South-South development co-operation in transformation

China worked together with African countries on SSDC to enhance self-development

China's South-South development co-operation (SSDC), or foreign aid, has been the subject of many heated debates, which have escalated in recent years. Many critics may have forgotten that ‘China is big, but not yet rich' - and that it was a low-income country when it started providing development co-operation to African countries in the 1960s. The past 50 or so years have witnessed a joint learning process for economic transformation in China and Africa.

China's approach in SSDC differs from the international aid of established donors, focusing on using ‘what China owns and knows best' by combining trade, investment and development co-operation. What are the unique features of China's SSDC? As one of the poorest developing countries in the 1980s, China has used its comparative advantage, working together with African countries to enhance the capacity for self-development.

In official language, China follows the principles of equality and respect, reciprocity, mutual benefit and noninterference in domestic affairs. Aside from adherence to the ‘One China' principle, no political strings are attached to China's co-operation (State Council Information Office 2011).

This is not to say that the country's aid or development co-operative activities are ‘altruistic' - they are not. The government "never regards such aid as a kind of unilateral alms, but as something mutual" (State Council, White Paper 2011). This "mutual [economic] benefit" is based on the simple idea of "exchanging what I have with what you have" (hutong youwu or 互通有无) from which both can gain, as was taught by the economist Adam Smith.

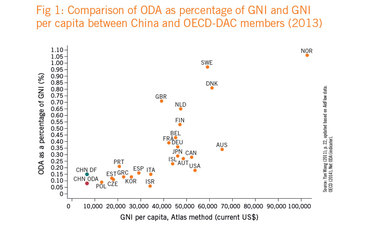

Second, the size of China's aid and South-South co-operation is small and commensurate with its per-head income level. Many analysts have tried to compare the amount of official development assistance (ODA) between China and established donors such as the US without considering the huge differences in income per capita, which is rather misleading.1 When China started to provide development assistance to African countries 50 years ago, it was poorer than most of the sub-Saharan African (SSA) countries. Even now, China's per-capita income, at $7,589 in 2014, is only one-quarter or one-eighth of that for the established Organisation for Economic Co-operation and Development (OECD) donor countries (see figure 1 in box below).

China's definition of aid differs from that of the OECD Development Assistance Committee (DAC), and therefore, direct comparison is not appropriate.2 According to the State Council Information Office's White Paper on China's Foreign Aid (2011), China provides grants, interest-free loans and concessional loans, with eight types of foreign aid: "complete (turn-key) projects, goods and materials, technical co-operation, human resource development co-operation, medical teams sent abroad, emergency humanitarian aid, volunteer programmes in foreign countries and debt relief".3 There are other official flows (OOF) and OOF-like loans and investments, which are not included in the official definition of foreign aid (Bräutigam 2011).

Based on strong demand from African countries, new types of SSDC have been added in recent years, including: OOFs (large but less concessional loans and export credit provided by the Export-Import Bank of China); resources for infrastructure (RFI) packages; equity investment by China-Africa Development Fund (CADFund) fund; infrastructure investment by the China Development Bank (CDB) and other commercial banks (which are OOF-like loans and investments intended for development, but non-concessional, and suitable for long-term infrastructure investment).4

Emerging donors contributing to Africa's infrastructure

Non-traditional bilateral development financiers - such as China, India, Arab countries and Brazil - have emerged as major financiers of infrastructure projects in Africa.

Overall, infrastructure resources committed to Africa by these countries jumped from $1 billion a year in the early 2000s to over $10 billion in 2010. China held a portfolio of some $20 billion in active infrastructure projects in more than 40 African countries. Chinese financing for African infrastructure structure projects is estimated to have reached a record level of roughly $5.1 billion in 2009, although it fell to around $2.3 billion in 2010 (Chen 013).

