Monetary Policy

India’s Mohanty to lead review of key open market operation

Reserve Bank of India executive director Deepak Mohanty will head working group assessing liquidity adjustment facility; review will examine method in light of changing liquidity dynamics

Norway’s Gjedrem says return to inflation target will be delayed

Norges Bank governor Svein Gjedrem says weakness in growth will lead to concessions on inflation mandate

Peru raises reserve requirement in bid to stem capital inflows

Central Bank of Peru increases reserve requirement on overseas loans to 75%

SNB: money market rates best target during recessions

Swiss National Bank study shows money market-based monetary policy procedures create greater stability

National Bank of Hungary tests hybrid inflation targeting rule

National Bank of Hungary study says hybrid regime takes best of price-level and inflation targeting regimes

Rate round-up: Canada, Peru hike as Sarb cuts

Canada hikes rates while South Africa cuts on rising rand; continued uncertainty in global economy prompts Korea, Japan and Australia to keep rates steady

France’s Redouin favours central banks’ new dual role

Banque de France first deputy governor Jean-Paul Redouin says having financial stability and monetary policy under one roof will strengthen surveillance of financial sector

The big divide over deflation and debt

In the fifth of a six-part series on the Japanese economy, Robert Pringle reports from Tokyo on how the crisis has impacted Japan’s global outlook

EXCLUSIVE: Don’t rely on near-zero rates, says Rajan

Former IMF chief economist Raghuram Rajan warns the Federal Reserve has no quick fixes to solve United States’ economic ills but says Bernanke right man for the job

Interview: Raghuram Rajan

University of Chicago Booth School of Business' Raghuram Rajan on Fed policy and officials, the structural flaws in the US economy, and the future of economics in central banks

Federal Reserve: discount rate minutes July-August 2010

Two of 12 regional Feds wanted higher primary credit rate

Israel justifies rate hold

Bank of Israel minutes flag economic uncertainty as factor behind Governor Stanley Fischer opting to hold rates

ECB’s González-Páramo highlights flaws in collateral framework

European Central Bank executive board member José Manuel González-Páramo acknowledges risks in central bank’s willingness to accept broad range of collateral

Inflation targeting survived crisis test: Norway’s Qvigstad

Norges Bank deputy Jan Qvigstad says increased transparency has been very valuable

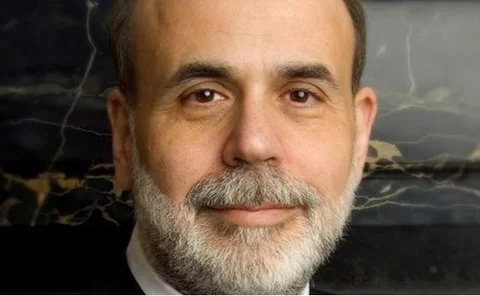

Bernanke: Fed won’t rule out leaning against wind

Regulation should be “first line of defence” against bubbles, but FOMC is monitoring financial imbalances

Central Bank of Turkey – Inflation Report (Q3 2010)

Central Bank of Turkey says recent figures have shown high inflation towards the end of 2009 to be a blip

Fed cannot bear full burden of job creation: Fisher, Plosser

Regional Federal Reserve presidents Richard Fisher and Charles Plosser say loosening monetary stance further will not cure unemployment ills; monetary policy no panacea for macroeconomic problems

FOMC officials cite disinflation in explaining policy shift

Federal Open Market Committee minutes reveal officials see anaemic growth tempering price pressures

BoJ expands fixed-rate fund supply on growth, yen fears

Bank of Japan unveils six-month term to existing fixed-rate funds operation; facility to expand by $238 billion on fears of weak US growth, yen strength

Focus on banks’ incentives must continue post-crisis: Bank’s Bean

Bank of England deputy governor Charles Bean says crisis focus on bank incentives must remain; financial market problems require macroprudential instruments

Unemployment caused by structural mismatch: Minneapolis Fed’s Kocherlakota

Minneapolis Federal Reserve president Narayana Kocherlakota analyses the breakdown between job openings and unemployment in the United States

Bernanke dismisses higher inflation targets, unconvinced on conditional commitment

Federal Reserve chairman Ben Bernanke rejects higher inflation targets; says conditional rate commitment too risky, despite success in Canada

Riksbank's Öberg calls for careful policy normalisation

Riksbank first deputy governor Svante Öberg points to risk in returning benchmark rate to pre-crisis levels

Canada's Murray: 2% inflation target not necessarily optimal

Bank of Canada deputy John Murray says inflation targets could be even lower than 2%