Spreads

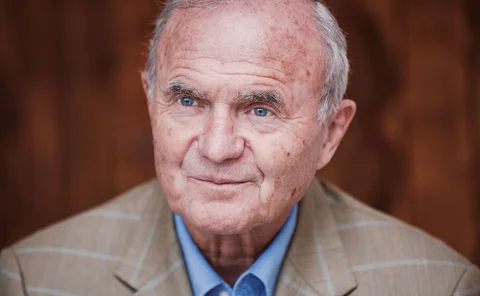

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Eurozone bail-in regime has not widened bond spreads – ECB paper

Wider financial and economic environment play key role in determining bond spreads – researcher

Central Banking’s ‘Leaders’ for custody, banking and gold

Central banks want integrated custody platforms and real-time data from custodians as the low-yield environment drives demand for banking services and increases the relative attractiveness of gold

Insights from network analytics in suptech

With regulators leveraging technological innovations to move towards informed, data‑driven decision‑making and automation, supervisory technology is attracting enhanced interest. Kimmo Soramäki and Phillip Straley examine how regulators are gaining…

Italy’s trial

Francesco Papadia argues Italy is likely to suffer financial and economic damage under its new political leadership, but will still not leave the euro

BoJ’s bond purchases impact credit spreads – paper

The BoJ’s corporate bond holdings have reached $29 billion, or about 0.6% of GDP

Sovereign debt crises hit non-tradable sectors harder

A 1% increase in bond spreads is associated with an average decline of 3% in growth of zero-traded industries

Credit spreads’ limited use as short-term predictors – paper

Researcher examines the accuracy of three sets of credit spreads

Inclusion of 'spatial effects' help explain Colombian money market spreads, central bank paper argues

Traditional factors like 'size and leverage' insufficient to explain borrowing spreads, argues paper, which is 'first attempt' to model Colombian money market within a spatial econometrics framework

Croatia among EU members whose spreads are most affected by fundamentals

While spillovers from external shocks remain the dominant factor in spreads EU-wide, Croatia is among those where fundamentals are playing an increasingly influential role