A methodology to measure and monitor liquidity risk in foreign reserves portfolios

Andrés Cabrales, Cristiam Rincón and Diana Fernández

Foreword

The cashless society?

Executive summary

Trends in reserve management: 2019 survey results

Implementing a corporate bond portfolio: lessons learned at the NBP

Sovereigns and ESG: Is there value in virtue?

A methodology to measure and monitor liquidity risk in foreign reserves portfolios

Reserve management: A governor’s eye view

How Singapore manages its reserves

Appendix 1: Survey questionnaire

Appendix 2: Survey responses and comments

Appendix 3: Reserve statistics

Due to a range of factors, liquidity in the financial markets has changed over the last few years. Central banks, who set liquidity as one of the main objectives when investing their foreign reserves, have been disconcerted by this, and for some of them monitoring liquidity risk has become a priority. This chapter proposes a simple methodology that allows central banks to measure liquidity in the areas that matter the most: time needed to liquidate and the cost of liquidation. The results of such a methodology are valuable as they are intuitive and measured in units that are helpful for key decision-makers. The measures provided are also useful since they can be viewed from different levels and can be aggregated. The calculation is performed using market information and data gathered after surveying key market participants. Additionally, the chapter will explain how the methodology can be used to measure portfolio liquidity under stress scenarios.

Much has seen said with regard to how liquidity has evolved in recent years. On 15 October 2014, something incredible happened: the US Treasury market suffered a 12-minute flash crash that took the world by surprise. For years, US Treasuries were considered one of the most stable liquid assets in the world, but because of what happened in that short period of time perceptions were altered. Many central banks took note, paying closer attention to liquidity risk and quickly realising that strict guidelines to control liquidity was not enough. As markets and regulation change, liquidity risk evolves and must be monitored. In August 2017, the US Securities and Exchange Commission (SEC) submitted a report to the US Congress that offered a wide review of the liquidity conditions of the debt markets in the US.11 Securities and Exchange Commission, “Access to Capital and Market Liquidity,” report to Congress (2016). In line with the market’s concern, it concluded that regulation, risk appetite, electronic trading and reporting requirements constitute the main influences of current and future market liquidity.

Liquidity has always been important for foreign reserves portfolios because central banks must be able to sell their holdings at any given moment. These moments might not be easy to predict, and could occur during periods when markets are not calm, and a central bank might then have to liquidate assets under extreme conditions. Due to such issues, and the fact that market liquidity conditions have changed, the idea that portfolio liquidity should be monitored on an ongoing basis is reaching consensus.

International standards

Currently, there is no formal definition of what is considered a liquid asset for foreign reserves portfolios. The International Monetary Fund (IMF), in its 2014 “Revised Guidelines for the Administration of International Reserves Management”, indicated that the administration of reserves, “… especially that of its most liquid component and any related operation must be conducted in markets with sufficient depth and liquidity that can process transactions in an orderly and efficient manner”. The IMF does not specify the asset classes that meet this definition. The guidelines recognise that having very liquid assets also has a cost, and so “reaching an acceptable level of investment returns must be a priority within clearly defined liquidity and risk limits”. As a possible strategy, the IMF recommends that:

the reserve manager may wish to define a minimum amount of reserves to hold in those asset classes approved with the greatest liquidity; in which case, as the size of the reserves decreases (in a non-crisis environment), the percentage share of these asset classes will increase. On the other hand, a reserve manager whose reserves are large may be able to increase the percentage of reserves that are held in less liquid asset classes, potentially increasing the return that can be earned for a level of risk (different from the liquidity) determined.

This suggests that, when choosing the liquidity level of the reserves, countries must take into account both the liquidity of the assets and whether the reserves are at an adequate level according to their particular needs.

