Financial Stability

ECB’s Cœuré outlines efforts to cushion impact of regulation on SME lending

Executive board member says the European Central Bank can only tackle funding constraints – other stakeholders must address credit risk and lack of capital

IMF annual report says asset bubbles among risks of ‘MP-plus'

IMF warns of risk associated with loose monetary policy in the world's biggest economies, but says stance should remain 'very accommodative until recovery is well established'

Zimbabwean governor attempts to stem panic as StanChart faces closure

Gideon Gono tells depositors not to withdraw their savings following a government announcement that Standard Chartered will be shut down for non-compliance with indigenisation laws

EU and OECD say weak supervision shares blame for Slovenia's impending bank crisis

European Commission follows OECD in highlighting Slovenia's 'excessive imbalances'; both bodies call for improved supervision from the central bank

FDIC vice-chair says Basel III capital requirements provide illusion of safety

Thomas Hoenig says capital ratios allow banks to leverage up while outwardly appearing safe; warns systemically important banks have much worse leverage ratios than smaller institutions

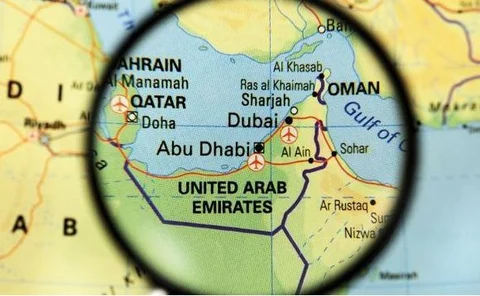

Emirates central bank to introduce direct debit system

Central Bank of UAE to bring in direct debit system to allow payment in instalments without the need for post-dated cheques

Norwegian authorities chase benchmark rate reform

Financial Supervisory Authority of Norway proposes new framework for Norwegian Interbank Offered Rate-setting process; central bank looks to push envelope further

Bernanke says Fed stress tests were a ‘critical turning point’ in crisis

Fed chair says stress tests offer macro-prudential dimension to supervision; US banks have more tier 1 common equity under a severe stress scenario than they did in reality in 2008

Sarb’s head of financial stability fears new powers may cause conflict

Hendrik Nel says the Reserve Bank was not given much choice but to accept new supervisory powers; warns of conflict with monetary policy and possible threat to independence

New model prescribes strongly counter-cyclical medicine for financial shocks

Working paper from the Bank of Canada suggests counter-cyclical bank capital rules can help steady the ship in the wake of financial shocks, in tandem with monetary policy measures

FSB to assess efforts to end ‘mechanistic reliance’ on credit ratings

Peer reviews aim to hasten a move away from rating agencies, with countries expected to eliminate references to credit ratings from laws and encourage better internal credit risk assessments

Payment pricing preventing electronic migration in Ireland

Article in central bank’s quarterly bulletin finds Ireland could save €1 billion by switching from cheques to a more efficient payment instrument

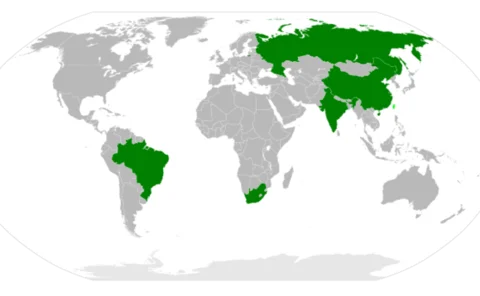

Chilean paper finds room to reduce risk by diversifying investment in Brics

Statistical analysis finds little co-integration of stock market vectors in Latin America and the Bric countries; says this gives investors a good opportunity to diversify, which would reduce risk

Fed tightens rules for retail forex banking

Federal Reserve publishes final rules for banks engaging in foreign exchange transactions with retail customers; includes requirements for risk disclosures, good conduct, capitalisation and margining

Bank of Spain reshapes supervisor to meet new demands

Banking supervision directorate restructured to meet the requirements of Spain’s memorandum of understanding and the move to European banking union

ECB on collision course with European Parliament over top supervisory appointments

Yves Mersch fears EP veto over supervisory board heads will 'institutionalise conflict' between the ECB and EP, and contravene the Maastricht Treaty

Czech research examines macroprudential policy in small economies

Policy note stresses the importance of considering cyclical systemic risk when setting macro-prudential policy in a small EU economy

IMF strikes €1 billion funding deal with Cyprus

Staff team agrees Fund’s contribution to overall bail-out package; Christine Lagarde praises Cyprus’s ‘ambitious’ programme of reforms

Haldane defends BoE's macro-prudential policy

Andrew Haldane says recent instruction to banks to increase levels of capital will stimulate lending to real economy; academics debate viability of macro-prudential policy

Bank of Lithuania chief urges banks to consider fee cuts as non-cash payments rise

Report shows sharp increase in volume of non-cash payments in Lithuania; governor Vitas Vasiliauskas says this gives banks room to consider cutting fees

Saudi vice-governor warns of 'quantum leap' in money laundering

Abdulrahman Al-Hamidy says countries with weak defences may suffer from capital flight and higher levels of inflation

Danish governor sees further bank ‘resolutions' on the horizon

Nils Bernstein commends mortgage lenders for addressing the sector's challenges without the need for further legislation

Fiji's new $5 note is island nation's polymer pioneer

New FJ$5 note will be Fiji's first polymer banknote, and will supplant the defunct FJ$2 note as the country's smallest

IMF paper recommends China adopt ‘better-targeted’ macro-prudential policies

Study encourages China to tailor macro-prudential tools to regional and economics differences in country’s banks; suggests coupling policies with greater commercialisation