Corridor of power

Shaukat Aziz: Pakistan is proud to be one of the pilot countries of the Belt and Road Initative (BRI). Here, the initiative is executed not with the cookie-cutter approach so often employed in the past with other Western institutions, but with professionalism, transparency and adherence to national requirements. Countries such as Pakistan have limited access to capital markets, although the Bretton Woods Institutions – such as the World Bank and the International Monetary Fund – have set up camp here. The BRI has a very specific purpose and a basic philosophy: if you develop your infrastructure properly – in a timely and appropriate fashion related to the needs of your country – your economy will expand and growth will improve. The underlying aim is to create an environment for growth, higher employment and the empowerment of people with more opportunities in their home countries.

Good infrastructure is an enabler of growth, effective poverty reduction and improvement of standards of living. The first BRI project in Pakistan was the deep-sea Gwadar Port, which has been built in record time. Sceptics initially suggested it was a naval base, but if you visit you will discover that it is merely a port, close to the Iranian border, which opens Pakistan up further through greater access to the sea. However, it is not a modest project – it has transformed the entire region. Prior to the port’s development, there was not even a proper road connecting the area, but high-standard motorways have since been built where, previously, driving had never been seriously considered as an option.

The BRI is a national game-changer that creates and unleashes positive forces. We should develop this concept continuously and improve it so we can obtain quality growth and quality life for our people, sharing and caring for everybody, rich or poor.

Ashfaque Hasan Khan: Globalisation today has made the world richer than before but, in recent years, it has come under severe criticism from its erstwhile champions. In their view, the fruits of globalisation have not been shared fairly, which has led to growing inequality among and within nations. Such thinking has given rise to nationalism and protectionism in the West, which is hampering international trade, global growth and prosperity.

President Xi Jinping, addressing the World Economic Forum in January 2017, clearly stated that there was nothing wrong with globalisation. What was required was to make globalisation work for all – rich and poor. The BRI has clearly demonstrated a way forward to make globalisation work for all as it builds on connectivity and co-operation among participating countries.

Connectivity is vital for the success of regional co-operation, facilitating exchange activities within and between countries. At the first Belt and Road Forum in Beijing in May 2017, President Xi noted that “in pursuing the BRI, we should focus on the fundamental issue of development, release the growth potential of various countries and achieve economic integration and interconnected development, and deliver benefit to all”. The key to the success of President Xi’s vision is connectivity through physical infrastructure, such as roads, motorways and ports; telecommunications networks; energy infrastructure, such as pipelines; electricity; banking and financial infrastructure; and people-to-people connectivity, such as international tourism, overseas study programmes, and so on. The BRI portal now lists 138 countries and 30 international organisations, as of the end of January 2020, including the recent additions of Italy and Luxembourg.

Evidence suggests infrastructure investment contributes to economic growth and ushers in sustainable prosperity. But the world is facing a large infrastructure gap that constrains trade, openness and future prosperity. According to a study by the Asian Development Bank (ADB), Asia requires US$26 trillion of investment to bridge the infrastructure gap by 2030. Multilateral development banks, such as the World Bank and the ADB, are working hard to close this gap, but China’s BRI can also help solve this problem – not only in Asia but in other parts of the world. BRI investment projects are estimated to add more than $1 trillion of infrastructure between 2017 and 2027. The BRI must thus be seen in the context of global infrastructure needs and China’s long-term economic strategy, as well as the development strategy of participating countries. The BRI has emerged as a new driving force to global growth and prosperity. By looking at the growing list of participating countries, it is safe to describe the BRI as a vehicle for new globalisation –

or ‘globalisation 2.0’.