Central banks have taken a particular approach through time. Although liquidity is one of the three key pillars of reserve management, portfolio policies were set in such a way that monitoring liquidity was not considered fundamental. In that regard, key asset classes where defined as “liquid” and guidelines were set to guarantee a certain level of liquidity. Government bonds from G5 nations were easily identified as ideal investments given their credit quality, and the size and the level of development of their markets and guidelines restricting small issue sizes, large holdings of issues, illiquid sectors and long-dated maturities at which certain asset classes were set. Central banks therefore created an environment for foreign reserve assets in which liquidity was considered a given.

In the case of Colombia, all the permitted assets have markets with sufficient depth and liquidity that in normal times can process transactions in an orderly and efficient manner. Tranches are also defined in line with reserve objectives and allowed risks are set accordingly. Guidelines, similar to those mentioned above, have been put in place and have worked over the years. However, as conditions change, monitoring liquidity has become more relevant. The chapter will address how Banco de la República has managed the issue, and discusses how the indicators were defined, examining them in detail, and assessing how stress scenarios can be taken into consideration.

The case of Banco de la República

Banco de la República’s investment portfolio is mostly made up of fixed income instruments. It is divided in two main tranches to address liquidity needs: short term and medium term. The short-term tranche is designed to be the first barrier of defence, and its guidelines are comparatively strict to maintain low duration, low credit risk and high liquidity. The benchmark is designed with the objective of maximising returns while avoiding losses with a very high probability. The medium-term tranche, on the other hand, is invested with a longer horizon and a slightly higher risk tolerance. Nowadays, most of the medium-term portfolio is managed actively while the short-term tranche is managed passively.

Aside from these tranches, the investment guidelines approved by the reserves committee are designed so that investments in the portfolio have a high degree of liquidity. The main investment guidelines limit exposure to sectors and issuers, define the type of issues that are allowed, and establish minimum issue size and the maturity term of the investments. Additionally, it is important that all securities have a large secondary market.

Given this, liquidity in the investment portfolio of international reserves has been controlled by the defined guidelines. However, in some cases these measures may not be sufficient when market conditions dry up in even the most liquid assets. Therefore, although these characteristics are important for the liquidity of a portfolio, it is key to consider how conditions may change for the assets that are held and how investment decisions might affect the liquidity of the portfolio. While reserve portfolios have guidelines that directly address liquidity risk, it is prudent to go a step further and find a way to monitor this particular risk in a more active manner.

Finding the best indicator

According to one study,22 Y. Amihud and H. Mendelson, “Asset Pricing and the Bid–Ask Spread,” Journal of Financial Economics 17 (1986): 223–49. illiquidity is mainly related to the premium required by investors on the price of an asset as compensation for transaction costs. In reality, its causes and manifestations are many and varied since different factors can affect the liquidity of an asset in different ways. According to some commentators, the following are the characteristics of a liquid market.33 F. Black, “Towards a Fully Automated Exchange, Part I,” Financial Analysts Journal 27 (1971): 29–34; A. Kyle, “Continuous Auctions and Insider Trading,” Econometrica 53(6) (1985): 1,315–35; T. Lybek and A. Sarr, “Measuring Liquidity in Financial Markets,” IMF Working Paper 232 (December 1, 2002).

-

-

Tightness: As a basic requirement, to be able to talk about a market, and therefore about liquidity, bid and ask prices must be available. Narrow bid–ask spreads imply that the difference between prices is small, reflecting that transaction costs should be relatively low in liquid markets

-

-

-

Immediacy: The speed at which orders can be executed reflects the efficiency of trading, clearing and settlement systems. In a way, this measure helps quantify the cost of considering a position (purchase or sale) on an asset over a period of time. This cost must be low, meaning that the price to carry out the transaction does not vary significantly during this time

-

-

-

Depth: The existence of an abundant number of orders by buyers and claimants

-

-

-

Breadth: Large sizes in the flow of transactions do not affect prices significantly

-

-

-

Resiliency: This is the liquid market aspect that measures the speed of new order flows that correct deviations in prices. Unlike immediacy, where the idea is that the price does not change during the execution time of the transaction, here reference is made to the efficiency of markets to recover quickly from a random and uninformed shock