In fact, the global ‘South' is no longer a homogeneous backward group. Nagesh Kumar stated in 2008: "Different countries and even regions within the countries are at vastly different stages of development. Thus the complementarities within the group have increased tremendously. The relevance of [SSDC] arises from the replicability of development experiences of one country in other co-developing countries. In the process of their development, developing countries accumulate valuable lessons. These skills and capabilities are due to shared development challenges faced by them."5

In particular, China has been working in bottleneck-releasing sectors such as power generation and transmission. While "donors have neglected power since the 1990s" (Foster and Briceño-Garmendia 2010, p. 25), 50% of China's commitment on infrastructure was allocated to electricity (Chen 2013). A recent study found that China has contributed, and is contributing, to a total of 9.024 gigawatts (GW) of electricity-generating capacity, including completed, ongoing and committed power projects. The impact of this investment is likely to be transformative when one considers that the entire installed capacity of the 47 SSA countries, excluding South Africa, is 28GW.6

Figure 2 shows empirical evidence that China-financed infrastructure projects in 2001-2010 have, to a significant extent, targeted and addressed African countries' bottlenecks in five sectors: water, electricity, road and rail, air transport and telecoms (based on PPIAF-China project data). The total number of project in the dataset is 168 allocated in the five sectors, and the probability of these China-funded projects ‘hitting the bottlenecks' is 62.5% in the period of 2001-2010. There is, however, much room for better targeting and improvement, especially in the water sector.

Challenges within China's SSDC

The first challenge is the lack of transparency in China's SSDC projects - official data at the project level is not readily available. The publication of the white paper on China's Foreign Aid (State Council 2011 and 2014) and China Africa Economic and Trade Cooperation 2013 (Ministry of Commerce 2013) represent progress in the right direction. The government needs to be more open and proactive in providing more accurate data, making laws and regulations clear on development co-operation. This would be favourable to increased accountability to tax payers in China, as well as to the international development community. China does not have a legal framework governing foreign aid, nor does it have an independent aid agency.

It is therefore difficult for Chinese citizens to participate in the decision-making process on foreign aid, for Chinese officials to be held accountable, and for international bodies and governments to seek collaboration on international development or financing issues. Drafting China's law on foreign aid and co-operation, as well as establishing an independent aid agency, should be a priority for the policy agenda.

The second concern is about ‘tied aid' and inadequate technological diffusion and spillover effects. Most of China's aid is tied, a practice the members of OECD-DAC agreed to move away from progressively since 1995, since tied aid may increase costs and reduce efficiency.

However, China's own experience indicates that tied aid has some advantage of facilitating ‘learning by doing' and ‘learning by implementing' projects. According to Ricardo Hausmann, "the tricks of the trade are acquired from experienced senior workers" (Hausmann 2013). But there is academic literature on aid and trade, which found mixed results (Wagner 2003, Lloyd et al 2000, Morrissey and White 1996).

The value of implementing actual projects in learning and development seems to be underappreciated by economists and the donor community. In the 1980s and 1990s, most donor-financed projects located in China comprised tied aid, and Chinese workers and project managers have learned and benefited from them. Actually, ‘learning from aid projects' is one of the reasons why Chinese companies are so competitive in implementing construction projects (see "China's comparative advantage in renewable energy: hydropower" box, p. 65).

The third concern is that Chinese aid projects seem to have generated few local employment opportunities. Many African officials are concerned that Chinese workers are displacing local workers. Although data and evidence needs to be reviewed on a case-by-case basis, clearly, the indirect employment generation from China-financed economic infrastructure has been under-researched.

The International Monetary Fund (IMF) found that in recent years, China has become the largest single trading partner for Africa and a key investor and provider of aid and that a 1 percentage point increase in China's real domestic fixed asset investment growth has tended to increase sub-Saharan Africa's export growth rate on average by 0.6 of a percentage point (IMF 2013, p. 5).

Better education and training should be provided to Chinese companies to abide by laws and regulations regarding labour, social and environmental standards. In addition, better training and capacity development programmes should be provided to African workers and managers, in order to complete projects in a timely manner and to show tangible results.

No two countries are the same in their economic transformation. China has made some mistakes and paid a price for them. For instance, the country's strong drive for rapid growth and industrialisation is associated with widening rural-urban income disparities and a damaged environment.

In March 2007, former Chinese premier Wen Jiabao pointed out that China's growth was imbalanced, inequitable and unsustainable. Since then, there has been tremendous effort to ‘rebalance' the economy, reducing its reliance on exports, investment and paying more attention to the quality and efficiency of growth. However, making deep transformations and upgrading industries is proving extremely difficult, as reforms often go against the vested interest groups.

In this sense, African countries need to be selective, to avoid the mistakes China has made. African governments, non-governmental organisations and civil societies can play important roles in providing pressure to ‘push' development partners, including China and Chinese companies, in the right direction.

Box: China's South-South development co-operation

Reflecting the fact that ‘China is big, but not yet rich', one can take into consideration different stages of development, and compare China's total official development assistance (ODA) as a percentage of gross national income (GNI) to those of the Organisation for Economic Co-operation and Development (OECD) countries.