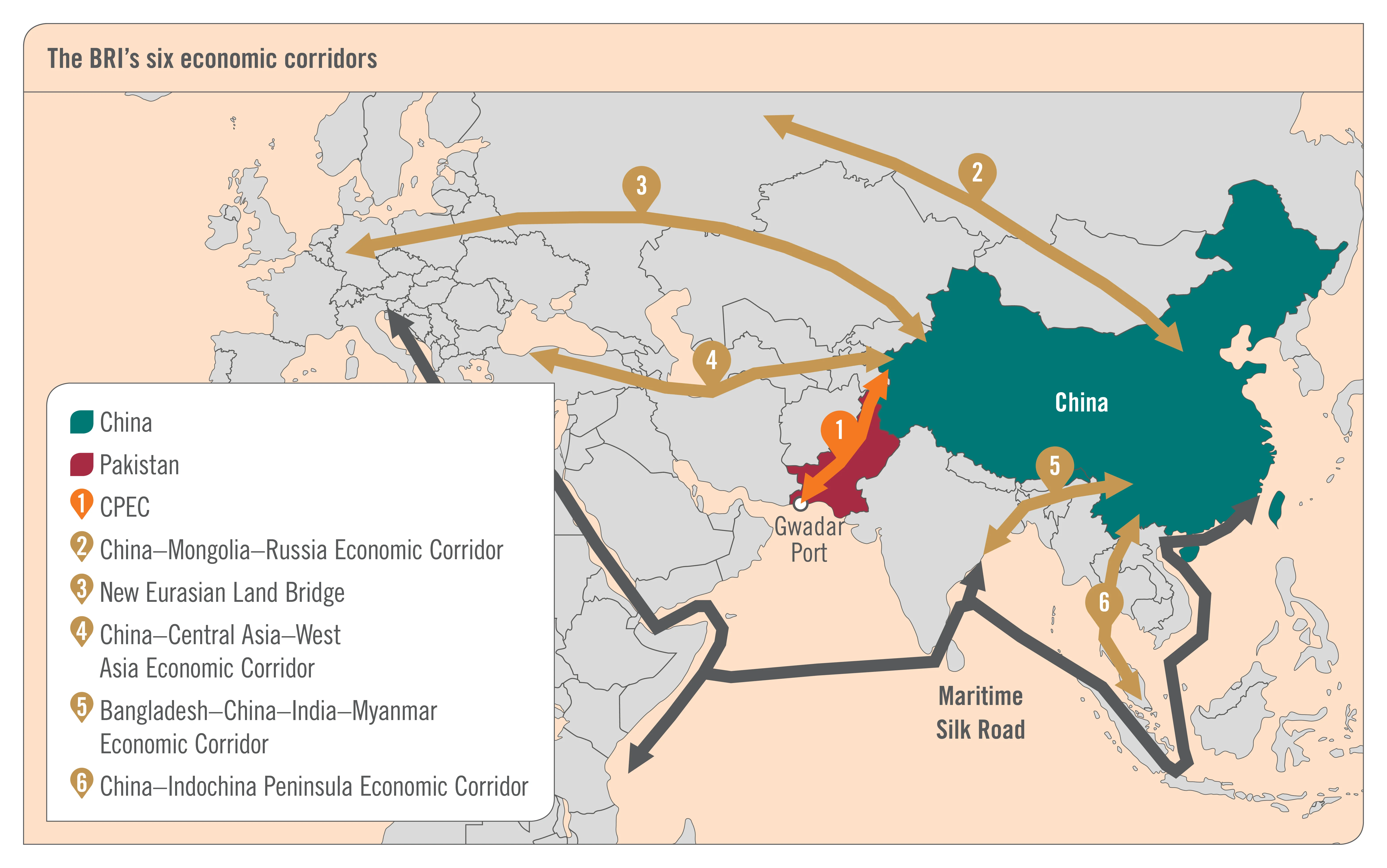

The development strategy of the BRI builds on connectivity and co-operation through six economic corridors, including the China–Pakistan Economic Corridor (CPEC) – the only bilateral corridor connecting the two countries. The remaining five are multicountry corridors. CPEC is considered central to China–Pakistan relations and is part of the national security strategy of the two countries. CPEC is considered the linchpin or flagship project of the BRI. It has provided a unique opportunity for Pakistan to boost its strategic and economic position in the region and has the potential to transform Pakistan into a regional hub for trade and investment.

