Monetary policy

BoE’s Vlieghe dismisses neo-Fisherian idea that low rates cause low inflation

MPC member says “small minority” of academics who suggest lower rates may cause low inflation do not present particularly compelling arguments

Central banks may be partly to blame for low real rates, says BIS’s Borio

Ever-bolder attempts to raise inflation could push down on real rates, generating little inflation but worsening the risk of instability, Claudio Borio says

Impact of interest rate cap still unclear – Kenyan governor

There is not enough data on interest caps to influence the MPC’s decision, says Njoroge; interest rates remain on hold at 10%

Banks have still not fixed ‘poisonous mix’ of problems – BIS’s Borio

Claudio Borio warns that in some respects, banks have still not solved the problems revealed by the 2008 crisis, which leaves them vulnerable

Mauritian governor explores low-growth puzzle

The government and the central bank need to work together in order to stimulate growth, Roi says, recognising each institution can only do so much

Stiglitz urges central banks to focus on credit, not interest rates

Emphasis on interest rates ignores more important question of whether credit is getting where it is needed, Nobel economist argues

Turkish central bank hikes as Trump election hits lira

Turkish lira has been targeted in emerging market currency sell-off; rate hike ignores the latest call for more cuts from Turkish president

Central Bank of Honduras legislation needs to be ‘fast tracked’, says IMF

Implementation of inflation targeting regime hinges on legislative change, IMF says in latest report; Honduran authorities to submit legislative reform on central bank mandate by March 2017

Demands on central banks have created critical juncture – El-Erian

Economist says burden placed on central banks has created economic and political instability across the globe, and something must soon give

BoE’s Cunliffe: central banks not causing low natural rates

Quantitative easing has not caused rates to fall, but is rather responding to a low natural rate, deputy says; the fall in sterling could require deviation of the policy rate from the natural rate

Bank of Italy publishes unconventional monetary policy papers

Papers and presentations cover models and data on unconventional programmes

Paper examines relationship between monetary policy and bank funding crises

Current regulatory tools are not sufficient to contain bank runs, Canadian working paper suggests, underscoring the importance of policy measures such as reserve requirements

Carney faces grilling from parliament in wake of tenure decision

Regardless of Brexit timetable, BoE governor will leave on June 30, 2019; he warns firms could trigger plans to leave London in late 2017 if Brexit deal proves unsatisfactory

US affected by spillovers as well as causing them – Fed’s Fischer

Foreign developments can be a “substantial headwind” to US monetary policy, vice-chair says; hints at continued momentum towards a December rate hike

Fed research proposes micro-founded approach to term structure modelling

Economists build structural New Keynesian model in contrast to the statistical approaches in much of the available literature, identifying key factors shaping term premiums

RBNZ delivers rate cut as exchange rate strength persists

Board reaffirmed move in light of Trump victory, but cut has been in the offing for some time as NZ dollar strength holds down inflation

National Asset-Liability Management Africa 2016 | Wellington Management | William J. Hannigan

William Hannigan on the challenges facing central banks investing in government bonds, and the current low-yield environment

RBA paper finds it is hard to pinpoint US productivity slowdowns

Break in productivity growth trend in US appears to have happened in early 1970s, although beliefs took three decades to fully adjust, authors find

BoE paper takes DSGE approach to deflation probabilities

Comparing simulations using a DSGE model estimated on different market-based measures of deflation probability helps to pick out causality, researchers say

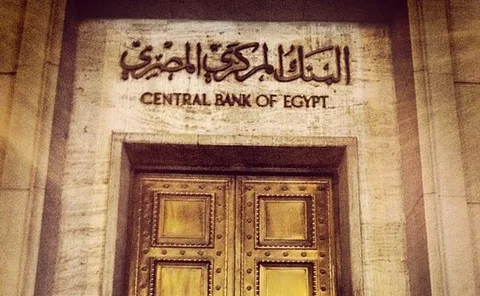

Central Bank of Egypt devalues currency

Egyptian pound falls 32% as central bank moves to align official and black market rates; IMF mission chief welcomes additional exchange rate flexibility

Brazil’s inflation forecasts send mixed messages for monetary policy

‘Market’ forecast suggests there is a limit to monetary easing, central bank minutes show, though ‘reference’ scenario indicates room for more easing

Carney: I will stay ‘as long as I can’

Carney says the decision to stay or go will be “entirely personal”; Bank of England governor says central bank will not “slavishly rely” on QE

No change to monetary policy, UK finance minister says

Hammond clarifies comments made by PM, emphasising the government will not be altering BoE mandate; finance minister says it is the government that needs to offset monetary policy impacts

QE is not hurting pension funds, says Broadbent

‘Material constraints’ not seen yet, says BoE deputy governor, who believes problems are being driven by more fundamental causes