-

Liquidity is not only a difficult concept to define, but several factors also affect each of these characteristics. The degree of liquidity varies according to many aspects, including the economic cycle, credit quality and shape of the curve. For instance, during periods of stability, liquidity can be reflected mainly in transaction costs. Nevertheless, during periods of stress and significant changes in fundamentals, issues such as the speed with which prices change and the adjustments involved in reaching a new equilibrium play a more important role than the transaction costs themselves. Therefore, it is important to try to capture most of the dimensions in liquidity if you want to achieve a more complete picture of the condition of a portfolio. This is why it is important to look at normal scenarios, but almost equally useful to examine more extreme scenarios that might affect your particular portfolio. In the case of Banco de la República’s portfolio, many indicators were analysed and the final decision, based on a range of these issues, answered the key question of which indicator best suits the type of mandate of the central bank.

Our initial approach was to try to include most of the above dimensions in the liquidity indicator. In that regard, it was important to capture the fact that changes in market liquidity aren’t observed directly in one dimension (ie, prices) but might be perceived in another (ie, volume or execution time). Also, given the heterogeneity of the agents in the market, one indicator needs to be complemented with the outcome of other measures to reach a conclusion regarding a change in the liquidity (ie, facing higher bid–ask spreads may be an indicator of lower liquidity; however, the volume traded may be unchanged, implying bid–ask spreads could be influenced by other factors such as the negotiation power of the dealers). These cases illustrate the relevance of including the different dimensions in the liquidity indicator.

Narrowing down

After carefully reviewing many of the indicators that help gauge the liquidity of the assets in the foreign reserves portfolio, a decision had to be made. More than 30 measures were examined to see how viable it was to set up a continuing monitoring scheme to cover all the dimensions of liquidity measurement. Several issues arose. To start with, the amount of data that was needed to be collected was alarming. Some indicators required less information, while many needed numerous fields for various periods of time. Despite the fact that more information is now available each day on the market, that large amounts of data had to be handled was a setback. It was important that the indicators had some level of simplicity, and large databases and long processing times were not particularly desirable. Given the level of care required for these types of calculations, the more information that you handle the greater the odds that it will be mishandled, and the greater the number of working hours that would have to be dedicated to guarantee an accurate result.

It is also important to know that a good proportion of the information needed is not available for free, which meant unexpected costs could arise. Another issue was to decide which indicators to choose. From our research, it was observed that liquidity could be analysed in five dimensions. One option to follow was to choose one or a few indicators for each dimension. On that basis, the analysis was exhaustive. An additional option was to have an indicator for each dimension, and find a way to aggregate them into a single measure. This measure would then cover all aspects regarding liquidity, and its evolution could be monitored over time. When looking at this last option, it was difficult to find a methodology to aggregate all five signals. In addition, the final result would actually be a number that would not be easy to interpret. In that regard, you could monitor the evolution of a signal over time, but the final value calculated would not relatable to something tangible. As mentioned, it is crucial to have access to the required information to calculate the chosen indicators, but it is also important not to choose indicators solely because of the information available. It was key that the indicators chosen are selected due to their relevance.

After careful review and analysis, the main objective of the project was refined. Not only was a liquidity indicator needed to monitor our reserves portfolio, it had to be simple and directly relatable to the possible use of the foreign reserves. In that regard, it was decided that the most useful measures to produce were: (i) how long it takes to liquidate the foreign reserves portfolio; and (ii) the cost of liquidating the foreign reserves portfolio.

Foreign reserves liquidity indicator

To construct the liquidity indicators, several assumptions were set. To begin with, the main indicator would measure liquidity under a simple scenario: market conditions being stable and the amount sold on a daily basis of each financial asset would be the maximum amount that would not disrupt market prices. On that basis, the indicator would measure the time and cost of liquidation in a quiet period. Later in this chapter, there will be a discussion of how other scenarios can be measured, but it is important to point out that as you create more complex scenarios, and deviate from normal conditions, the less reliable your indicator will be. However, as mentioned, considering other scenarios is crucial if you want to capture more dimensions when measuring liquidity.

