People’s Bank of China (PBoC)

PBoC delivers on cash injection promises

People’s Bank of China uses standing lending facility and reverse repos to inject in excess of $37 billion into interbank market; releases statement to prepare market participants ahead of time

ECB bulletin examines 'virtuous circle' in Chinese reforms

Research article published by the European Central Bank says there could be a ‘virtuous circle’ between reforms aimed at rebalancing China’s growth and those aimed at promoting the renminbi

Central bank of the year: The People's Bank of China

The PBoC has anchored market-based reform in China by curbing excesses in the financial system while pressing ahead with interest rate and capital account reform at a time of major political change

The winners of the inaugural Central Banking awards

Paul Volcker, Mario Draghi, People's Bank of China, Central Bank of Colombia, Sveriges Riksbank, Bank of Spain, BlackRock, Northern Trust, VocaLink and OpenLink win inaugural Central Banking awards

Chinese liberalisation could be ‘force for global stability', says BoE economist

Article in Bank of England quarterly bulletin says a more open capital account in China could be a force for growth and financial stability at home and abroad

China moves to block Bitcoin as digital currency gains credence

Bank of America analysts say Bitcoin could become a ‘serious competitor to traditional money', but the People's Bank of China warns it 'cannot and should not be used as currency'

China and India take divergent paths in liquidity management debate

People's Bank of China is targeting liquidity injections through a standing facility, while the Reserve Bank of India is reducing the amount available to banks through its equivalent funding window

FDIC inks MoU with China on bank resolution

The document, signed in Beijing yesterday, seeks to improve collaboration on resolution planning through the exchange of information and co-operation on risk monitoring

China should be in ‘no hurry’ to relax capital controls, says ADB paper

Working paper makes recommendations for Chinese fiscal and monetary policy, including maintaining control over exchange rates and taking steps to curb the growth of shadow banking

Robert Pringle’s Viewpoint: Looking for a game-changer for the financial system

The world may need to look to central bank governors in countries such as China and India to champion reform of the global monetary architecture

China sees accelerating interest rate reform, starting with deposits

China expected to follow lending rate liberalisation with removal of the deposit rate cap; new agency created to co-ordinate financial regulatory bodies

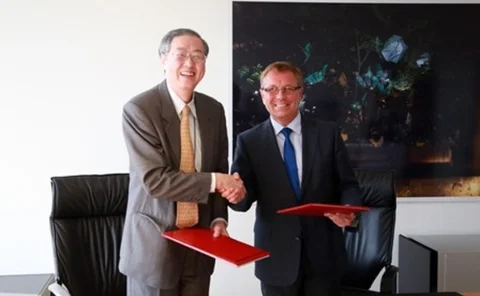

Hungary signs RMB swap line with PBoC

Agreement is the People's Bank of China's second with an EU member state following deal with the UK; equals the size of swap line China has with its neighbour Mongolia

Getting to grips with monetary policy?

Global co-operation on monetary policy remains out of reach

The PBoC, the liquidity squeeze and market liberalisation

The PBoC was accused of poor communication and inaction when interbank rates spiked in June. But Hui Feng believes the central bank wanted to give regulated financial institutions a warning

PBoC injects 17 billion yuan to ease liquidity

Move to pump funds into the system has divided opinion over whether the People's Bank of China is setting a course for further easing

Corporates remain lukewarm on offshore RMB, despite reported growth

Data released from Swift this week suggests international trade settlement in RMB continues to grow, but corporates aren't so sure

PBoC removes lending rate floor

From tomorrow, Chinese banks will be able to price loans as low as they like - but in the short term the effect is unlikely to be felt as loans are generally priced above benchmark rate

Robert Pringle's Viewpoint: Let the Fed lead

Implicit coordination of monetary policies under Fed leadership is better than none at all

IMF says China needs new tools to get a grip on credit growth

Staff report on China highlights need for a new growth model centred on private consumption; calls for the PBoC to adopt interest rates as its key policy instrument

China unveils raft of reforms to liberalise the renminbi

Series of reforms will facilitate cross-border renminbi settlement; RQFII programme has also been extended to Singapore and London

Renminbi convertibility remains top of Chinese reform agenda – HSBC

Chinese authorities interested in ‘quality’ rather than ‘quantity’ of renminbi growth; expected to push through reforms to achieve convertibility in 2015, says senior HSBC executive

Euro's international role hampered by continued fragmentation

ECB study finds reserve manager confidence in the euro is recovering, but a leading fund manager says the euro cannot challenge the pre-eminence of the dollar without issuing federal bonds

Bundesbank’s Nagel says internationalisation of renminbi is ‘long overdue’

Executive board member says that renminbi is now established as a trading currency – the first step towards becoming a global reserve currency

Chinese financiers hit out at 'blind' PBoC

China central bank accused of being blind to potential capital market reaction in its attempts to clamp down on the shadow banking sector