Monetary Policy

South Africa in fresh attempt to curb rand volatility

Ruling African National Congress will consider short-term capital inflows tax to curb rand volatility, currency’s strength; party questions merits of Sarb’s hard-won inflation targeting regime

Bank’s macro model takes a bruising

Former Bank of England economist says model misjudges trade-off between growth and inflation

Ex-deputy Muto endorses Bank of Japan’s anti-inflation targeting stance

Former Bank of Japan deputy governor Toshiro Muto says introducing inflation targets, as government wishes, will not cure deflation; analysts agree

Malawi cuts for first time in three years

Reserve Bank of Malawi implements two percentage point cut to key rate as inflation moderates; food price inflation wanes as shortages begin to abate

Turkey: Manufacturing sector very sensitive to monetary tightening

Central Bank of Turkey study shows monetary tightening impacts some areas of the economy more than others

Fed’s Bullard calls for further QE

St Louis Federal Reserve president James Bullard says United States must commit to further stimulus if it wants to avoid a deflationary trap like Japan

Refining the BoJ’s operating model

In the third of a six-part series on the Japanese economy, Robert Pringle reports from Tokyo on how the crisis has impacted the nation’s global outlook

Argentina may raise deposit ratio in latest attempt to curb money growth: reports

Governor thought to be keen on ten percentage point rise in proportion of deposits lenders must place in central bank coffers

ECB closes in on inferior collateral with new haircut scheme

European Central Bank’s new discount schedule increases haircuts levied on troublesome collateral, such as asset-backed securities; analysts expect move to discourage pledging of risky assets

Venezuela’s Merentes announces plans to reopen foreign dollar-denominated bond market

Central Bank of Venezuela president Nelson Merentes says market will accept bonds from South American neighbours

Bank of England – Asset Purchase Facility Annual Report (2009/10)

Asset Purchase Facility Annual Report shows Bank £1.75 billion down on back of decline in value of gilt stock

National Bank of Slovakia – Monthly Bulletin (June 2010)

National Bank of Slovakia’s June Monthly Bulletin shows inflation was lower than expected for the month

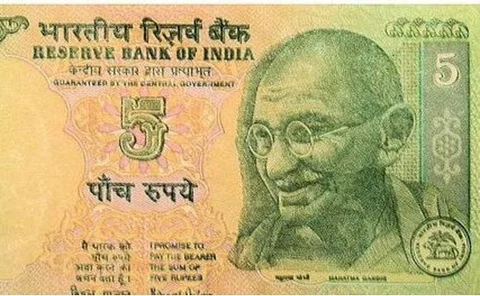

RBI attempts to soothe market jitters with more rate reviews

Reserve Bank of India will release four extra monetary policy reviews per year in a bid to keep investors calm; decision brings it in line with bulk of major central banks

King stresses wait-and-see approach to rate-setting

Bank of England governor Mervyn King dismisses suggestions that one or another view dominates rate-setting committee; deputy Charles Bean reiterates question marks over effects of quantitative easing

Expansionary policy commitment redundant: Norges Bank

Norges Bank study says low interest rate rhetoric at central banks ineffective under neo-classical Phillips curve model

Central Bank of Sri Lanka – Annual Report (2009)

Sri Lankan central bank’s Annual Report for last year says country’s escape from high inflation allowed it to focus efforts on growth

CEPR: Central banks stuck in interest rate trap

Centre for Economic Policy Research study says central banks will inevitably end up in a low interest rate trap during a crisis

India jerks in policy reins to choke off ballooning inflation

Reserve Bank of India levies bigger-than-forecast 50 basis point rate hike as data show inflation has spilled over from food to all areas; higher fuel prices, weather patterns key going forward

Quantitative easing doesn’t work: Woodford

National Bureau of Economic Research paper co-authored by Michael Woodford says quantitative easing has little impact, but credit easing does occasionally when targeting specific assets

Argentina lets non-banks into debt sale

Argentine central bank throws open note auction to companies, allowing them to circumvent secondary markets; move linked to rapid expansion of money supply

Canada’s Carney explains rate hike

Bank of Canada governor Mark Carney says decision to hike rates was due to unexpected improvement in private demand

BoE: Asset Purchase Facility Quarterly Report (2010 Q2)

Bank of England’s latest Asset Purchase Facility Quarterly Report shows fear over eurozone debt crisis led to rise in corporate debt purchases

ECB: Crisis amplified monetary policy channels

European Central Bank study on credit channels finds the financial crisis amplified the impact of monetary policy on the economy

BIS: Inflation targeting only one option

Bank for International Settlements study says inflation targeting is not necessarily the only prescription for price stability