Unresting investing

Successful projects should be advertised to encourage potential countries to participate in the Belt and Road Initiative (BRI).

The Silk Road Fund is a medium- to long-term investment and financing institution specifically established for the BRI. Since the establishment of the Silk Road Fund in 2014, the institution has invested and supported substantial important projects, primarily through equity investment.

By the end of October 2019, 34 projects had been funded, with a total commitment of US$12.3 billion in investment, including CNY30.4 billion. Although the investment is not large, it is mostly made up of equity, which will lead to greater amounts of funding.

The Silk Road Fund has benefited greatly from its involvement with the BRI, gaining experience from the past five years of projects.

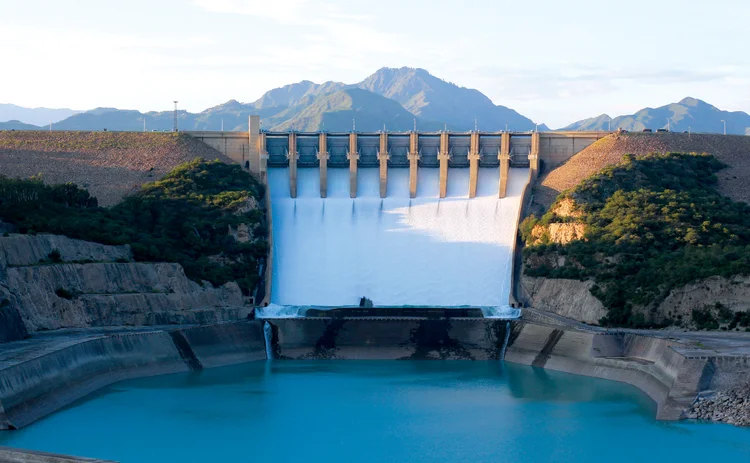

Attaching importance to synergising BRI countries’ domestic development plans and adopting an inclusive approach to leveraging the comparative advantages of both parties will help build engines for high-quality development. China’s comparative advantage is manifested in its abundant capital as a result of a relatively high savings rate. It also has rich experience in power plants, high-speed railways and industrial manufacturing – core pillars in the economic development of the BRI countries. The first Silk Road project was investment in hydropower in Pakistan, which was struggling to sustain its electricity supply. By replenishing electricity and increasing supply, Pakistan fostered a favourable environment for economic growth. China, thanks to its experience, is able to carry out investment and financial co-operation within BRI countries. In general, its projects are long-term equity investments in areas such as infrastructure, resource development, industrial co-operation and financial services.

Diverse partnerships to achieve multilateral ownership

The Silk Road Fund has also vigorously promoted co-operation with third-party markets, effectively expanding the space for high-quality development. In addition to co-operating with multilateral development institutions, multinational corporations and financial institutions – including the World Bank – the Silk Road Fund also co-operates with developed countries.

This effective combination of third-party markets, China’s comparative advantages in capital and production capacity, developed economies’ advanced technology and management, and the investment needs and resource endowment in the investment-

targeted country can optimise resource allocation on a larger scale and ensure rewarding returns for all stakeholders.

One example is the Silk Road Fund’s relationship with the European Investment Fund under the umbrella of the European Investment Bank. The two firms have jointly established the China–EU Co-investment Fund. The investment of sub-funds is market-based, which facilitates the connection between the BRI and the EU Infrastructure Investment Plan – or the ‘Juncker Plan’, named after then European Commission president, Jean‑Claude Juncker. The primary investment objective of the sub-fund is to assist the development of small and medium-sized enterprises (SMEs) in Europe. The fund has successfully promoted the entry of some European SMEs into the Chinese market, and consequently accelerated the integration of Chinese and European markets.

Another example is a joint investment group co-founded by the Silk Road Fund and Singapore’s Surbana Jurong. Its mission is to conduct infrastructure investments in Southeast Asia.

Green investment and sustainable development

In 2015, China proposed a new development concept: “innovation, co-ordination, green development, openness and sharing”. At the second Belt and Road Forum for International Cooperation, President Xi Jinping asserted that China should adhere to the concept of “openness, green development and integrity”, and strive to achieve the goal of “high-quality benefit to the people and sustainability”.

As an investment and financing institution serving the BRI, the Silk Road Fund, as a responsible investor, has signed and joined the Green investment principles for the Belt and Road. In the process of investment decision-making, the Silk Road Fund fully evaluates the impact of a project on the local ecology, environment and society, paying special attention to the environmental, social and governance implications of the project. Examples include projects undertaken in Dubai aimed at developing clean energy sources. In alliance with Saudi Arabian power and water company ACWA Power, the Silk Road Fund has invested in the world’s largest thermal-storage solar power plant, with a capacity of 950 megawatts, which will facilitate the development of clean, local energy and a transformation in energy delivery.

Broadening the channels for investment and financing

The use of local currencies in the construction of the BRI helps mobilise local savings, reduce the cost of currency exchange and maintain financial stability. At present, the renminbi has been officially included in the International Monetary Fund’s special drawing rights currency basket, and the use of the renminbi in cross-border currency investment is on the rise.

The Silk Road Fund is a dual currency fund with total capital amounting to CNY100 billion and $40 billion. The Silk Road Fund has also made some successful forays into renminbi investment, carrying out renminbi equity and loan investments in the Middle East and Central Asia. Here, renminbi funds are used to purchase Chinese equipment, raw materials and services – for example, engineering, procurement and construction – reducing costs and preventing exchange rate risks.

The fund has expanded the popularity and influence of overseas enterprises in China and has helped these enterprises enter the Chinese market and expand the number of trading partners for the future.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com test test test

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com test test test