Additionally, it was important to determine how each financial asset would be sold. Take this simple scenario: the maximum amount that can be sold in a day was set as the largest trade that could be done in order not to affect market prices. Therefore, the indicator assumes that one trade is executed per day per asset. This could be the case for the less-liquid assets, but for most liquid assets you could argue that more than one of these trades could actually be executed per day. Due to the simplicity of the methodology, the indicator can be easily adjusted to take that into consideration. It is also important to be aware that, although more than one trade could be executed per asset in a day, given the characteristics of its market you have to consider whether this is operationally viable as the number of trades could increase substantially.

The cost of liquidating a portfolio is calculated by adding the cost of liquidating the assets in the portfolio during the entire liquidation period:

where i is the issue, n is the total number of issues, m is the total time to liquidate all issues, si is the bid–ask spread of the issue, ai,t is the nominal amount sold that day of the issue, t is the day that the issue is being sold, and daily voli is the daily volatility for that particular issue.

The proposed equation is similar to John Hull’s formula for the cost of liquidation in a normal market.44 J. Hull, Risk Management and Financial Institutions (3e) (Hoboken, New Jersey: John Wiley & Sons, 2012). However, Hull only considers bid–ask spreads and divides them by two, thereby reflecting the cost from the perspective of a mid-price. The formula includes an extra factor, the change in price of the asset if it is not sold on the first day. The reasoning behind this is, if it is decided to sell an “X” amount of reserves and that cannot be done on the first day, any delay in selling should be attributed to the fact that, due to liquidity reasons, that portion of the portfolio could not be sold. Cost can therefore be defined by the bid–ask spread and the change in valuation of the assets as they are held in the portfolio and await liquidation.

To classify the information and reduce the amount of data required to calculate the indicator, all assets were grouped in different categories. Assets were divided into three sectors: government, government-related and corporates, with each then divided by bucket depending on the country of origin of the issuer and its approximate maturity. As an example, Table 4.1 shows a portion of the sovereign issuer matrix, where issuers are classified by countries such as the US, Germany, UK and Japan, with each country then being subdivided depending on the maturity of the issue (eg, six months, one year, two years, three years). While the information will not be exact, it is a good way to simplify the amount of data that you have to collect given that otherwise you would have to have information for every single issue that you hold in the portfolio, which might be an almost impossible task. Three of these matrices were constructed for each sector to record the required information for each bucket: (i) the amount of the asset that can be sold per day; (ii) the bid–ask spread of the particular group; and (iii) daily price volatility for each bucket.

| SOVEREIGNS | ||||||||

| 6 months | 1 year | 2 years | 3 years | 5 years | 7 years | 10 years | etc … | |

| United States | ||||||||

| Germany | ||||||||

| United Kingdom | ||||||||

| Japan | ||||||||

| France | ||||||||

| etc … | ||||||||

| Source: authors. | ||||||||

Although the amount of information needed is reduced greatly by classifying the assets into groups, it is important to note that a great deal of information is still used and calculated. Additionally, given that some assumptions are made, it is important to take into consideration that the information recorded is representative of the average characteristics of the “bucket” of issuers that it is representing. To be extra cautious, a “heat map” was included in each matrix to highlight the buckets that had the most significant contribution to the portfolios. The information in those buckets, given its relevance in the calculation of the indicator, was revised several times to guarantee its quality and consistency.

To obtain the information regarding maximum trade sizes and bid–ask spreads to complete the matrix, many conference calls were held with trading specialists in the asset classes being measured. The information gathered was compiled and a consistency check implemented by comparing figures with similar, publicly available, information. Once the information was compiled, the calculations could be made. The first step in constructing the indicator is to define the amount of days it takes to sell each asset. This calculation is straightforward, as you just have to divide the total assets under management of each issue by its corresponding amount. Despite the fact that the methodology is simple, much useful information can be gathered.