CPEC covers everything from energy and key elements of infrastructure development including roads, motorways, sea routes and airports, to communication, industrial co-operation, the establishment of special economic zones (SEZs) and the Gwadar Port development. CPEC was officially launched in April 2015 during President Xi’s visit to Pakistan, when $46 billion in investment was committed over the following 15 years. The project has since expanded to help overcome electricity shortages in Pakistan, with project investment increasing to $68 billion. CPEC projects will be launched in three phases: 2015–20, 2020–25 and 2025–30.

The first phase of the CPEC projects is almost complete. It is highly encouraging to note that it has made significant contributions to Pakistan’s economic development so far. CPEC has already proved a real game-changer for Pakistan and will play a demonstrative role for other countries participating in the BRI.

Like many Asian countries, Pakistan has been facing a large infrastructure gap and acute electricity shortages, which have constrained economic growth. According to the ADB, inefficiencies in energy production cost Pakistan $18 billion, or 6.5% of GDP, in 2015. Given Pakistan’s sprawling geography, the development of remote areas has been a gigantic task requiring enormous budgetary resources. Thanks to the BRI and CPEC, Pakistan has been transformed to an electricity surplus country, successfully overcoming electricity shortages through CPEC power projects.

Physical infrastructure has been developed and world-class motorways and road infrastructure have been built. The connectivity of Kashgar in China and Gwadar Port – with close to 3,000km of motorway network – has already been achieved. Since this motorway passes through remote areas of Pakistan, it has opened those areas to business. This surge in connectivity is bound to bring prosperity to even far-flung areas of Pakistan. Massive construction activity is taking place around Gwadar Port and the city of Gwadar itself, and an SEZ has been earmarked for Chinese industries exclusively. This port city should also witness the establishment of oil refineries and oil pipelines.

With the completion of major infrastructure and energy projects, the first phase of CPEC has helped Pakistan address its huge energy deficit, strengthen transportation and communications networks, and build physical infrastructure such as roads and motorways. Pakistan has suffered electricity shortages since the 1980s, but these were aggravated enormously between 2008 and 2015, when power outages became the norm in urban and rural areas, and the country was losing $4.5 billion each year in production and business costs. Pakistan has managed to address these bottlenecks with the help of the BRI and CPEC.

The second phase of CPEC will focus on industrial and agricultural co-operation, the further construction of Gwadar Port, and socioeconomic development. Twenty-seven new projects of the second phase were defined in April 2019, 17 of which are due to commence in the first half of 2020.

In agriculture, emphasis will be placed on increasing productivity of major crops, livestock, the dairy sector and fishing; reducing the post-harvest loss of agricultural crops; and improving warehousing.

After removing bottlenecks in power generation, the pace of industrialisation will be accelerated through the establishment of nine SEZs, to which China is willing to relocate its labour-intensive industries. All SEZs except Gwadar will be open to all countries. Beside industrialisation, this project will also increase Pakistan’s exports to China as well as to other parts of the world. Three SEZs will be made functional soon.

Pakistan’s southern regions, including Balochistan, are packed with high-quality minerals. The execution of CPEC is divided into five functional zones; the ‘western alignment’ in Pakistan has been earmarked for exploration and ecological conservation, and Gwadar–Quetta–Dera Ismail Khan for mineral exploration. China has expressed its keen desire to undertake mineral exploration projects here.

The second phase of CPEC will also address Pakistan’s human capital development challenges. Emphasis will be given to the establishment of high-quality educational as well as skill development institutions.

Enter high growth

CPEC is not just a bilateral initiative between China and Pakistan, it has a regional perspective as well. It has the potential to become a truly regional pivot if extended to countries such as Afghanistan, the Central Asian republics, Iran, Turkey and Oman. Such a regional initiative, once implemented, will put Pakistan at the centre of regional connectivity and build it into a hub of economic activity, with Gwadar facilitating trade with the region.

The BRI and CPEC have benefited Pakistan immensely, strengthening the country’s physical infrastructure and laying down the foundation for balanced regional development. It has so far created in excess of 80,000 jobs, with 90% of the workforce coming from Pakistan. It has also contributed at least 1% to real GDP growth. Once the project is completed, it has the potential to transform Pakistan from a low- (3%–4%) to a high-growth (7%–8%) country, substantially raising the average per capita income. CPEC has the potential to connect many countries in the region, all of which can benefit from this initiative. Without doubt, BRI has emerged as a new driving force of global growth and prosperity.

