Europe

BoE paper highlights non-linearities in bank funding and solvency

Results could be important consideration in stress-test design, authors say

Wider use of LEIs will improve stability, says DNB president

LEI system should be improved and made compulsory for more types of financial data – Klaas Knot

Schnabel takes on Germany’s ‘false narratives’ on ECB policy

Criticism based on “half-truths” imperils trust in single monetary policy and “undermines European cohesion”

Bulgaria: long live the currency board

Bulgaria should reject the euro and extend its currency board to cover bank deposits

Global governance is getting harder, warns BoE’s Cunliffe

Fading memories of crisis, new players and Brexit all create challenges, deputy says

DNB to tighten macro-pru over real estate fears

EBA says Dutch central bank fears overheating after house prices in large cities exceed previous peak

Central Banking Awards 2020: the winners

All the winners in the 2020 Central Banking Awards

ECB paper looks at professional inflation forecasters

No statistically significant evidence of some forecasters being worse than others, researcher says

EU regulators must end ‘tick-box’ approach to money laundering - EBA

First EBA report on national supervisors’ AML/CFT approaches says many agencies fail to co-operate

People: Fed governor gets new term; IMF’s Poul Thomsen to retire

New appointments made and portfolios reshuffled in the US, UK and more

ECB monetary policy was weakened by regulation – Bundesbank paper

Tighter regulation reduced lending by weakly-capitalised banks from 2008 to 2018 – researchers

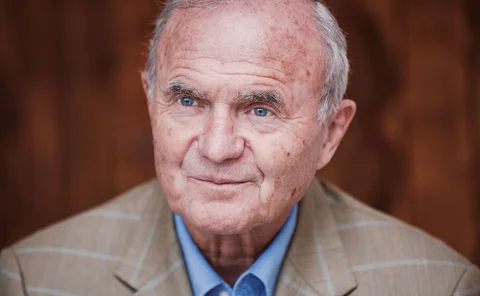

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Specialised lending initiative: BNP Paribas

A new ‘global’ setup helped secure US dollar-denominated assets from a Eurosystem central bank

Collateral management services: National Bank of Georgia/Montran

The duo developed Georgia’s fully automated new collateral framework

Global markets award: HSBC

The UK-headquartered bank is a leader in green finance and helped its clients navigate the low-rate environment over the past year

ECB officials lay out positions on future inflation target

Weidmann and de Cos set priorities as strategy review focuses on inflation measurement and target

Eurozone banks increase illiquid assets after solvency shocks – DNB paper

Shift in asset holdings could create asset price distortions after banking crises, researchers say

Governor of the year: Mark Carney

Carney has played a vital role in managing Brexit risks while driving efforts towards climate, payments and dollar funding reform

Asset manager of the year: Amundi Asset Management

The French asset manager helped reserve managers meet ESG criteria while also boosting central bank assets under management

ESRB models long-lasting EU recession for stress tests

Tougher adverse scenario adopted because EU is “at an advanced stage of the financial cycle”

Watch out for Brexit cliff edge 2.0, experts warn

Measures to mitigate a sharp rupture for financial services could be less likely at end-2020

Central Banking Awards 2020: first winners announced

Prizes include central bank of the year, risk manager, payments and FMI, and treasury systems

Treasury systems initiative: Calypso Technology

The tech company secured important breakthroughs including with its Maps treasury operations system

Payments and market infrastructure development: European Central Bank

The ECB has created a framework to help payments and market infrastructure firms bolster cyber defence that is being disseminated on a global scale