Once you have the number of days to liquidate, you can look at how much time each particular asset, tranche or portfolio takes to liquidate completely. One can also study the evolution of the volumes traded and that remain in the foreign reserves as time passes. Volumes can be looked at as a percentage of total reserves as well as in nominal amounts – both are relevant depending on what you want to analyse. Figure 4.1 shows what a portfolio or tranche might look like if it takes around 15 days to liquidate. As days pass, less is left to sell, and in the end it might take several extra days to liquidate the less-liquid issues.

Figure 4.2 shows how you can break up an entire portfolio into tranches or sub-portfolios, and compare how they can be liquidated as time passes. This is useful to see if the portfolios behave in line with liquidity objectives. As an alternative, one can look at the evolution in terms of the amount of cash that is being liberated as the portfolio is sold off. This might be more relevant if policymakers have a good idea of the amount of reserves that might be needed for policy operations. Figure 4.3 is a good example of how this can be looked at. In addition, how these indicators evolve through time can be monitored. As an example, Figure 4.4 shows how to monitor the liquidity of several portfolios with regard to how long they take to liquidate.

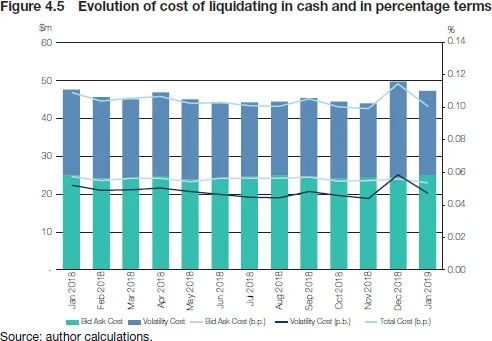

Following this, it is possible to use the cost of liquidation formula for each asset and calculate the cost of each issue. As was the case with the previous results, the information generated can also be aggregated in several ways and many important conclusions drawn. Figure 4.5 serves as an example of how the evolution of liquidation costs can be monitored and attributed to understand where the liquidity cost is materialising.

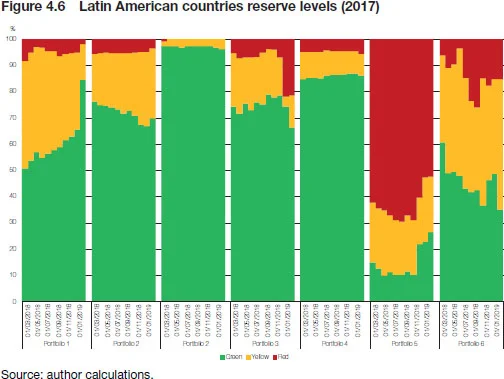

Additionally, both signals could be aggregated to try to capture both measures at once. For example, a traffic light signal can be created so that it is green for portions of the portfolio that can be sold in one day and yellow or red for portions that are sold after day one. Of this group, the assets that have higher liquidity costs are defined as red and those with lower costs are set as yellow. Each institution is free to determine the threshold that is set to distinguish between green, yellow or red. Figure 4.6 serves as an example. This would serve as a practical way to get a glimpse of liquidity under the set of rules that each institution can define.

Stress scenarios

As mentioned, the main indicator is constructed under one scenario; the one considered is the most probable and where the information gathered is the most reliable. However, the methodology can be easily applied to other scenarios. By adjusting all three types of matrices – amount sold per day, bid–ask spreads and issue volatility – different assumptions can be set. For example, another stress scenario that was measured was the 2008–09 financial crisis. For that, the analysis was performed and it was assumed that the portfolio would be liquidated in the same manner, and the matrices were modified to accommodate the information that was made available by market experts. The amount that could be sold during the day and the bid–ask spreads were modified to accommodate the financial crisis. Volatility was also modified to take into account the levels observed during the period. Additionally, given the assumption of normal distribution type behaviour when pricing liquidity, it is important to consider if another type of distribution should be included. By analysing this scenario, for example, it was found that the information on volume did not vary a lot, and that the greatest impact was seen via the bid–ask spreads. Therefore, a quick conclusion was that, under a similar scenario, the velocity of liquidation was actually not affected materially; the cost was the factor that actually made a difference.

