovative financial services companies

ECB should enhance forward guidance during normalisation – Cœuré

Executive board member thinks changing economic phase and QE unwinding require more communication

Central banks adapting to high-speed markets, BIS report finds

“Major developments” in markets are affecting the way central banks operate, Markets Committee says

Market power can explain financial market anomalies – BIS paper

Market power of intermediaries can explain behaviour of risk premiums, authors find

Market power, intangibles and risk premia behind low risk-free rates – paper

Brookings paper questions savings glut and technological slowdown hypotheses

US regulators offer supervisory relief in wake of hurricane Florence

Fed and state regulatory agencies will relax supervision so the banks can meet community needs

Argentina to continue reducing stock of short-term debt

Lebac’s expansion thought to contribute to inflation

Mary Daly takes San Fran Fed presidency

Head of research succeeds John Williams as president of Federal Reserve Bank of San Francisco

Riksbank focused on falling krona, weak inflation and instability – minutes

Executive board said it intends to increase rates by 25 basis points in December or February

Banks will ‘inevitably’ fail, says Ireland’s Donnery

Deputy governor takes stock of the policies implemented since the financial crisis to protect consumers against bank collapse

Yellen says Fed should begin forward guidance now

Action now could have equivalent impact to negative rates, says former Fed chair

Governor returns to Sudan’s central bank to fill leadership gap

Hazem Abdelqader died suddenly of a heart attack on a visit to Turkey

Carney says UK prepared for multiple Brexit outcomes

The BoE’s stress tests have become more rigorous amid rising concerns of possible Brexit scenarios

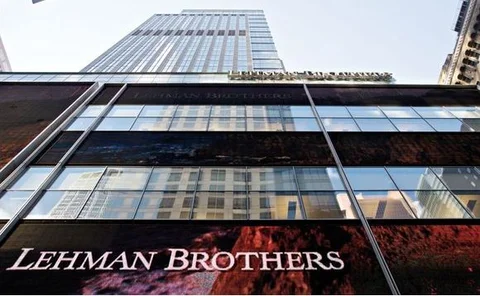

A decade on: Lehman Brothers at the brink

On September 14, 2008, there remained hope that Lehman could be saved and a crisis averted. Events moved rapidly thereafter