Monetary Policy

BoJ’s Nishimura favours dual approach to monetary policy

Bank of Japan deputy governor Kiyohiko Nishimura says provision for credit expansions in monetary policy provides degree of flexibility in policy options

IMF: Turkish banks vulnerable to monetary shocks

Fund study shows monetary policy channels in Turkey are severely disrupted when policy is tightened

BoE’s Fisher: further QE a possibility

Bank of England rate-setter Paul Fisher says central bank could provide stimulus should conditions warrant it

The Fed is being asked to do too much

Marcelle Arak and Sheila Tschinkel argue that more outright purchases of US Treasuries by the Federal Reserve will do little to stimulate US growth

Riksbank’s Wickman-Parak: crisis days are over

Riksbank deputy governor Wickman-Parak says central bank can return to conventional monetary policy following convincing economic recovery

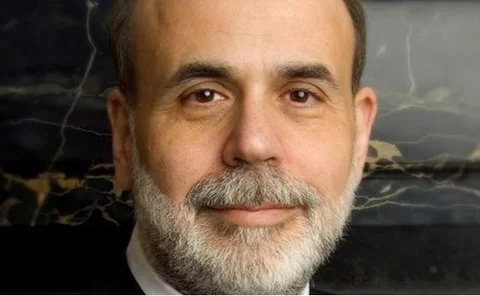

Bernanke hints at further round of QE

Federal Reserve chairman Ben Bernanke says Fed is prepared for further stimulus

FOMC minutes discuss QE options

Federal Open Market Committee meeting’s minutes discuss possibility of further investment in long-term Treasury securities

Google price index gets analysts’ thumbs-up

Commentators praise the innovation underlying Google price index; despite limitations, index could work as a CPI subset

Central banks should not get accustomed to QE: France’s Noyer

Banque de France governor Christian Noyer says central bank intervention was essential during crisis but should not be perceived as regular practice

Sentance: Bank risks losing credibility if rates remain on hold

Bank of England external MPC member Andrew Sentance says central bank risks being seen as not taking its inflation-fighting remit seriously if it does not begin to raise rates

Singapore tightens to spur faster appreciation

Monetary Authority of Singapore tightens policy further to allow for faster appreciation of Singapore dollar

Buba’s Weber rebuffs criticism of German surplus

Bundesbank president Axel Weber dismisses argument that eurozone’s surplus countries should boost demand to aid deficit-laden neighbours; condemns “misleading” comparison to China

Monetary policy cannot correct over-leveraging: Bank’s Miles

Higher interest rates will not prevent build-up of debt, which amplified effects of recent crisis, says Bank of England rate-setter David Miles

ECB: monetary policy could have prevented the crisis

European Central Bank study finds low benchmark rate had significant role in lax lending standards before crisis

Shirakawa flags limits of monetary policy

Bank of Japan governor says loose monetary policy is a necessary condition for recovery, but its efficacy is limited and may have unintended consequences

Take responsibility: ECB’s Bini-Smaghi to EMEs

European Central Bank executive board member Lorenzo Bini-Smaghi says emerging markets seeking bigger global role must take responsibility for imbalances

BoJ minutes show divergence on risks

Minutes of Bank of Japan's September meeting show disagreement on risks to economy

RBI’s Gokarn identifies emerging inflation risks

Reserve Bank of India deputy governor Subir Gokarn says changing dietary habits are driving up food prices

St Louis Fed: forward rates provide investors little advantage

St Louis Federal Reserve study says informational value of longer term forward rates provides no additional economic benefits

RBA develops more robust monetary policy model

Reserve Bank of Australia study uses sign restriction VAR models to explain exchange rate puzzle in measuring monetary policy

Pay attention to monetary aggregates: Canada’s Macklem

Bank of Canada senior deputy governor Tiff Macklem says interest rate transmission blockages make money, credit data key in crisis; adds voice to growing chorus of central bankers

Japan edges towards zero bound

Bank of Japan cuts benchmark rate to 0% to 0.1% range, announces further stimulus

RBI names working group to review key open market operations

Reserve Bank of India names working group members assessing liquidity adjustment facility; six out of ten from central bank

NY Fed’s Sack on FOMC’s policy shift

New York Federal Reserve executive vice president Brian Sack said further measures represent meaningful shift in balance sheet path