Muneer Kamal:

Pakistan is in a unique geographical position. Normally, regions develop together, but Pakistan cannot trade with India, Afghanistan or Iran because of politics, war and sanctions.

Luckily for Pakistan, it has another neighbour that is already the largest manufacturer in the world and, over the next two decades, is likely to become the single biggest economy as well. Over the past six decades, Pakistan has developed a unique relationship with China, one that has led to the early deployment of BRI policies.

When the BRI was launched in 2013, Pakistan was included as one of the six corridors. CPEC is one of the flagship projects and was introduced at a crucial time for Pakistan. Plagued by relentless domestic terrorist attacks, and with the war in Afghanistan raging on its borders, Pakistan was in trouble. At that point in time, there was little hope, and options for loans seemed to dry up. To top it all, the country faced a yawning energy gap.

The pace of development and implementation of the BRI was incredible. Within six years, the first phase of CPEC power projects was completed, following a total of $30 billion worth of investment. Nine projects have been implemented and commissioned: 5,320 megawatts (MW) at a cost of $7.9 billion, on the construction of eight additional power projects at 4,470MW at the cost of $9.5 billion. We are planning 2,544MW more at a cost of $4.5 billion.

In addition, Pakistan has been diligently implementing BRI infrastructure. Some of the motorways – for example from Sukkur to Multan – have been completed, and some are on the verge of completion. In Lahore, the $1.62 billion metro train project will be completed in the first quarter of 2020.

Where was the renminbi?

In the second phase, as we move forward, there are even more significant long-term implications for Pakistan. China has identified nine SEZs, of which three have been deemed development priority areas: Khyber Pakhtunkhwa, Punjab and near Karachi.

What makes the BRI initiative unique is how funding has been provided: for example, in a power-plant initiative, a Chinese company partnered with Engro, one of the largest companies in Pakistan. Habib Bank, Pakistan’s largest bank, provided the equity for the project, which was financed in Pakistani rupees and foreign currency, which contributed around 25%–30%. The project cost around $30 billion, which is where the problem arises. All the energy projects were US dollar-denominated, so where was the renminbi?

One lesson Pakistan has learnt is that it needs to calculate how to project and make loans in Pakistan in other currencies. And, as the BRI advances into other countries, a key lesson should be that financing does not have to be dollar-denominated – particularly for Pakistan projects.

Trade between China and Pakistan stands at between $16 billion and $18 billion. As more BRI projects are implemented in Pakistan, buttressed by the government’s stabilisation programme, economic growth and trade will increase.

Renminbi usage in bilateral transactions will therefore have to be achieved very quickly. Pakistan does not currently directly exchange the rupee with the renminbi – the dollar is used as a converter. A capital account should be opened within the central banks to facilitate a direct pairing.

Another issue to consider is that the capital market has barely been used to bridge the funding gap. In December 2016, three of China’s exchanges – the Shanghai Stock Exchange, the fourth-largest in the world; the Shenzhen Stock Exchange, the ninth-largest; and China Future, China’s only derivatives exchange – along with Habib Bank, acquired a 40% stake in the Pakistan Stock Exchange.

Several road projects under the BRI have either been or are about to be implemented with exclusively Chinese funding. Certain components of the projects, such as the equipment, will be delivered by China, but it is being financed in local currency. But it is not a good idea to finance local currency for foreign currency funding. We must create infrastructure bonds in Pakistan, and the exchanges that are now heavily investing in the Pakistan Stock Exchange would need to support this initiative. We must develop infrastructure bonds to be listed on the stock exchange to fund the rupee requirements of BRI projects.

Currently, the Chinese have contributed funding for six infrastructure projects. I suggest that some of these projects are financed by Chinese financial institutions – a plus point for the stock exchange – and 40% of the free flow in Pakistan headed up by other foreign funds such as BlackRock, Vanguard and Lazard.

If they were to be listed on the stock exchange, BRI projects would gain further exposure and entice the best funds from around the world to invest. In addition, if successfully implemented and floated on the stock exchange, the rupee infrastructure bond would expose the projects to the international global community.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com