Central Banks

Mandate change proposal would be unconstitutional, Polish governor says

Bank governor says giving the central bank a growth mandate would not be permissible under EU law; senior figures in governing party call for monetary easing programme

Norges Bank paper tries to extract high-frequency forecasts from low-frequency data

Researchers find low-frequency information can be important in forecasting high-frequency variables, designing a model that outperforms a random walk benchmark

BoE researchers unearth further evidence of electronic trading driving liquidity shocks

Study of market liquidity finds episodes of volatility have centred on fast, electronic markets, and says broad trend has been towards greater use of electronic platforms

BoE’s Brazier defends new stress testing framework

Executive director says the Bank of England already has much of the forecasting infrastructure it needs, but will not overestimate its ability to spot the UK’s position in the financial cycle

Economists challenge foundations of monetary economics

‘Neo-Fisherian’ approaches use standard New-Keynesian models to show that cutting interest rates will produce lower, not higher, inflation – and the result is surprisingly difficult to overturn

Central Bank of Barbados continues digital drive

Central bank publishes its economic review in video format as part of an ongoing digital drive; governor DeLisle Worrell is driving force behind digitisation

BoJ holds QQE fire but pushes back inflation forecast

Bank of Japan leaves asset purchase programme unchanged despite downward revision of outlook; central bank now predicts inflation target will be reached in second half of fiscal 2016

European banks ‘lagging behind’ in re-thinking strategies, Bundesbank board member says

European commercial banks have been too slow in adapting to a changed regulatory environment and low interest rates, says Andreas Dombret of the Bundesbank

Central Bank of Iceland approves failed bank plans

Central Bank of Iceland approves ‘composition agreements’ by failed banks, offering them the opportunity to duck a heavy stability tax

Riksbank attacks government's amortisation proposals

Sweden’s central bank strongly criticises aspects of government proposals to cool the housing market; says measures threaten the independence of Swedish macroprudential regulator

Swaziland currency drops under Fed decision pressures

Delayed Fed rate rise put pressure on Swaziland lilangeni, central bank says, and more moves are likely

Fed rate rise given the ‘amber light’

Federal Reserve holds rates but hints there could be action at the December meeting; analysts still seeing mixed signals

Emerging markets risk ‘quantitative tightening’, Caruana says

Problems now affecting emerging markets are a continuation of global problems, head of BIS says; response by policy-makers is too reactive and based on domestic circumstances

Countries under credit stress should ‘front-load’ fiscal consolidation, says ECB paper

Front-loading will bring confidence effects, the working paper suggests

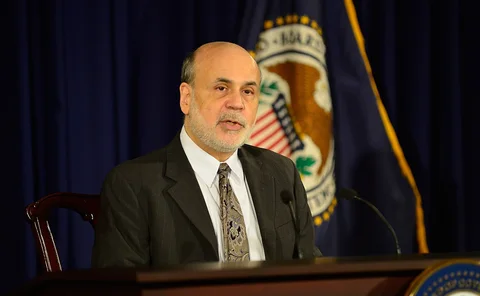

Bernanke offers insight into Fed’s political balancing act

Former Fed chair tells of navigating both political and economic pitfalls in crisis response, and says the US central bank’s independence is still under threat

NBIM records Q3 loss amid stock market volatility

Norges Bank Investment Management posts uncomfortable loss in third quarter, driven by sharp drop in its equity investments, but fund’s chief executive stresses long-term focus

Turkish central bank may act as inflation forecasts rise

Declining exchange rates and rising food prices have pushed inflation expectations upwards, monetary policy committee says; governor says he will raise interest rates if necessary