Central Banking

Japan appoints new currency policy, regulatory chiefs

Japan’s ministry of finance makes new appointments in its July reshuffle

BoJ’s Shirakawa: monetary policy not enough against bubbles

Bank of Japan governor says more policy tools required to preserve stability

East Asia-Pacific central banks softened US shocks

Hong Kong Monetary Authority research finds East Asia-Pacific monetary authorities dampened shock from United States money market

Euro-area acceleration cycle industry driven

Banque de France provides quantitative assessment methods for euro-area business cycle analyses

High oil prices lift output of exporting economies

Bank of Finland research finds that for Iran, Kazakhstan, Venezuela, and Russia oil price positively affects output growth

RBI's Subbarao: India must go for growth

The governor of the Reserve Bank of India says restoring growth to pre-crisis levels and de-mystifying the office of the governor are among his main objectives for his first term at the helm

RBI's Subbarao on reviving growth, decoupling and global imbalances

The governor of the Reserve Bank of India discusses his objectives for his first term and how the decoupling argument needs to be revised

In return to normality, fiscal order must come first

Governments must put their books in order before central bankers raise rates, say economists

BoE’s Haldane outlines views on capital rules

Bank of England''s financial stability executive director says capital levels were possibly way too low before crash

Loyalty programmes influence payments choices

Reserve Bank of Australia finds that price incentives, and loyalty programs in particular, are influential when it comes to consumer decisions about payment instruments

BoE’s Haldane: OTC markets need reforming

Bank of England’s Andy Haldane says over-the-counter post-trade infrastructure needs top-down push to reform

Russia’s regional banks don’t utilise local info

Bank of Finland shows that local banks in Russia do not possess a superior ability to deal with information asymmetries

Nonprime borrowers in negative equity are alike

New York Federal Reserve research explores common characteristics of nonprime borrowers in negative equity

Bundesbank names new Berlin branch chief

Buba appoints Claus Tigges to manage office in German capital

Central concerns

José Manuel González-Páramo, a member of the ECB’s executive board, talks to Risk about the role of the central bank and the need for greater oversight and transparency in the derivatives market

Liquidity lessons from the crisis

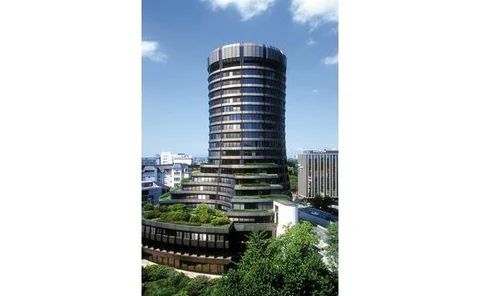

Daniel Heller, the head of the Basel-based CPSS, discusses propsoed reforms for payments, clearing and settlements

BIS's Cecchetti moots longer time horizon for monetary policy

Central banks may need to stretch their time horizons for inflation targeting to successfully combat financial instability, says Bank for International Settlements’ Stephen Cecchetti

SNB economist to depart at year-end

Kohli to retire from chief economist role in December

Britain begins to offload state banks

Dunfermline sold and supermarket rumoured to be interested in Northern Rock

Washington's timetable for regulatory reform

Patton Boggs, a law firm,sets out how and when Obama's proposals for US financial regulation reform will become law in 2009

BIS's Cecchetti on inflation, imbalances and instability

The head of the Bank for International Settlements' monetary and economic department, on how central-bank policy should change in light of the crisis

BoE’s Tucker: banking social contract needs reform

Bank of England’s Paul Tucker says that banks must adjust and it will not be cheap

Fed Hoenig: new rules must be simple

Kansas City Federal Reserve’s Thomas Hoenig calls for new rules for systemically-important institutions to be comprehensible

Transition economies are corruption prone

Bank of Finland research shows countries in economic transition tend to be more corrupt