Federal Reserve Bank of St Louis

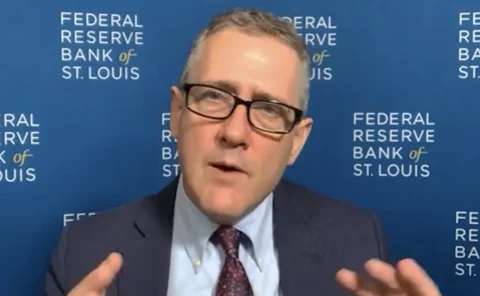

Bullard steps down as St Louis Fed president

FOMC hawk will become dean of Purdue Business School after 15 years leading regional Fed

Book notes: O Governador, by Luis Rosa

Documents Carlos Costa’s clashes with Portugal’s elite during the eurozone sovereign debt and banking crisis

No significant risk of US recession – St Louis Fed research

Sahm Rule and leading economic data indicate low – but not zero – recession risk

Fed’s Bullard revises rate projection upward

Policy-maker says bank stress likely to fade but inflation fight continues

Crypto ‘mixer’ regulation could be simple – Fed research

Counterparties could be obliged to follow similar rules as for cash

St Louis Fed president appeared at private Citigroup event

Media was not invited to October 14 talk by FOMC member Bullard

Regional Fed presidents signal resolve and acknowledge recession risks

Fed’s Collins, Mester, Bullard, Evans, Kashkari and Daly speak on the path ahead for policy

Housing affordability dropping across the US

Fed’s large rate hikes and constrained housing supply create tough market for buyers

Williams also expects US to avoid recession this year

Unemployment will likely rise to 4% as growth slows due to tightening process, says NY Fed head

Fed keeps investors guessing on speed and endpoint of tightening

Investors generally agree the Fed will tighten policy, but how much and when are unclear

Central bank social media trends in the ‘Instagram age’

Uptake of visual social media platforms rises, as Facebook usage plateaus

Is Powell still on track for second term?

Despite scandals and vocal criticism, support still looks likely to outweigh opposition

Fed ethics officials warned against trades

March 2020 advice cautioned against stock transactions in following months

Fed’s Bullard believes a ‘five-year window’ for AIT is ‘realistic’

St Louis Fed president says “big tent language” was a reason overshoot details were not specified; “precise numerical implementations” can “get you into trouble”

Dallas Fed predicts 2022 core inflation above 2%

Economists expect auto and transportation costs to abate, but spike in housing prices

James Bullard on Fed policy, action and governance

St Louis president calls for tapering amid “exceptional” job market and risk of “more persistent” inflation, quantifies ‘big tent language’ for pioneering AIT move, and details Congress’s role in Fed ethics oversight

Fed joins Network for Indigenous Inclusion

Australian, Canadian and NZ central banks established group earlier this year

Regional Feds make string of appointments

Atlanta, Cleveland and Dallas Feds name officials, while St Louis appoints outside advisers

Some philosophical questions about the future of central banking

Kenneth Rogoff weighs up the many challenges facing central banks in the years ahead, from debt and inflation to negative rates and the dangers of ‘mission creep’

The distant cry of hawks? Fed begins tightening talk

Richard Clarida gives a date for hiking interest rates, as debate on taper timing continues

Senior Fed officials differ on taper

Powell stands firm, but two regional presidents suggest a sooner-than-later approach

World Bank appoints Caribbean and central Asian directors

New York Fed names chief of innovation hub and St Louis appoints head of economic equity institute

Fed’s CBDC efforts should not be driven by digital yuan, Fed official says

A decision on ‘Fedcoin’ should be independent of action taken by China, says David Andolfatto

Fed’s Quarles says time is coming for taper talk

St Louis Fed’s Bullard says it is “too early” to talk of tapering asset purchases