Other scenarios can also be measured – for example, a scenario in which larger amounts are sold – and this can be accommodated by widening the bid–ask spread matrix to reflect the extra cost that would be incurred if the market prices are affected by the entity´s desire to sell unusual amounts. A “step system” could be used and different bid–ask spreads applied as larger volumes are sold. To re-collect the information on bid–ask spreads relative to the amount sold per day, it is recommended that market specialists are consulted to ensure the information put into the indicators is of the best quality.

Conclusion

On examining the results of the methodology, several conclusions can be drawn. The first is that liquidity risk is a fact. For years, central banks have tried to tackle this via strict guidelines; however, the environment has changed. Due to several factors, liquidity is now a risk that must be monitored closely and not taken for granted. It is recommended that measures be set and a monitoring framework put in place.

Liquidity evolves, and as a result indicators should be updated regularly. For example, the matrices presented in this chapter are updated on an annual basis so that the indicator reflects market conditions. Information might not vary from one year to the next, but it is important to be up to date when new regulation or market tendencies change the level of liquidity in key markets.

Key decision-makers and risk-takers within the institution should be aware of the liquidity risk present. Although strict guidelines can limit exposure to desired levels, it is best they know of the evolution of liquidity and the status of the portfolio given the risk tolerance set. It is also important that information be provided in a setting that allows them to recognise and monitor the risks.

Once a level of familiarity is created with the liquidity indicators, it is key to determine whether certain boundaries should be set. For example, a boundary can be applied so that a certain amount of a “liquid” portfolio be available after a specific amount of days. Therefore, a relevant discussion would be about determining the desired velocity of liquidation for the portfolio. If a central bank needs “X” amount of dollars for its policy operations, for example, how long would it take for them to be available under normal circumstances? Additionally, if other portfolios reach a level of liquidity that is out of the key risk-taker´s comfort zone, guidelines might have to be adjusted. Different targets can be set given the wide array of information that is created with these measures. Another important point would be to define what should be sold. In the case of our indicators, the assumption was that all assets of the selected portfolio are sold from day one, independent of their daily transaction size. In that regard, it a relevant to discuss if it would be best to just sell assets that have a relatively high transaction size to optimise the number and impact of the daily operations. Decisions of this kind might actually influence investment priorities, and high concentrations or illiquid assets might thereby be avoided in these types of portfolios.

In terms of the indicators that have been presented, their simplicity is a key factor. While the underlying assumptions may be strong, it is important to realise that the most possible scenario under which liquidation is executed in normal market circumstances is the one that is most easily measured. Variations can be calculated, and in many cases with simple adjustments, but as these become less probable the information that is included is perhaps less reliable. Stress scenarios should always be analysed, but the results drawn should be observed with an understanding of where they come from.

The liquidity indicator is flexible because it can be adjusted to measure many aspects. For example, when considering the desired liquidation procedure some institutions might prefer to liquidate under normal circumstances, while others might prefer to execute at a faster pace. All of these scenarios are measurable, and the important condition is that the information collected is representative of the type of scenario analysed. In this particular case, for instance, the cost of liquidating a certain amount in one, two or three days can be measured by the methodology, and you can tailor the measure to your needs.

