News

High debt, low growth conundrum gets IMF staff treatment

Paper says countries aiming to deleverage should keep monetary policy loose, but warns of attempts to tackle it through inflation; says conditions for fiscal consolidation have changed post-crisis

Higher interest rates no ‘immediate threat' to UK banks, says FPC

Financial Policy Committee still warns firms are not taking sufficient account of potential stresses and that borrowers would be exposed to higher interest rates were debt levels to rise further

HKMA’s Yue focuses on renminbi as China liberalises capital markets

Deputy chief executive Eddie Yue believes the renminbi will be ‘crucial’ in managing impact of China’s capital account liberalisation on global markets; hosts forum with UK government official

Basel update shows biggest banks' CET1 position improving

Latest periodical review of progress towards Basel III standards shows the world's biggest banks are closing the gap on core Tier I capital requirements; US issues guidelines for Basel compliance

RBNZ institutional set-up makes forward guidance easier, says Grimes

Former chair of Reserve Bank of New Zealand’s board of directors says the concentration of power in the hands of the central bank’s governor makes forward guidance easier and policy-making clearer

Hong Kong and Australia see risks in low interest rates and Chinese NPLs

Impact of any shift in the yield curve on banks' balance sheets ‘may not be small', according to HKMA; RBA urges lenders to maintain prudent risk appetite as rates remain low

ECB’s Russo: indirect clearing model needs work

Head of payments and market infrastructure at the ECB calls for greater clarity from regulators on the capital treatment of indirect clearing

ECB appoints Oliver Wyman to conduct ‘comprehensive' eurozone bank review

European Central Bank appoints the same consultancy firm as conducted Spain's banking stress tests and is doing the same for Slovenia; more details of the comprehensive review to follow soon

Central banks struggle to publicise new banknotes

Netherlands Bank finds that two-thirds of the Dutch population do not check the authenticity of their banknotes, which adds to the difficulty of communicating changes in their security features

BoE MPC members scramble to reaffirm low rates

Ben Broadbent, David Miles and Paul Tucker deliver speeches stressing their commitment to forward guidance and assuring markets the committee is ‘not in a rush’ to tighten policy

Politically-aligned governors more likely to 'survive', research finds

Paper unearths evidence that central bank governors with the same political leanings as the government in power last significantly longer in their roles

Buffett’s ‘greatest hedge fund’ claim puts spotlight on the Fed

Warren Buffett's claim the Fed is ‘the greatest hedge fund in history’ fuels bloated balance sheet and politicisation debate; Fed veteran Gary Stern says 'sage of Omaha’s' comments are ‘misguided’

NY Fed trials new reverse repo facility

Federal Reserve Bank of New York tests new overnight reverse repo facility; William Dudley believes it will bolster the Fed’s control over short-term money market rates

Somalia appoints first female governor to scandal-hit central bank

Central Bank of Somalia to be led by female governor for first time; predecessor resigned after UN report placed central bank at the heart of a 'systematic misappropriation' of public funds

BoE executive director departs for private sector

Paul Sharma quits Prudential Regulation Authority after 20 years as a regulator, to move to consultancy Alvarez & Marsal; marks second high-level departure from PRA in the past week

CLS launches settlement for same-day USD/CAD trades

Settlement risk mitigation firm is due to launch a new settlement session this week for trades settled on a same-day basis

Rajan unveils rate hike - and cut - as QE lingers on

RBI raises repo rate but cuts MSF rate as focus shifts from defending the rupee to keeping inflation in check; Rajan warns Fed taper ‘only postponed'

Emerging market volatility not a sign of crisis, says Malaysian supervisor

Emerging markets are much better prepared to deal with foreign investment outflows than in the past, says Securities Commission Malaysia chairman

IMF's Lagarde backs Fed over asset purchases

The IMF’s managing director believes the Fed should take a 'gradual' approach to reversing its asset purchases and rate cuts; stresses the importance of unemployment figures

Euro crisis will leave Greece stronger, says Herbert Grubel

Membership of a currency union initially failed to force Greece to reform its economy but the country is now set to emerge from the crisis unshackled from former vested interests; the case of Greece may offer lessons for other democracies

RBNZ closing loan valuation loopholes

Reserve Bank of New Zealand proposes stricter rules on how banks value housing loans and residential properties to prevent them undermining new macro-prudential policy

SNB reiterates commitment to franc price ceiling and zero interest rate

Swiss National Bank is ready to buy unlimited quantities of foreign exchange and take other measures if required to hold the franc down; inflation should turn positive next year, it says

Scandinavians open macro-pru toolbox to cool overheated housing markets

Rising property prices, increasing household debt and towering banking sectors are pushing Norway, Sweden, and Denmark to consider unconventional measures to pre-empt a crash

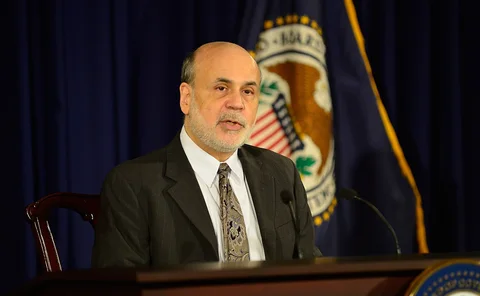

Bernanke defends Fed communication after QE surprise

Ben Bernanke says FOMC communication in June was justified as Fed shocks markets by ploughing on with asset purchases; economists question why markets were focused on September meeting