Fiscal policy

New US tax plan promising for growth – Fed minutes

FOMC members revise the growth outlook upwards for next 12 months, as tax cuts promise to provide “some boost” to consumer spending

Public spending cuts have bigger multiplier than fiscal stimulus – paper

Research weakens case for expansionary policies, say authors

Credit no longer supporting Chinese growth – research

China’s economy has become “saturated with credit”, argues IMF research paper, with fiscal stimulus primarily boosting manufacturing

India needs radical reforms, says academic

State ownership has gone too far but the state needs stronger capabilities in other areas, argues Vijay Joshi

UK debt could be a stability risk, says BoE’s Sharp

FPC member goes against advice for central bankers to “stick to their knitting” and discusses how fiscal policy could impact BoE’s financial stability work

Kuwait could create financial stability committee – IMF

The central bank could strengthen supervision by creating a new committee, say IMF staff; the country is weathering oil shocks well

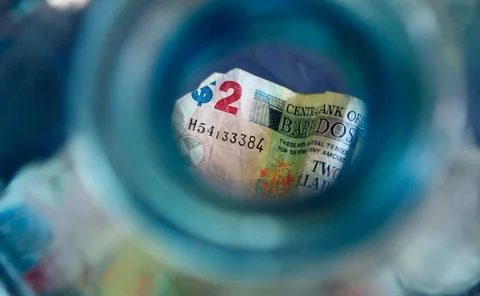

Central Bank of Barbados governor ‘concerned’ about level of reserves

Barbados central bank tweaks securities requirement ratio amid foreign exchange shortage; less than 10 weeks of import coverage remain

Too soon to start celebrating economic improvements, says Mminele

Sarb deputy warns against complacency in latest economic roundup, saying it is too soon to start celebrating lower inflation and a more stable external environment

Fiscal policy shocks amplified by accommodative monetary policy – paper

IMF research analyses impact of government spending spillovers, noting effects are amplified in countries with interest rates near the lower bound

Blanchard and Summers call for rethink of stabilisation policy

Both economists question consensus on fiscal prudence and advocate stricter financial regulation

Danish central bank critical of fiscal easing plans

As growth accelerates and inflation rises the economy risks overheating, the central bank says

Legal independence ‘not 100% insurance’, warns Posen

Academic says central banks have to look at the political context when policymaking, while senior figures say it is the responsibility of central banks to speak out

Danish central bank advises Faroese public spending cuts

Higher salmon prices and low unemployment may overheat the economy, the central bank says

IMF’s Lagarde gives update on women’s empowerment pledges

The fund has teamed up with the UK to provide ‘gender-budgeting’ assistance to countries requesting financial management support

Denmark central bank issues warning as economy heats up

The National Bank of Denmark cautions the labour market is tight and the economy may be close to overheating

Housing reform ‘will stabilise’ market – Danish central bank

The new taxation system aims to reduce price volatility by 20% and stem rising house prices in cities

Multiplier of spending cuts bigger than fiscal expansions, paper argues

Impact of austerity is at its peak during recessions, Richmond Federal Reserve paper finds

Fiscal stabilisation spurs growth in low fixed-asset sectors - IMF

Those with difficulty raising external funds benefit most from policy, paper argues

Archive – Interview: Allan Meltzer

Robert Pringle talks to Allan Meltzer, Carnegie Mellon professor and chair of the US Congress’s International Financial Institution Advisory Commission (the “Meltzer Commission”); first published in February 2003

Book notes: The Limits of the Market, by Paul de Grauwe

De Grauwe has produced a concise analysis into how markets and governments react with one another; but his lack of familiarity with the history of economic thought is surprising

Bank of Colombia paper charts fiscal multipliers in developing countries

Stronger fiscal-monetary co-ordination in developing economies during periods of expansion would extract more value from stimulus; fiscal multipliers higher in fixed exchange rate regimes

Turkish inflation begins to fall amid economic strength

Inflation fell back to single digits in July for the first time since January; economy buoyant amid stimulus measures in wake of failed coup

Tax cuts should focus on income from capital, French paper argues

Cutting taxation on labour is less effective in boosting growth, researchers say

US taxes low by global standards, say Chicago Fed economists

Overall burden of taxes is low by OECD standards, and taxes on capital income are notably lower than in Germany, economists say