It could be argued that normal liquidation might sound appropriate, but in practice it is actually not very common. Given this, it is important to insist on stress scenarios being examined. Additionally, and due to the importance of best execution practices, an institution might want to consider if it defines how it will operate under extreme scenarios. This chapter has assumed that each asset is traded once per day. This might be the case for some institutions but not for others. As a result, it is crucial to adjust the measure to accommodate the most common practices that will apply. Also, it might be desirable to document the conditions that will be in place when the extreme scenario becomes a reality. For example, it is widely assumed that limit orders might be the best strategy where one has to sell abnormal amounts since best prices could be obtained by a single counterparty that is able to liquidate large amounts by operating on a discretionary basis throughout the day. If that is the belief of an institution, it might be useful to set guidelines that define how trades would be allocated under such conditions. These guidelines would help determine how “single” counterparties would be selected whenever large and abnormal amounts have to be traded.

A key aspect explored in this chapter is the existence of market risk. At times, larger bid–ask spreads might be frowned upon, but it is important to measure if the market risk being assumed might actually have a greater impact. On that basis, it is useful to keep an eye on the market risk of your portfolio if you have decided to liquidate a portion of it. If these risks are high, and your desire is to sell and maintain normal market conditions, derivatives could be used to hedge market risk. For example, if it takes several days to liquidate certain bonds in your portfolio, some of the interest rate risk could be hedged via futures. This is an aspect that should be assessed when determining the target levels to liquidate on a daily basis.

Although Banco de la República uses a methodology to calculate the liquidity for a portfolio that is mostly made up of fixed income instruments, as discussed the indicator can be constructed by taking into consideration other asset classes and types of portfolios. As long as there is reliable information on daily transaction volumes, bid–ask spreads and volatility estimates, it is possible to calculate both indicators.

An additional factor is that, as more market information is available and more liquidity indicators are offered by third-party providers, it is possible that to contrast the indicator or some of its inputs with results provided by others to provide a sense of how your measure compares. If any material difference arises, the issue should be analysed to understand the reasons behind it.

Liquidity comes with a price. Once one has determined a comfortable level of liquidity, it is important to set investment decisions in line with it. One simple example is “on the run” US Treasuries. Given their level of liquidity, bid–ask spreads are normally tight. However, if as an investor you are looking to hold a security for a long time (perhaps until maturity), maybe a “on the run” might not be the best strategy and the market could offer cheaper issues given that their liquidation could be more difficult. As a result, it is important to define the liquidity risk tolerance of each tranche as it might be a key investment decision factor. For each case, it is important to know which side you are on: are you a liquidity provider, a liquidity taker or somewhere in between?

Another key aspect is that although large holdings, in certain issues, might be convenient for some low maintenance and low transaction cost portfolios, an unexpected cost might arise if quick liquidation is applied. Large holdings are not necessarily desirable and investment decisions should consider liquidation costs. Finally, it is important to stress that the model does not come without flaws. The fact that it is simple could be its biggest flaw if results are not interpreted correctly. The indicator by no means tries to be an exact predictor of the cost of liquidating a portfolio, and the amount of days and costs are approximate values that, as mentioned here, serve to achieve a good measure of liquidity risk. The obtained values should be seen as a reference, and decisions (if taken) should always bear that in mind.

Final thoughts

As markets evolve, risks evolve. Liquidity risk has been no exception. Given this, it makes sense to monitor liquidity risk actively and understand its possible impact. Due to its characteristics, there are numerous ways that it can be measured and the most important decision is to find a method that creates comfort and monitors the issues that matter the most to each institution. In the case of the proposed indicator, it has proven to be simple and the results that were obtained generated enriching and illustrating conclusions. Despite the fact that it was designed with the intention of monitoring liquidity, it has been a useful way to learn some key lessons and to better understand liquidity in general.

The opinions expressed here are the authors’ own and do not necessarily represent the official position of Banco de la República or its authorities. The methodologies and practices explained are proposed by the authors and may be different from those implemented at Banco de la República, and do not necessarily comprise the policies or decisions of the board of directors of any other governing body of the institution. The authors would like to thank Thomas Philips for his help in developing the indicator. Dr Philips was instrumental in the process and his collaboration was decisive in creating the measure.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com