China's aid to developing countries started from a relatively low per-head income level in the 1960s. The analysis uses a recent estimate of China's ODA carefully done by Kitano and Harada 2014, which puts China's net ODA at $7.1 billion in 2013. They also estimated the net disbursement of preferential export buyer's credit of $7 billion in 2013.

Adding the two elements together, one would reach a total of $14.1 billion as China's development financing (which is a conservative estimate).

China's net ODA accounted for 0.08% of GNI in 2013, while China's development fund (DF) reached 0.15% of GNI in the same year. The first ratio is lower than some of the OECD countries.

However, if one draws a linear regression line on this scatter chart, China is located well above the regression line, indicating China is contributing a relatively significant proportion of its GNI to aid and development co-operation as compared with its per-head income level of $6,560 in 2013.

However, if one draws a linear regression line on this scatter chart, China is located well above the regression line, indicating China is contributing a relatively significant proportion of its GNI to aid and development co-operation as compared with its per-head income level of $6,560 in 2013.

To summarise, China, at its current stage of development, is more generous in providing development financing than some of the rich countries.

Box: China helps to address the infrastructure bottlenecks in Africa

A recent study ranks the donors/providers of infrastructure in sub-Saharan Africa for the period

2001-2008. China is shown to be the largest infrastructure financier, followed by three multilateral

organisations, the International Development Association, the European Commission and the African Development Fund.

In total, there are three southern providers in the top 10: China, India and the Islamic Development Bank. China alone accounts for 34% of the total official financing amount on infrastructure in SSA, higher than any northern partner.

In a study conducted in 2014, we used a threestep method to address the questions of whether, and to what extent, China-financed infrastructural projects match Africa's bottlenecks? The short answer is that they seem to have

matched in 63% of the 168 infrastructure projects

in 2001-2010.

Step 1, five indicators from the World Bank database are used to define African countries' bottlenecks, including water, electricity, roads and rail, air transportation and telecommunication.

We then compare the ranking numbers for sectors 1 to 5 for the country, i, and select the lowest-ranking sector to be the bottleneck 1 for country i; and then exclude the selected sector j*, select the next lowest-ranking sector as bottleneck 2, and continue to follow this process for bottleneck 3.

This process can be expressed as:

- Bottleneck 1 for country i = min ( Ri,j ), where j = 1, ... 5.

- Bottleneck 2 for country i = min ( Ri, -j* ), where j = 1, ... 5.

In Step 2, the World Bank-PPIAF Chinese projects database is used to find the location and number of infrastructure projects financed by China in each sector during the period 2001-2010. There are 168 projects allocated in five sectors.

Step 3, the two datasets are merged by country code, to see if the locations of the Chinese financed projects match the bottlenecks. We have also calculated some probabilities of projects ‘hitting' the bottlenecks. Results are as follows:

- Probability of hitting one of the 3 bottlenecks =105/168 = 0.625 = 62.5%

- Probability of hitting bottleneck 1 = 39/168 = 0.232

- Probability of hitting bottleneck 2 = 31/168 = 0.185

- Probability of hitting bottleneck 3 = 35/168 = 0.208.

Justin Lin and Yan Wang

Notes

1 Studies include, for example, Wolf et al (2013) from Rand, and Strange et al (2013) from the Center for Global Development.

2 The Organisation for Economic Co-operation and Development (OECD) definition of ODA includes grants or loans that are: a) undertaken by the official sector; b) with promotion of economic development and welfare as the main objective; and c) "concessional in character and convey a grant element of at least 25% (calculated at a rate of discount of 10%)". See www.oecd.org/dac/stats/officialdevelopmentassistancedefinitionandcoverage.htm

3 Turn-key projects and in-kind assistance were developed in the 1960s and 1970s, when China itself was in shortage of foreign exchange. These types of projects allowed poor countries to help each other without using US$ or other foreign exchange. The Tazara railway was completed in 1975 by Chinese and African workers working together using labour-intensive technology. This is also a unique way of avoiding issues of misuse of funds of both partners.

4 The World Bank 2014, Resource Financed Infrastructure.

5 www.un.org/en/ecosoc/newfunct/pdf/background%20study%20final.pdf

6 The US's Hoover Dam in Colorado, by comparison, is a 2 gigawatt facility, producing on average electricity for about 390,000 US homes. See Chen 2013.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com