Monetary Policy

Market tensions prevail, Trichet warns

ECB president says financial sector still shows signs of stress despite the success of the central bank’s bond purchase program

Japan’s new finance minister says government will not interfere in BoJ policy

Japan’s newly appointed finance minister Yoshihiko Noda says current central bank stance is fine

Iceland, China sign $512m currency swap deal

Icelandic and Chinese central banks agree on currency swap to boost bilateral trade; move emphasises recovery of confidence in króna

Venezuela cautiously reopens forex markets

Central Bank of Venezuela introduces tough rules for new regulated foreign currency market; bond trades will be carried out on new system under central bank's watch

Kenya’s Ndung’u moves to allay fears over 'weakening shilling'

Kenyan central bank governor Njuguna Ndung’u says currency's ten-year low against dollar is a result of fallout from Greek crisis

Argentina tightens rules on dollar purchases

Argentine central bank toughens regulation for large dollar buyers; says move not intended to limit access to market

Riksbank removes tolerance interval in monetary policy target

Swedish central bank revises the wording of its monetary policy objectives in light of the financial crisis

Monetary policy did not cause crisis: Chile’s de Gregorio

Chilean central bank governor José de Gregorio points to financial innovation and liquidity transformation as chief causes of crisis; calls for multiple tools to protect both price and financial stability

Israel’s Fischer on inflation targeting

Governor of the Bank of Israel Stanley Fischer stresses achievements of inflation framework

New Japanese PM could pressure BoJ to loosen

Japan’s new prime minister and former Bank of Japan critic Naoto Kan hints at more accommodative monetary policy; analysts think central bank’s independence will not be affected

Sarb considering market operations overhaul

Deputy governor Daniel Mminele says South African Reserve Bank may make changes after encountering problems towards the end of last year

Fed scoops prize for best swap lines: BIS

Bill Allen and Richhild Moessner study the effects of central banks’ swap lines and find those established by the Federal Reserve to provide dollar liquidity went furthest in achieving their aims

German rumours of French pact with ECB display tensions

Coverage of German magazine article alleging European Central Bank's bond purchase programme was aimed at helping the French indicative of fertile breeding ground for conspiracy theories

Rate move highlights gap between Russia and other Brics

Country remains in expansionary mode while fellow emerging markets start tightening due to structural and circumstantial factors

Turkish minutes flag instability in lending markets

Minutes from Turkish central bank's May meeting show policymakers fixed one week repo rate at 7% to reduce fluctuations in lending markets

Mix of bad luck and policy fuelled credit boom in Eastern Europe

IMF research finds both bad luck and poor policymaking led to credit boom in new EU member states

IMF: Capital, not liquidity, limited post-crisis lending

Fund paper on bank lending finds that capital rather liquidity constraints froze lending following the 2007 sub-prime mortgage crisis

China’s Li calls for tightening on back of housing bubble fears

People’s Bank of China monetary policy committee member Li Daokui warns economy may overheat unless tighter monetary policies are put in place

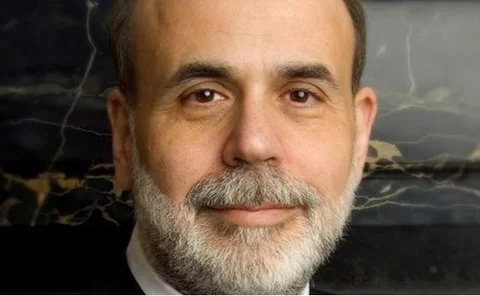

Bernanke praises emerging-market response to crisis

Federal Reserve chairman Ben Bernanke praises the Bank of Korea's policy response to the financial crisis

Cyprus: Fed took over-simplistic approach to controlling inflation

Cypriot central bank inflation study finds Fed failed to curb price growth in 1960s, 1970s

Canada hikes by quarter point

Bank of Canada raises overnight rate to 0.5%

Hungary defies government calls for cuts

National Bank of Hungary keeps benchmark rate flat at all-time low; decision will further anger new government, which has called for steeper cuts and easy money

Canada's Duguay: terminating penny coin has no impact on inflation

Bank of Canada deputy governor Pierre Duguay says eliminating penny coin will pose little threat of inflation

Shirakawa wants financial stability as primary mandate

Governor of the Bank of Japan believes central banks' key task should be to achieve a stable financial environment; says higher inflation targets would do little good at the zero bound