Central Banks

Stress tests should consider wider range of resilience metrics – BoE article

Metrics including liquidity and funding resilience should be considered as stress tests become an important part of a central bank’s regulatory toolkit; current liquidity and funding stress scenarios are “less advanced”

Bank of Israel moves to eight-meeting policy cycle

Cut in number of meetings reflects stability of economic indicators and will allow for more detailed analysis at each meeting, central bank says, though one member criticises loss of flexibility

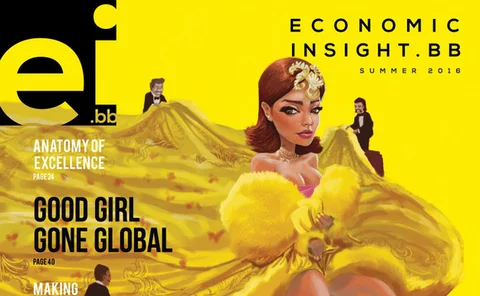

Central Bank of Barbados launches biannual economic magazine

Barbados launches financial magazine after “ironing out” issues; central bank’s latest venture “demystifies” economics for the general public

ESRB publishes guide to OTC derivatives database

Draghi repeats pledge to extend central clearing regulation to all forms of derivatives; ESRB paper sheds light on “opaque” markets

Sarb governor fends off political criticism

Central bank would co-operate should inquiry into supervision powers be launched; monetary policy committee leaves rate on hold with the prospect of an end to the hiking cycle nearing

IMF warns over problems in Belarusian banking system, but central bank disagrees

Systemic liquidity risks are “elevated” because of dollarisation, fund says; central bank claims country’s first asset quality review shows banking system is sound overall

Dutch banks’ cross-border lending data 'supports case for reciprocation'

Large Dutch banks boost lending in response to tighter regulations, paper says; behaviour is likely to undermine effectiveness of macro-prudential policy

BoE’s Forbes studies generation of ‘global tsunamis’

External MPC member asks why some global shocks have major consequences and others do not, seeking answers in countries’ financial linkages, common shocks and contagion

RBA’s Lowe: we are not ‘inflation nutters’

Philip Lowe underscores central bank’s “balanced” approach to controlling inflation in his first public appearance as RBA governor, and highlights other initiatives

Swift unveils software to help users detect fraud

Financial messaging service hopes new software will allow users to independently detect unusual activity; software to be launched in December this year

Fed holds but two more dissenters call for hike

Case for hike is building, says Janet Yellen, but economy has “a little longer to run”; two more FOMC members join Esther George in voting for hike

Eurozone employment-to-GDP-growth ratio has recovered strongly – ECB

Employment growth concentrated in Spain and Germany; productivity remains “stagnant at pre-crisis levels”

Central Bank of Kenya cuts rates despite new credit legislation

Commercial banks to amend lending rates again following a cut in interest rates; bank launches 50th birthday initiatives including new website

IMF lauds renminbi SDR launch, but some see momentum stalling

Fund officials praise China’s proactive approach to meeting SDR goals, but others warn progress on renminbi internationalisation may be slowing

RBA’s Heath highlights changing nature of Australian workforce

Automation, ageing population and decline of industry are reshaping the labour market’s demand for skills, head of economic analysis says, with lessons for central bank recruiting

Declining inflation reduces pass-through effects for emerging markets – BIS paper

Central banks should be less fearful of floating their exchange rates; emerging markets should take note exchange rate channel could be “less effective” in affecting inflation

BoJ targets inflation overshoot with revamped policy approach

Shift to “yield curve control” could give the central bank more room for manoeuvre on asset purchases, as it promises to keep easing until inflation exceeds the target

Liquidity stress testing ‘essential’ – ECB supervisor

Supervisor warns conference that banks will need to shape up their internal liquidity adequacy assessment process responses for 2017

Savers must adjust their plans amid low rates – Poloz

Bank of Canada governor illustrates harsh reality for savers with rates so low, underlining the need for people to put aside more funds or work for longer than anticipated

Russian central bank closes eight lenders and reports alleged crimes

Six banks and two credit institutions were shuttered by Russia’s central bank in September; dossiers on alleged “crimes” at six more sent to prosecutors

BIS research seeks to forecast global inflation

Economist builds global inflation forecast using country-level survey forecasts, finding it can be used to improve domestic inflation projections in some countries

BoE’s Hauser foresees end to fragmented post-trade structures

Central bank is supporting a movement away from “complex and balkanised” securities services as it looks to revamp infrastructure and encourage innovation

Reserve requirements complement monetary policy in small open economies – paper

Paper examines the use of indirect and direct monetary policy instruments in three Caribbean economies; increases in the reserve ratio are successful in reducing private sector credit

ECB paper examines use of eurozone bank lending survey

Changes in credit standards in the ECB’s bank lending survey serve as leading indicators for GDP and bank loan growth, researchers say