Central Banks

FSB finalises elements of global bank resolution framework

The raft of documents includes final principles for effective cross-border resolution actions; latest list of globally systemic banks also published

Inflation outcomes should not be sole criteria for judging performance, says RBNZ's McDermott

Assistant governor's comments come after policy reversal by RBNZ amid falling global commodity prices; staff article emphasises 'ex-ante' evaluation of monetary policy decisions

Research assesses South Africa’s vulnerability to Fed hike

Countries with large ratios of external financing needs to foreign exchange could be more vulnerable to Fed rate hikes, working paper finds

People: Finland names new head of statistics; RBI appoints executive director

Bank of Finland promotes head of macro-prudential analysis division to head of financial stability and statistics department; RBI gets new executive director; and more

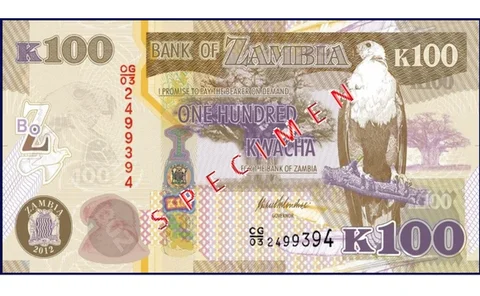

Zambia hikes by 300bp as inflation almost doubles

Bank of Zambia increases policy rate to 15.5% in an effort to keep inflation expectations anchored in single digits; annual inflation jumps to 14.3% in October as kwacha slides

State Bank of Pakistan overhauling risk management, annual review says

Central bank is looking to improve its risk management approach, with work proceeding on an enterprise risk management system

BoE’s Bailey stresses need for true understanding on boards

Andrew Bailey says executive board members should be responsible for explaining complex matters in simple terms, rather than leaving non-executives to figure it out for themselves

PBoC monetary policy reform could be 'trial and error', economists warn

The Chinese central bank wrapped up a two-decade long interest rate liberalisation process last month – now the hard job begins

Constâncio: ECB working to overcome stress test limitations

Current ECB stress tests have multiple limitations including some macro-prudential considerations, ECB vice-president says

ECB assessment finds capital shortfall at four largest Greek banks

European Central Bank banking supervision uncovered ‘adverse case’ capital shortfalls of €14.4 billion at Greece’s four largest banks; recapitalisation plans needed by November 6

CLS sets go-live date for Hungarian forint

CLS and Hungary's central bank launched the forint project in February 2014

Paper explores whether governments prefer under-capitalised banks in crises

Governments may prefer banks to be weakly capitalised as this increases the likelihood they will act as buyers of last resort for domestic debt; paper considers impact on regulation

Kazakhstan governor replaced with former deputy

President removes Kairat Kelimbetov from office citing lack of confidence in central bank and falling currency; names former deputy Daniyar Akishev as succesor

ECB to log bank loans to firms above €25,000 from 2018

New system will log all loans by eurozone commercial banks to firms above a value of €25,000 starting in March 2018; ‘AnaCredit’ likely to expand coverage to natural persons

Eurozone banking sector less reliant on central bank funding, ECB report says

Commercial banks relied less on central bank financing in 2014 and only achieved ‘moderate’ extension of credit; shadow banking sector becomes increasingly important

Europe should adopt expansionary fiscal policy, Fed's Stanley Fischer says

The ECB must continue with its ‘courageous’ supervisory and monetary policies, but they would be stronger if backed by an expansionary fiscal policy, says Stanley Fischer

Mandate change proposal would be unconstitutional, Polish governor says

Bank governor says giving the central bank a growth mandate would not be permissible under EU law; senior figures in governing party call for monetary easing programme